Microsoft Stock Breakdown

Get smarter on investing, business, and personal finance in 5 minutes.

Stock Breakdown

In the past 6 months the Nasdaq is up +8%.

But Microsoft is down -23%

This is despite last quarter’s revenues growing 16% y/y

And operating profits increasing 20% y/y

Was this a simple case of their valuation having extended itself?

Or is the market becoming fearful of their position in AI?

They were very early to invest and support OpenAI.

In fact, they have a 27% stake in OpenAI’s for-profit entity.

But now Anthropic’s Claude and Google’s Gemini is all the rage.

And with a 45% of Microsoft’s cloud backlog tied to OpenAI and growing fears that OpenAI has made more commitments than they will be able to fund…

Investors are wondering out loud if Microsoft bet on the wrong horse.

No one will be convinced that Microsoft is at risk of disappearing…

But what if growth just isn’t what investors are hoping for

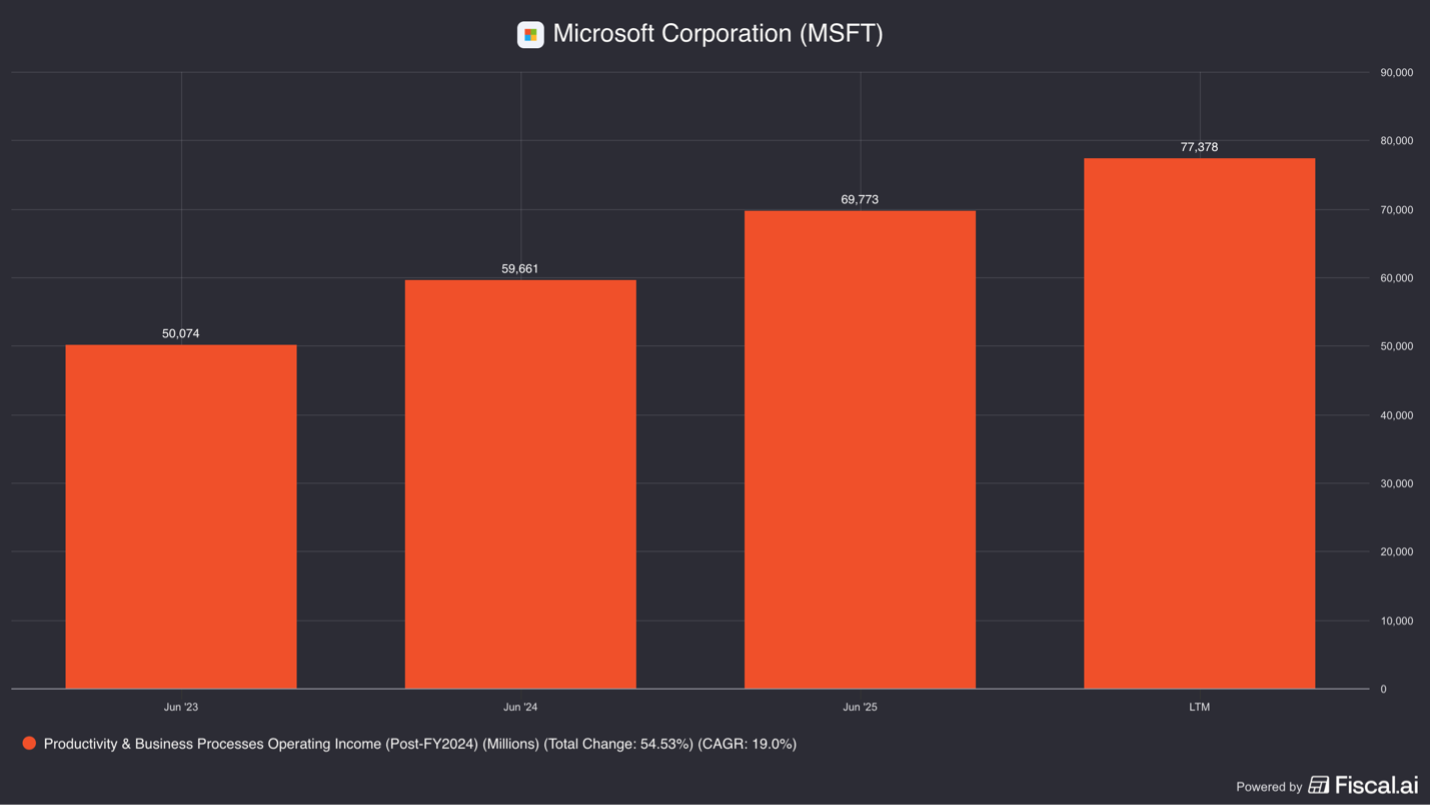

Their copilot product only has 3% paid penetration

Which is much worse than Tinder’s paid penetration…

And copilot was supposed to be a revolutionary AI business productivity product.

And while Azure is still growing strongly with +39% growth last quarter…

What happens if all of these cloud providers overshoot demand with their increasing capital outlays?

Isn’t their going to be pricing pressure?

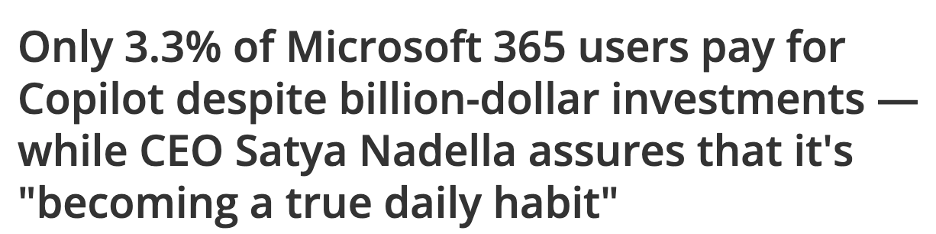

And despite the selloff, they still trade at 46x trailing FCF (excluding SBC), so they still need a lot of growth for an investor to make a return.

If we rewind a to the early 2000s, Microsoft was a business utility but was only a high single digit grower through the decade.

And the stock had a lost decade where the stock went nowhere.

What saved them was a business model transition from licensing to SaaS and the Azure Cloud business.

Can the shift to AI agents be as powerful for their business model today?

We explore all of this in this week’s Five Minute Money!

Business.

While many investors are already very familiar with Microsoft, we wanted to give a brief overview.

They operate through 3 segments.

