ServiceNow Stock Breakdown

Get smarter on investing, business, and personal finance in 5 minutes.

Stock Breakdown

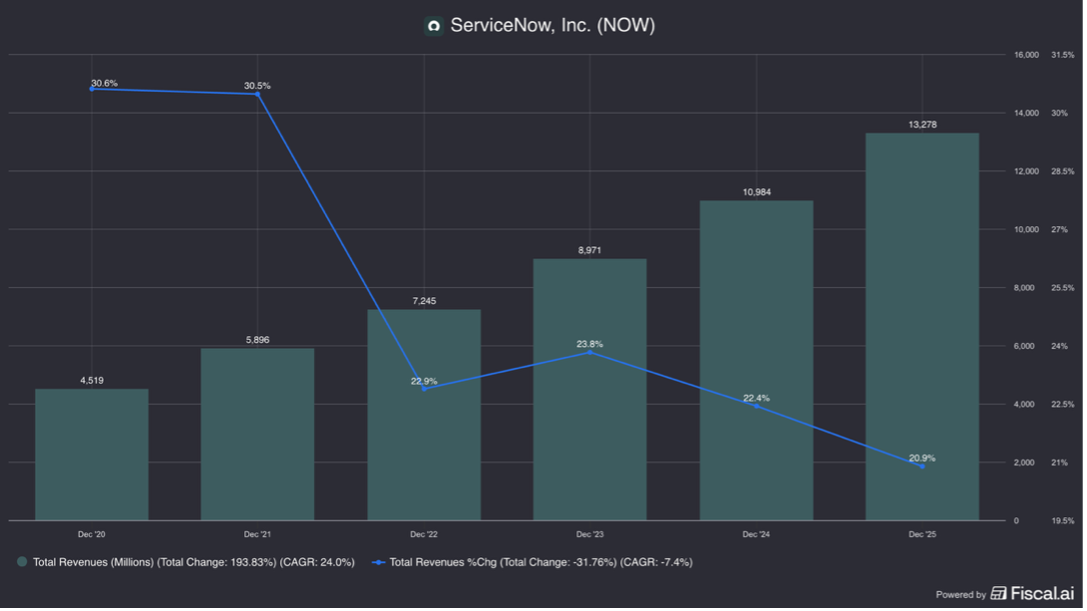

20% revenue growth.

34% operating profit growth

$4.5 billion in free cash flow which has grown at a 27% 5-year CAGR.

This don’t look like the financials of a business that is about to face imminent disruption…

And yet their stock is down -55% from peak.

ServiceNow was a darling of the SaaS revolution.

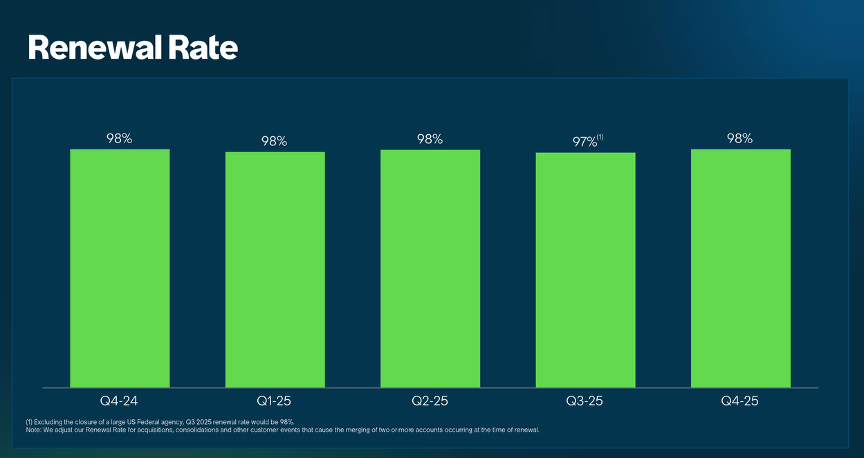

With strong customer retention.