1) Productivity & Business Process

Office/ Microsoft 365 Suite

This is their suite of apps (Excel, Word, PowerPoint, Outlook, Teams)

Also here is SharePoint, OneDrive, and Exchange

They monetize on a per seat basis with upsells for security, Teams Phones, compliance, Copilot and charge for more storage space

Linkedin

Monetized via advertising and subscriptions (for recruiters & to for premium features)

Dynamic 365

CRM for sales, customer service, field service, and also a CDP (customer data platform)

ERP for finance, supply chain management, commerce, human resources

Power Platform Integrations to build workflows and automations of tasks

Monetizes per user, usually per module

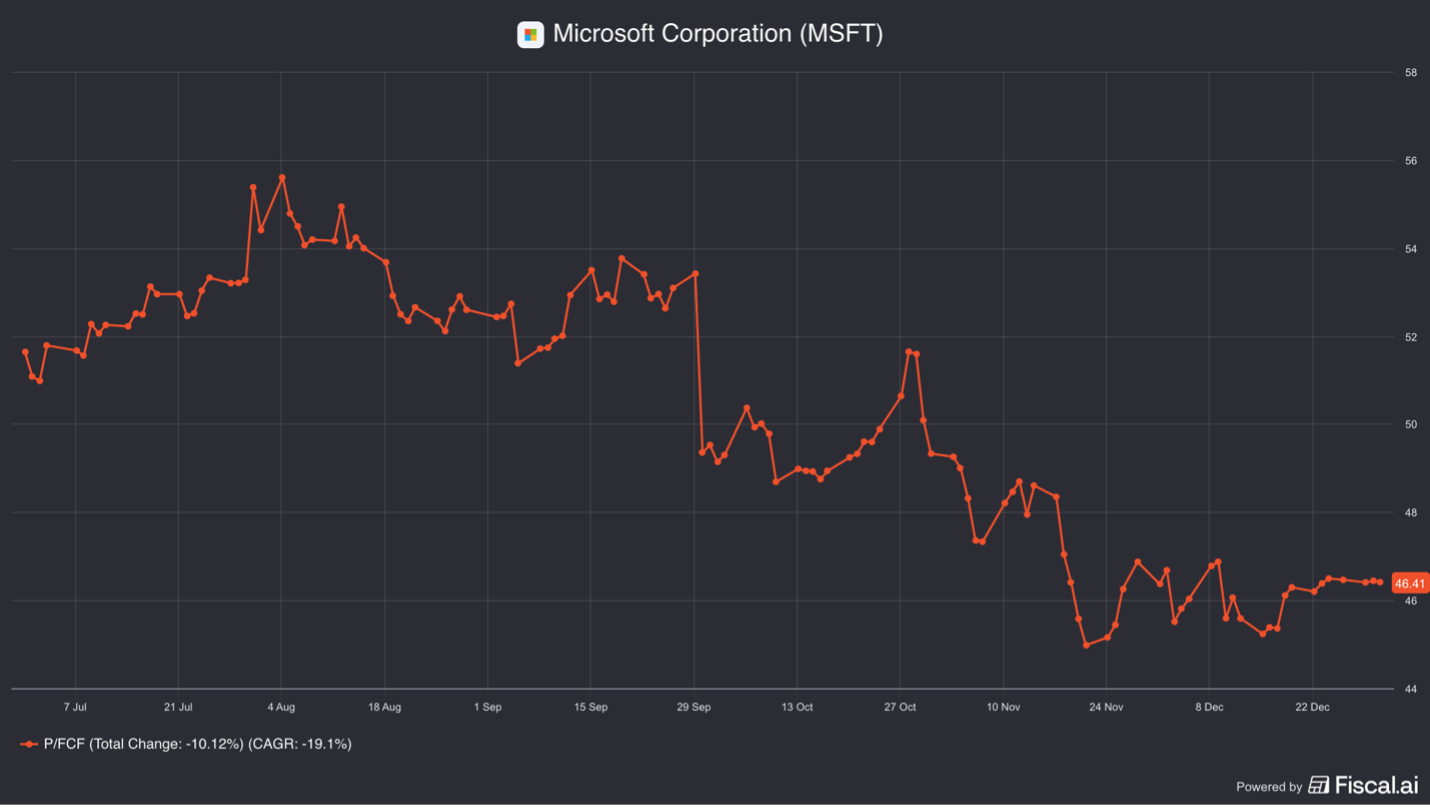

This segment generated $130.2 billion in revenues over the last twelve months and is growing 15% y/y

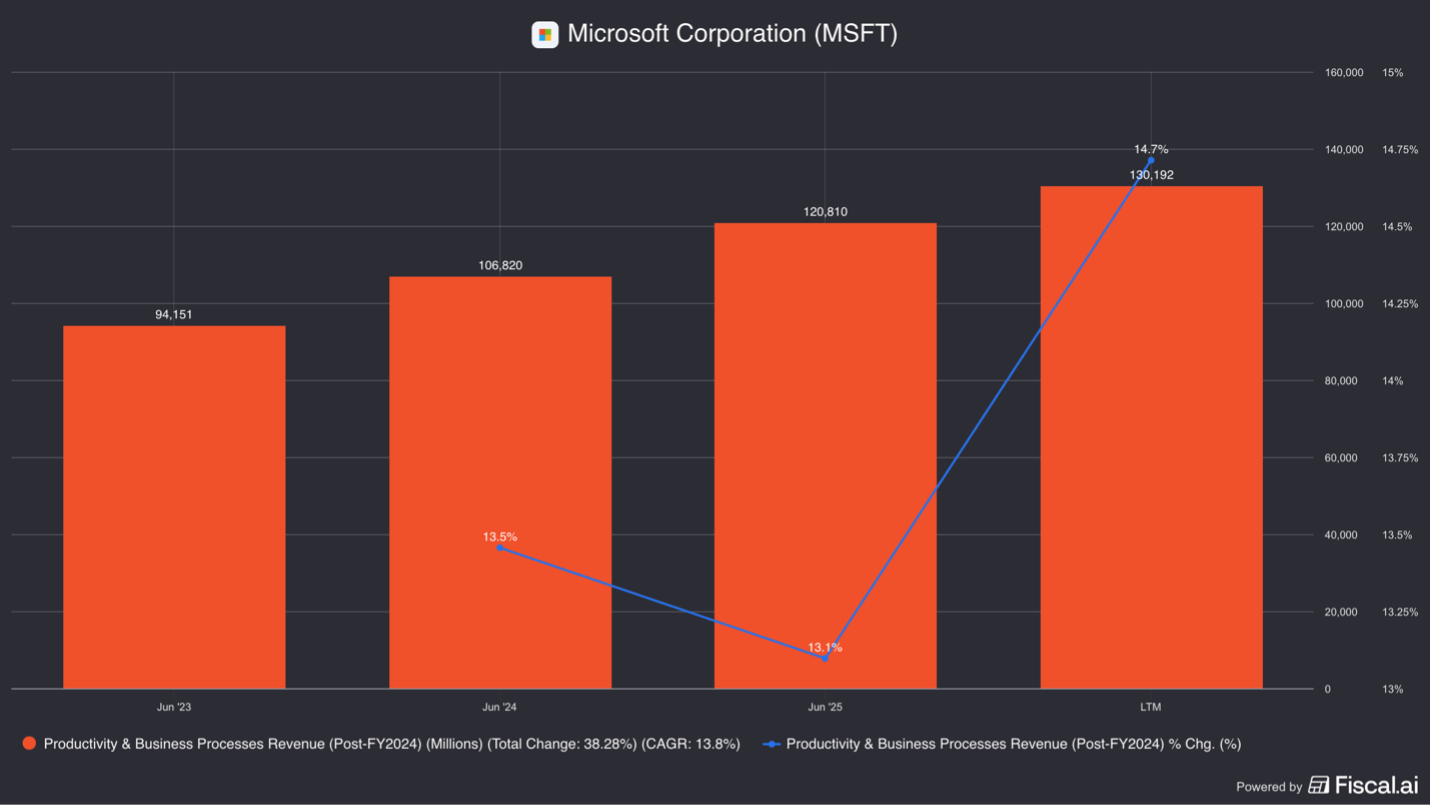

Operating income is $77.3bn, up 11% y/y for a segment EBIT margin of 59%.

2) Intelligent Cloud

Azure

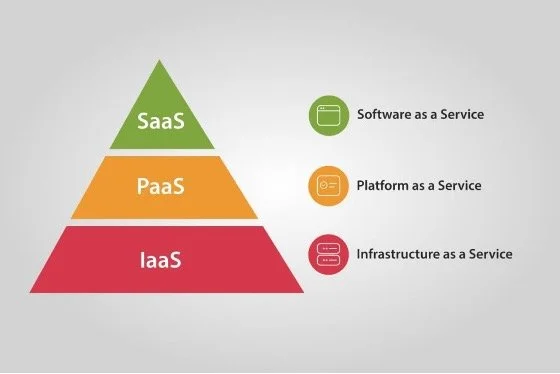

IaaS (Infrastructure as a Service)

Virtual Machines, containers, storage, networking – I.e. “rent a data center”

PasS (Platform as a Service)

Data base, integrations, App Service (for companies to host apps + webpages)

AI Platform

Azure AI and OpenAI Service

Security/ Identity

Azure Active Directory/ Entra , Defender (security), Sentinel (analytics)

Windows Server

On Premise and hybrid licensing

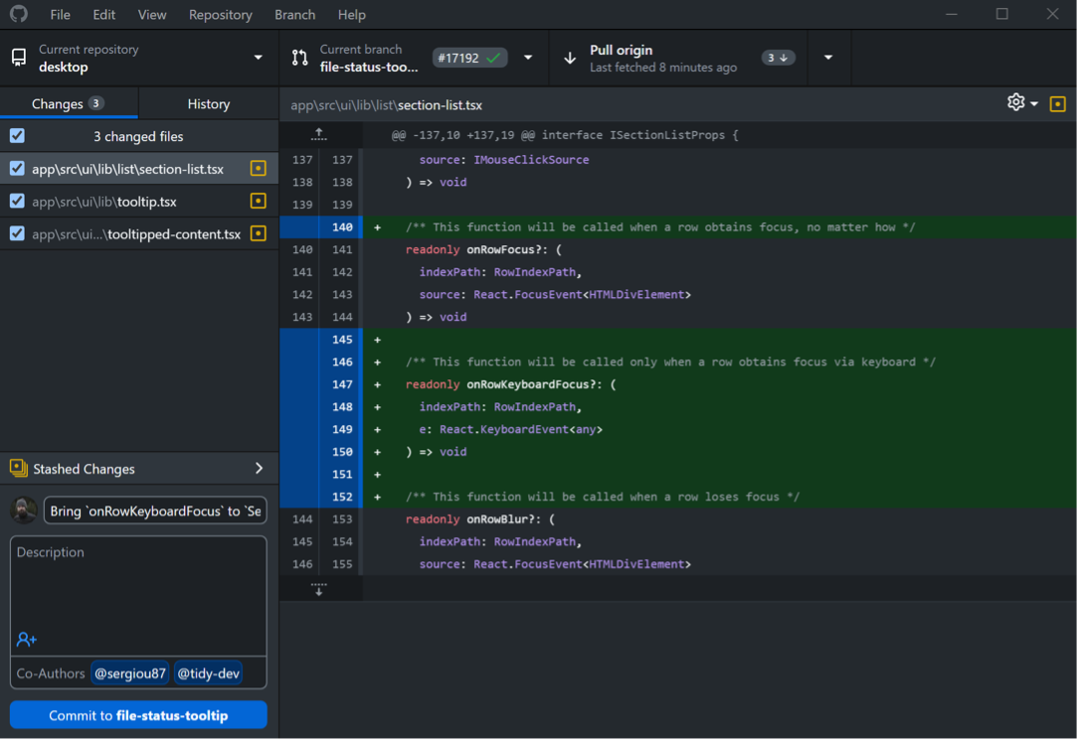

Github

Collaborative code development

Ai Solutions (Nuance)

Healthcare AI Products

All is monetized through a mix of usage, enterprise licensing basis, or per seat basis.

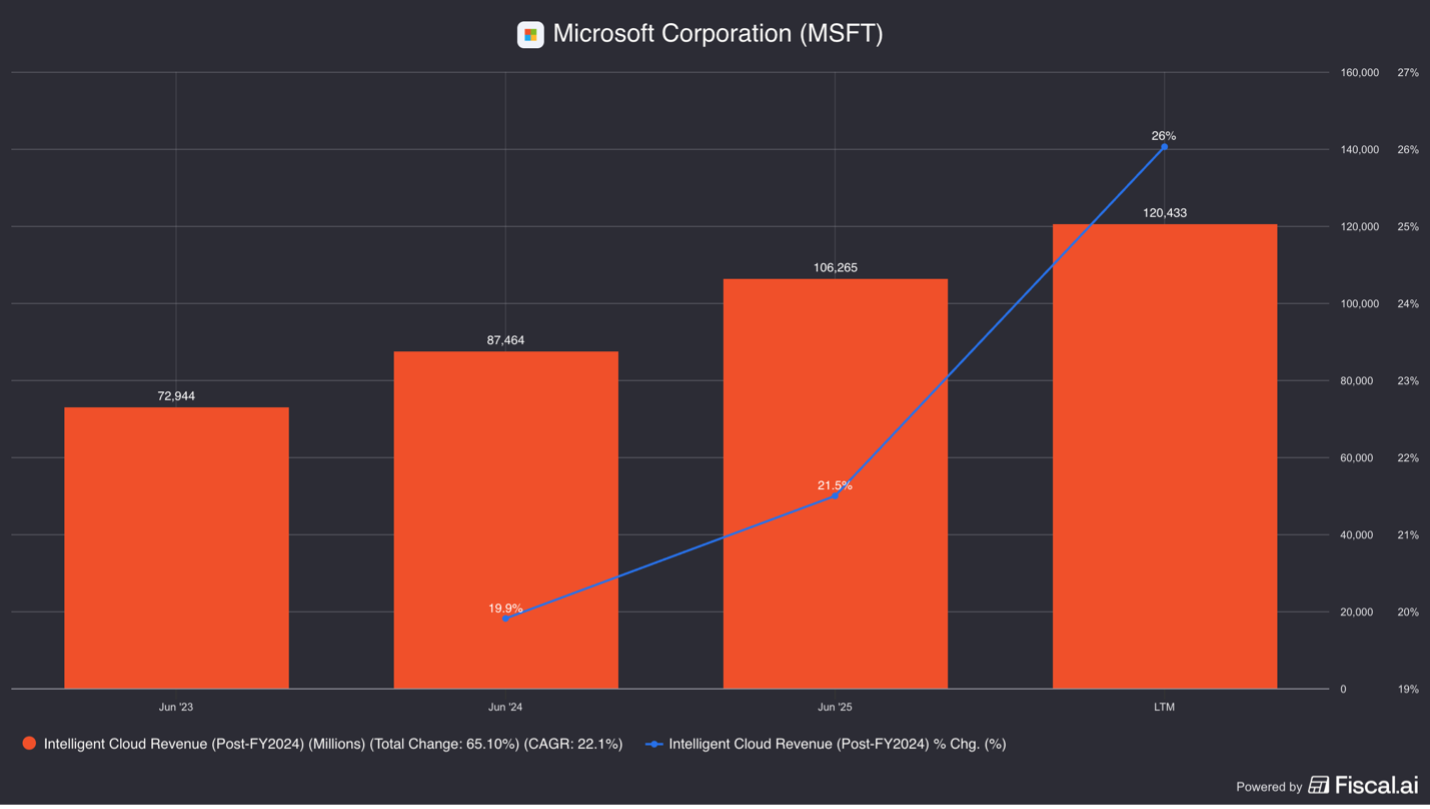

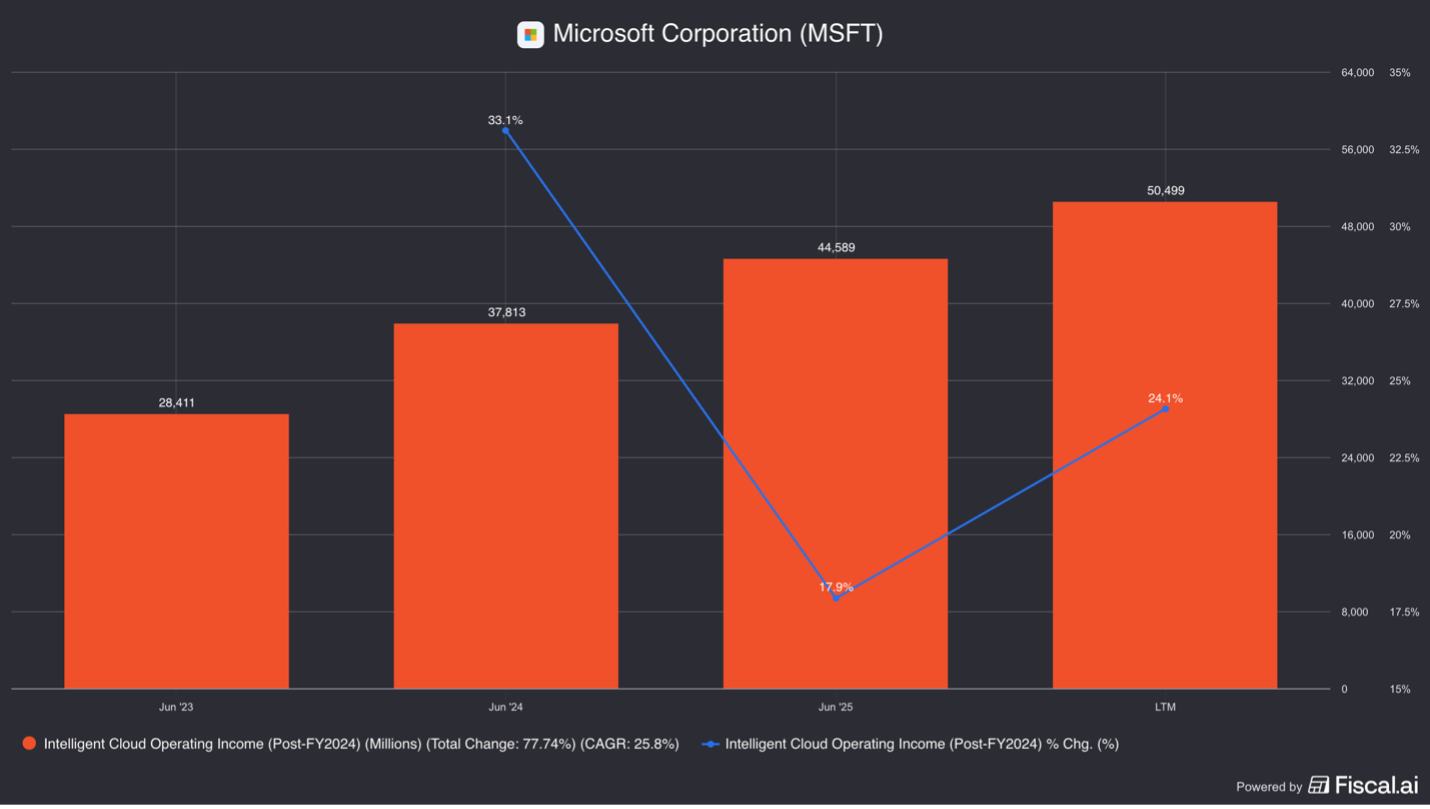

This segment generates $120.4 billion in revenues over the last twelve months and is growing 26% y/y

Operating income is $50.5bn, up 13% y/y for a segment EBIT margin of 42%.

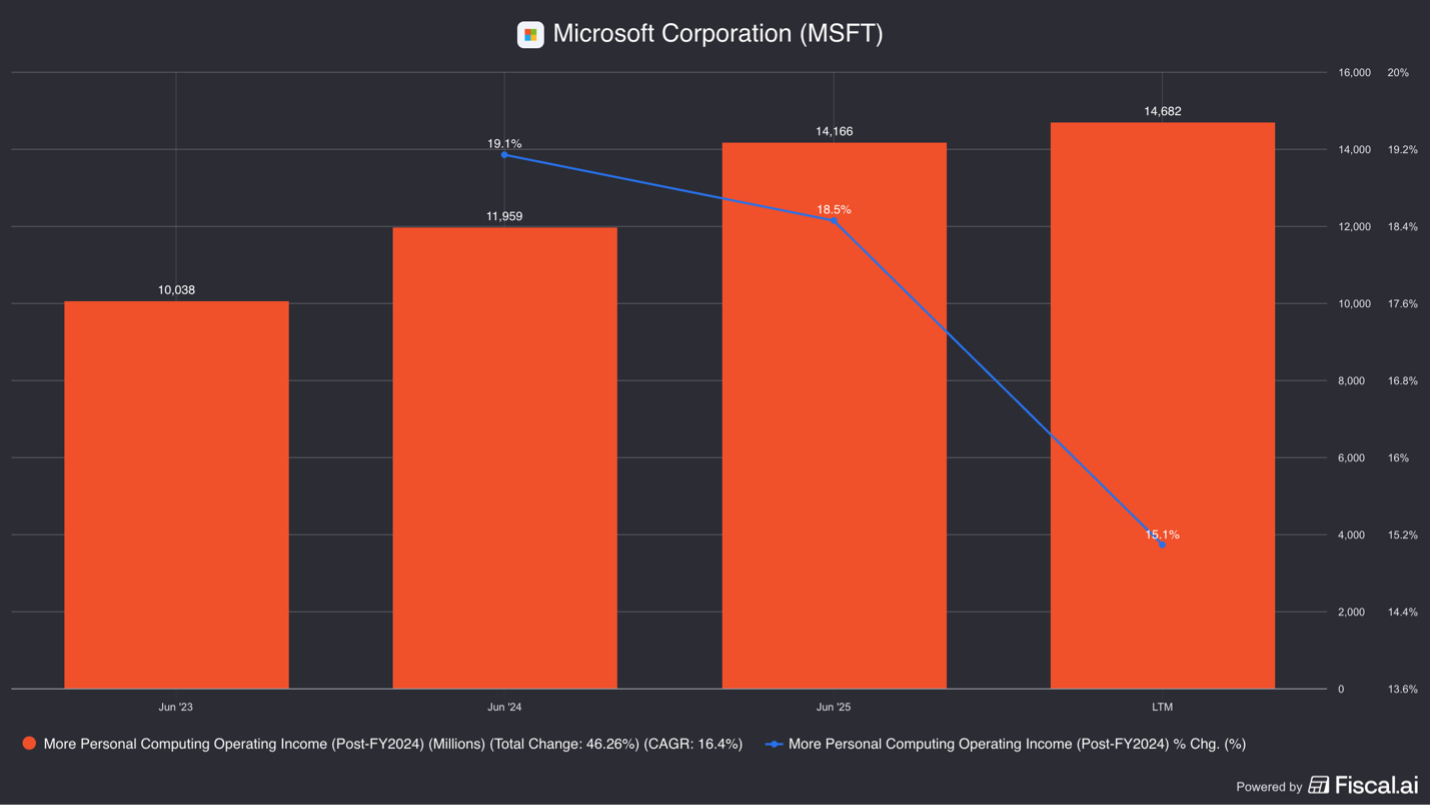

3) More Personal Computing

• Windows OEM Licensing

• Xbox

• Activision Blizzard

• Search & News Ads (Bing, Bing Copilot Chat, Edge Browser, MSN News)

• Surface Devices

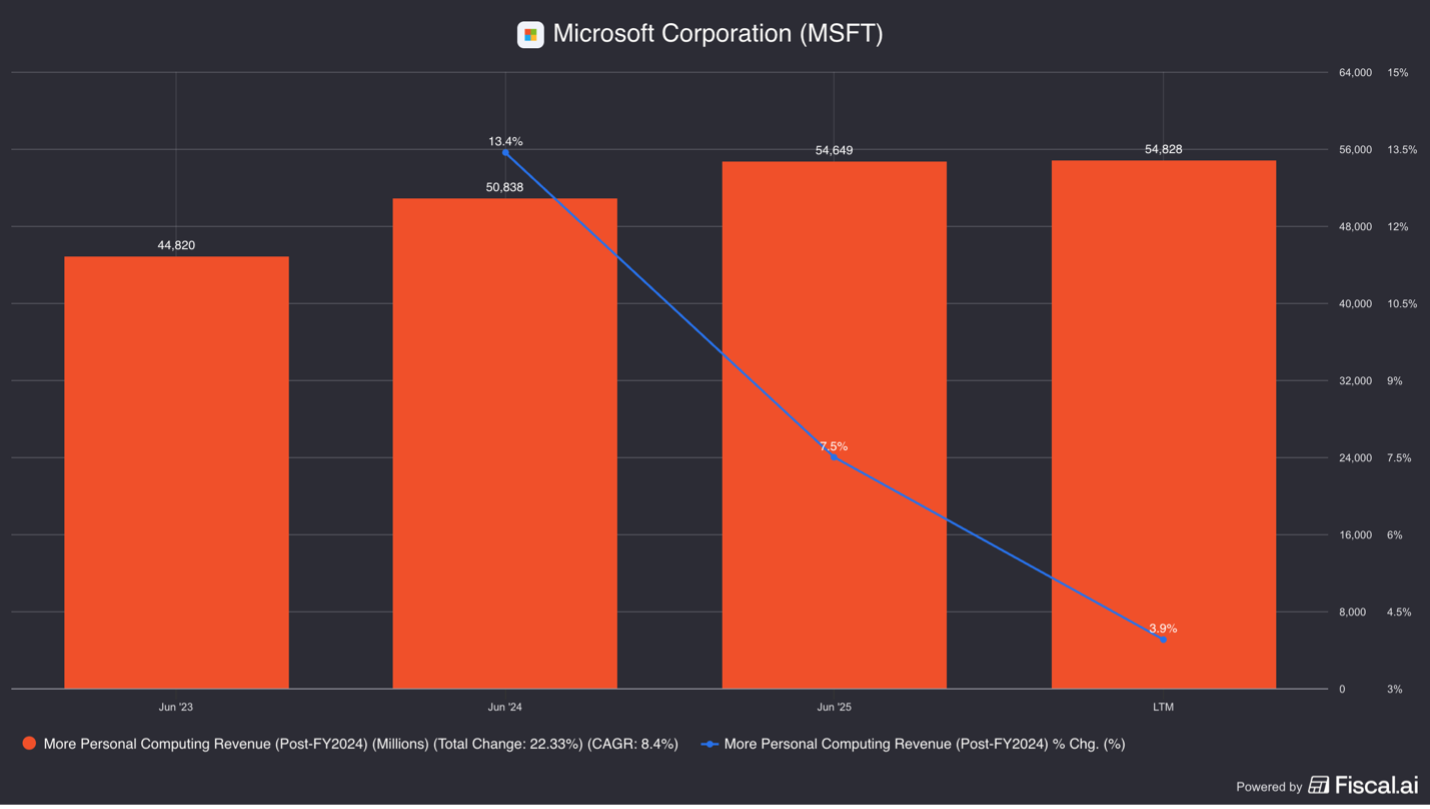

This segment generates $54.8 billion in revenues over the last twelve months and is growing 4% y/y

Operating income is $14.7bn, up 15% y/y for a segment EBIT margin of 27%.

In total the company generates $305.4 billion in revenues and is growing topline 17% with EBIT margins of 47%.

Operating cash flow (after stock-based comp) is $148 billion.

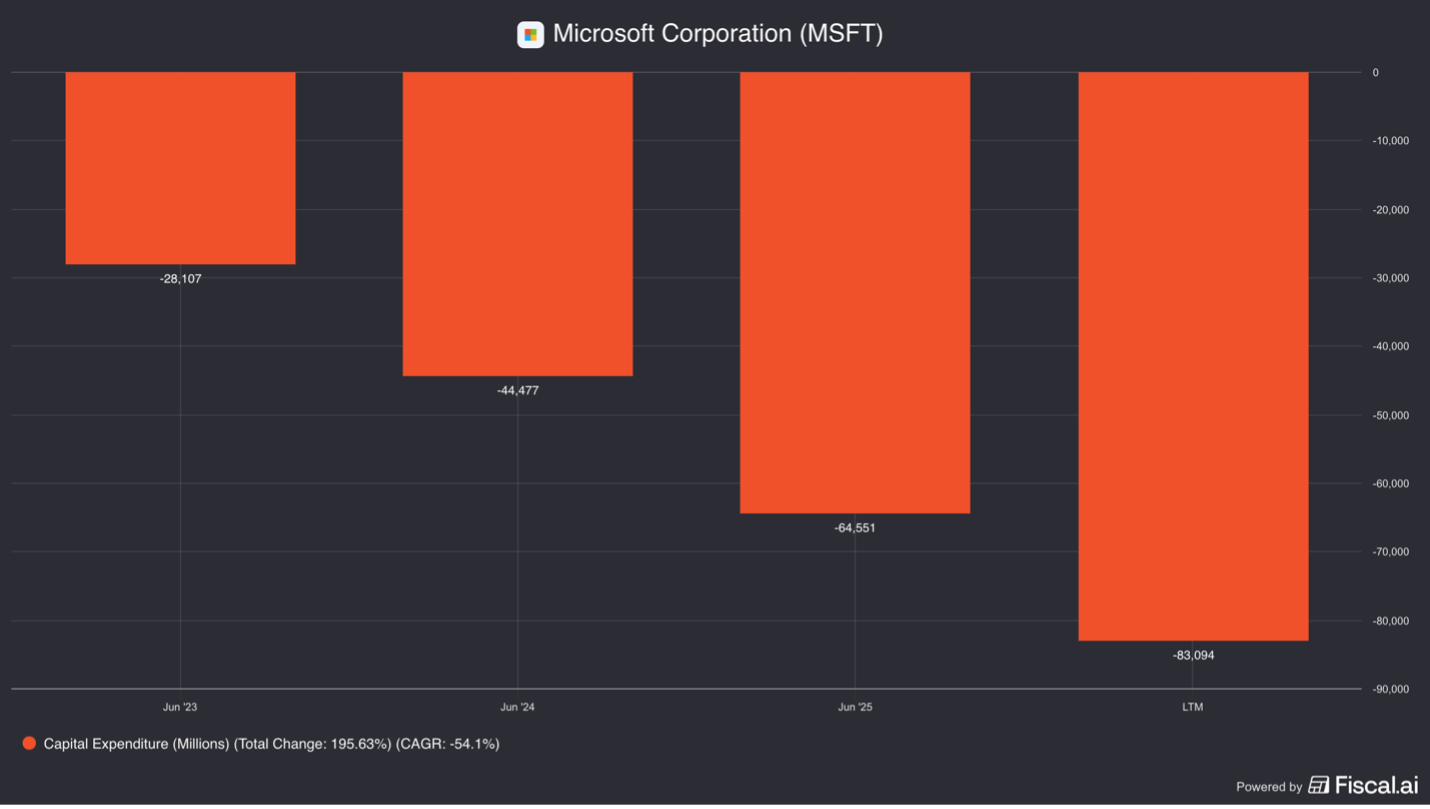

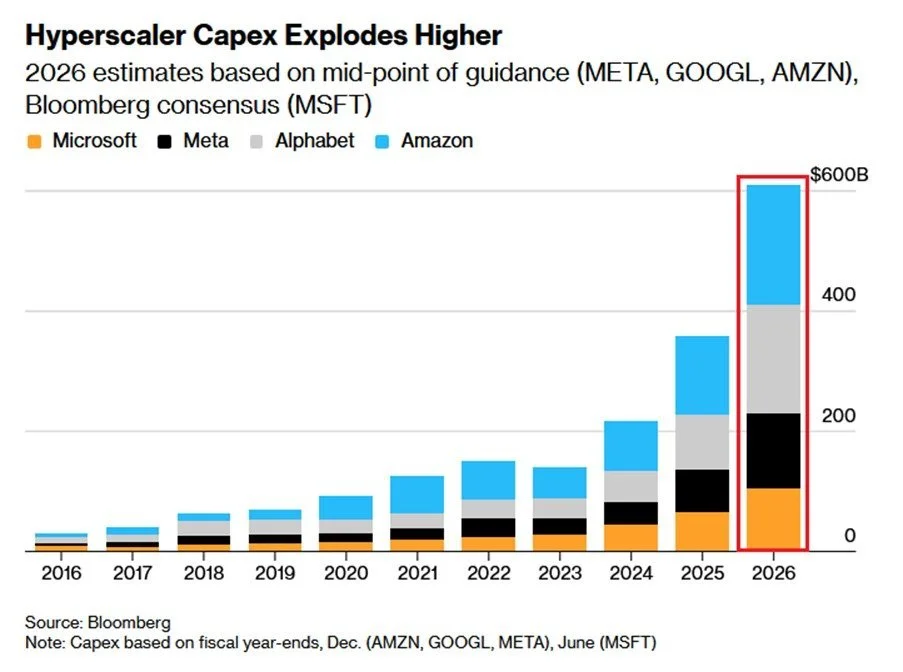

Capex was $83 billion, almost double what it was just two years ago.

And this is expected to increase further to almost ~$150 billion next year, swallowing most if not all cash flows. More on this later.

So what can hurt this behemoth of a business?

Competition.

Competition is the obvious one, but as it exist today there isn’t any “huge” threats.

They compete with Amazon, Google, Oracle, and some other smaller players in cloud.

The Microsoft 365 Suite competes against Google’s Worksuite (G Suite prior).

Dynamic 365 and the Enterprise Apps with namely Oracle, SAP, and Salesforce.

In cybersecurity they compete with Crowdstrike, Palo Alto Networks, and others.

In search they “compete” with Google (or more like compete for people who don’t realize they aren’t on Google).

This has been the competitive landscape for sometime and it largely hasn’t weighed on growth.

But the vectors of competition are changing now more than ever.

Transformation.

CEO Satya Nadella is transforming Microsoft to address a risk that can upend their multi-decades plus business model.

Let us look at cloud.

Competition happens on both the IaaS (infrastructure as a Service) and PaaS (Platform as a Service) layer

The infrastructure layer (IaaS) is largely commoditized. All of the big 3 players—Google, Amazon, and Microsoft—have good coverage, reliability, and a strong partner ecosystem.

Why a company picks one provider over another often has to do PaaS.

(Other reasons include existing relationships—a big one for Microsoft, compliance/ regulatory aspects, data already with a company—like Microsoft’s legacy on-prem servers, or regional footprint.)

PaaS allows a software developer to work with higher-level abstractions or pre-made building blocks for stuff like managed databases, security/ identity, queues, analytics, and developer tools, so they can create products and features much quicker.

For example, say you want employees to use their work logins to identify who they are inside your app.

Working at the infrastructure layer means creating and operating a full identity system: a user directory, secure password storage, login sessions, single sign-on, key management, auditing, and ongoing security updates.

Or you can simply use Microsoft Entra ID (or Amazon Cognito), which provides all of that as a simple service you can integrate into your app.

This platform layer on top of the infrastructure makes cloud a stickier service, because otherwise your code is just interacting directly with hardware and one cloud’s hardware is (by and large) the same as the next.

Now though this is changing on too levels—with AI specialized hardware like Google’s TPUs or AWS’s Trainium chips is becoming part of the discussion of who to pick.

For now Microsoft is “safe” because Nvidia still has a lead for AI-loads with their GPU chip, but if this changes they could lose share.

And the second vector of risk is coming from the potential obsolescence of the PaaS layer from AI.

This impacts not just the cloud business, but all of their apps.

CEO Satya Nadella on the BG2 Podcast said:

“I think the notion that business applications exist, that’s probably where they will all collapse, you know, in the agent era.

Because if you think about it. They are essentially CRUD (create, read, update, destroy) databases with a bunch of business logic.

The business logic is all going to these agents. And these agents are going to be multi-repo CRUD… they are not going to discriminate on what the backend is.

They are going to update multiple databases and all of the logic will be in the AI tier”.

Did you catch that part where he said business apps may collapse.

Microsoft Office 365 is of course is a business app…

To address this they are moving to transform the business to serve AI Agents, rather than just humans.

This is a total reconfiguration of the traditional business model with them moving from an “end-user tools company to an infrastructure company for agents.”

This transformation doesn’t just transform the layer of competition for the cloud business but could upend their ~$70 billion profit pool that is the Microsoft 365 suite.

In an AI Agent world, the users task starts with the AI agent, the AI agent can then move deep into the database to gather what it needs, complete a task, and then give the user an answer.

Want to know what accounts payable outstanding for your steel vendor is?

Just ask AI.

The user never needs to touch Excel.

However, most likely there will be a mix of activity—some human and some AI agent.

But, that also means you will need less humans, so the number of subscriptions will fall.

Microsoft is trying to offset this by charging a “seat” to the AI Agent.

And adding a usage model to meter AI Agents.

This could work, but it is also possible that seats shrink more than they can increase prices.

And other AI agents can enter the mix from other businesses.

If the importance of their software is collapsing, isn’t this a good opportunity as a business to look for other potential vendors?

The Key Question.

The key question on whether Microsoft is scr*wed is a question of whether AI becomes “commoditized”.

Microsoft was very early to bet on OpenAI and that they have priority, exclusive access to their APIs for some period of time.

This seemed smart until it looked like Google and Anthropic were edging out ahead of them.

Microsoft’s OpenAI bet is very commonly misunderstood though.

What they needed to do was guarantee a position with AI before there were other options.

Rewind 5 years ago there was no Anthropic, Mistral, xAI, Cohere, DeepSeek, and Google wasn’t going to give them access to their leading edge models.

So the OpenAI bet was their attempt to make sure they had a seat at the table when AI came.

And it did.

Now though there are many alternatives.

And it doesn’t seem like there will be one winner that is miles ahead of everyone and can own everything dealing with AI.

So as long as there are AI model options, Microsoft’s business is no longer existentially threatened.

They don’t actually need OpenAI to win, they just needed to make sure they had access to some top AI model.

And they do.

But with AI competition heating up, distribution and partnership became important for the AI companies and Microsoft can now offer customers many models to pick from in their “Foundry Models Lineup”.

As long as this is the case, AI isn’t actually what matters, it is who can deploy the AI that does.

And Microsoft is in a great position for this.

The DeepSeek and Fiber Risks.

But there are other risks too,

With a floor of capital entering the data center space, there is a risk that supply overshoot demand.

If this happens there could be pricing pressure because the assets are fixed costs that are already paid for.

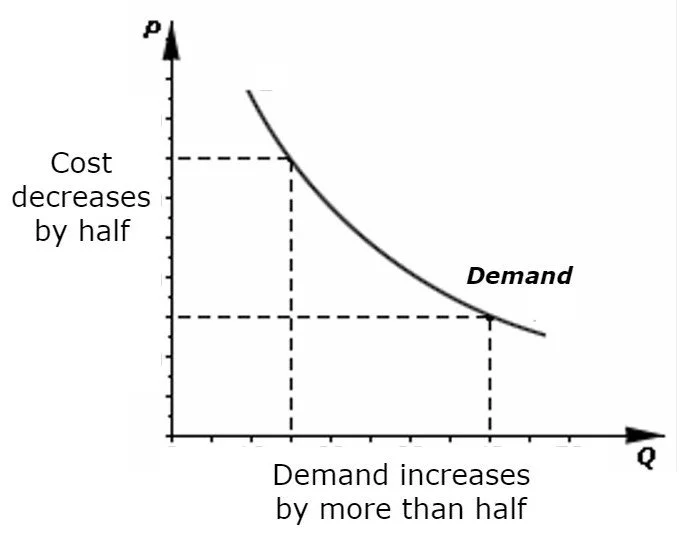

And there is the “DeepSeek” risk.

DeepSeek is an open source AI model that can be anywhere from 10-20x more efficient to run than a OpenAI or Google’s models.

While it isn’t leading edge, it is a lot cheaper and could be good enough for a lot of usage.

The risk is that AI may be come A LOT more efficient so you need less compute.

This is why Nvidia sold off 17%, losing $600 billion in market cap in a single day.

This combined with the potential of an overbuild out leaves the risk that there could be years of supply exceeding demand, which shows up in lower pricing on cloud and AI services.

This year big tech is estimated to spend over $500 billion on capex, which will be directed towards new data centers, chips, and hardware.

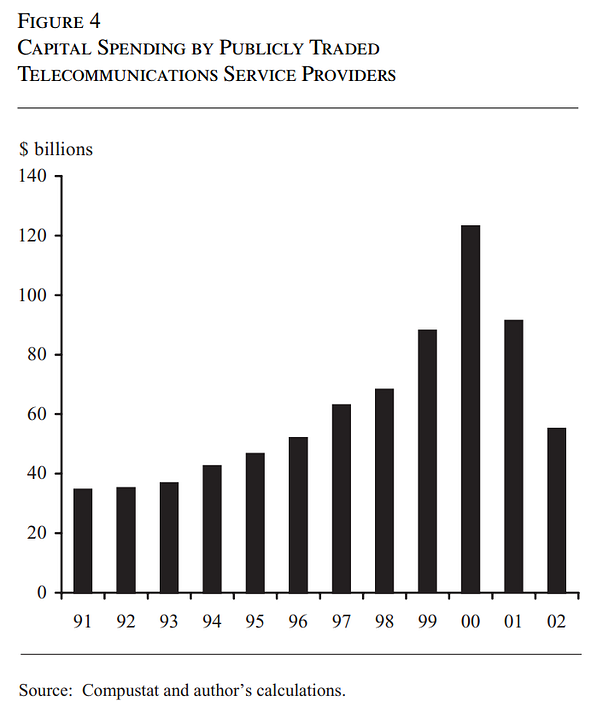

If we rewind to the late 90s, there was 39 million miles of fiber optic cable laid costing an estimated $90 billion. In total it was estimated that $500 billion was spent on infrastructure investment during this period.

When the bubble crashed in 2001, it was estimated that under 5% of this fiber was actually used.

It took roughly a decade for all of it to be utilized.

The concern isn’t that there won’t eventually be demand for AI, but what if the build out overshoots demand by 5-10 years and the infrastructure is unprofitable for some period of time.

Also, used GPU chips are unlikely to have much value in 5 years, so they may be a total write-off.

Now the new models from OpenAI and Google were much better and required more compute so the DeepSeek fear resided.

Plus people started talking about “Jevon’s Paradox”, which is the idea that the more efficient a resource becomes to use, the lower the cost, and thus the more demand.

And lastly, Microsoft noted that the data centers are fungible with other Azure workloads…

But this isn’t totally true. A GPU-first data center cannot run as efficiently the workloads that go to a CPU-data center.

So the risk still exist if the AI demand isn’t there.

But Microsoft is more worried about if the demand is there and they can’t service it.

This is because once a company gets started with a cloud provider it is sticky.

So if they can’t service them, they lose that customer likely forever and also their data.

And the AI agents need data to improve the models.

So Satya Nadella has effectively said we will overshoot because that is better than undershooting it.

This puts them is a good position competitively long-term, but there still is a risk that this crushes their earnings in the near term…

And investors earnings expectations alongside that.

It has to do with an accounting issues.

Allow me to explain.

The Capex Issue.

With $120bn in earnings, they trade at 25x trailing net income.

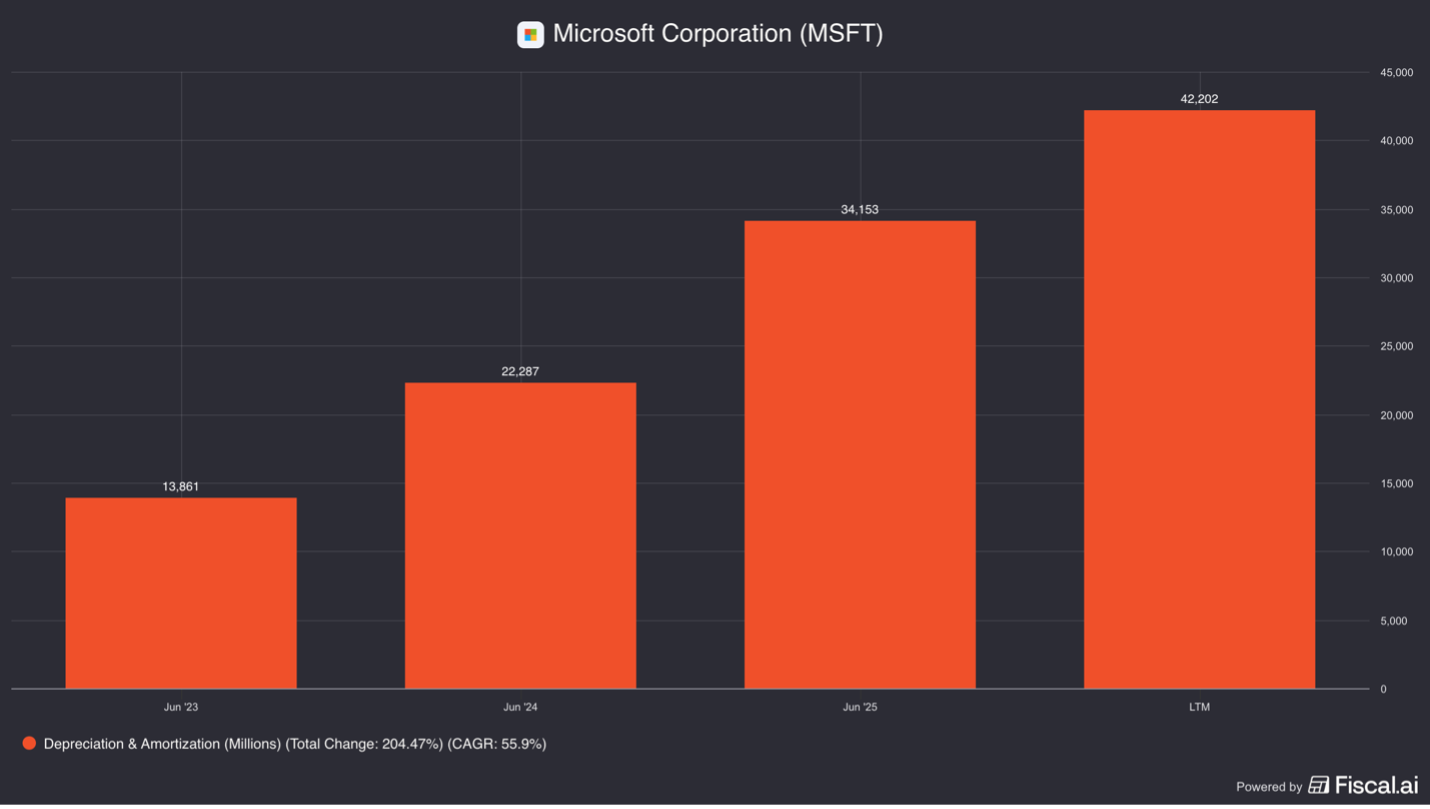

However, depreciation & amortization is only $42 billion versus capex of $83 billion.

This means that the P&L is only capturing half of what is being spend on data centers now.

The idea of depreciation is to capture the real expense of a long-lived asset in a given year.

So, if an asset is supposed to last 5 years then they depreciate it over 5 years and it matches the revenues they make off of that asset.

When you have an increase in capex, which are assets that are supposed to last, say, 5 years, there is a period where the depreciation is understated.

For example, say they spent $40 billion on capex every year for the last 5 years and $80 billion last year.

Depreciation used to be $40 billion / 5 years = $8 billion/ yr.

Now if they spend $80 billion a year for the next 5 years, depreciation will eventually be $16 billion / yr ($80 billion / 5 years).

However, it will take 5 years for depreciation to fully capture that $80 billion a year they are now spending.

So when capex is increasing, depreciation is understated.

This is a problem because we want to know what true owners earnings are, but our figures will be off if they are spending a lot on capex in order to grow earnings, even though only a fraction of that capex is being accounted for as an expense.

This is another way to say they may be “overearning”.

The accounting numbers are not capturing the true economics of their earnings.

Now there is one other distinction to make.

It is growth versus maintenance capex.

Maintenance capex is spent in order to maintain existing earnings.

This figure should ideally at least MATCH what depreciation is.

That way we know that the cost of all of their capex to maintain their existing earnings is accounted for in their income statement expenses and there is no risk that earnings are overstated from this.

Growth capex is extra capital expenditures that are forsaken in order to grow.

So, for example, if you run Chipotle, maybe every 10 years you redo the store. That is money spent just to keep people coming into your existing store so it is maintenance capex.

If you build a new Chipotle, then that is growth capex.

Both of these get lumped in together in capex so an analyst needs to figure out the difference to see if the expenses on the income statement are properly capturing that “cost of renovation for Chipotle every 10 years”.

With Microsoft, some of this capex is maintenance capex that is increasing in order to service AI workloads so earnings are likely overstated.

Some is growth capex that will allow earnings to grow more in the future.

This impacts the valuation.

Let me show you how.

Valuation.

At $402 a share, Microsoft has a $3 trillion market cap.

On a trailing P/E ratio they trade at 25x.

On a trailing FCF multiple (after SBC) they trade at 46x.

This is obviously a big difference.

The key difference is that depreciation element we were talking about.

Now as replacement chips and servers to handle AI are more expensive than older systems and some workloads move to AI, the cost to service these go up.

This means “maintenance capex” is increasing.

It is hard to estimate how much.

Let’s assume half of the increase in capex is due to maintenance capex increasing. This is around what the prior years capex was.

This means “normalized FCF” is really $88 billion.

So Microsoft trades at 34x FCF.

At this multiple, an investor would likely want to see 3 years of mid double-digit growth, which would get them to about a 22x multiple.

If they can continue to grow double digits at that point, a 25-30x multiple could be fair.

That is an upside of 14% to 36% (25x/22x and 30x/22x).

Of course there are still many risks with the changing AI landscape that could mean earning fall.

Or they could keep growing strongly for longer than we assumed above, implying upside.

But do not forget, Microsoft is in the midst of a total transformation from an “end-user tools company to an infrastructure company for agents”.

Whether they are better or worse off in the end is for you to decide.

For more on Microsoft, check out this video below.

Nothing in this newsletter is investment advice nor should be construed as such. Contributors to the newsletter may own securities discussed. Furthermore, accounts contributors advise on may also have positions in companies discussed. Please see our full disclaimers here.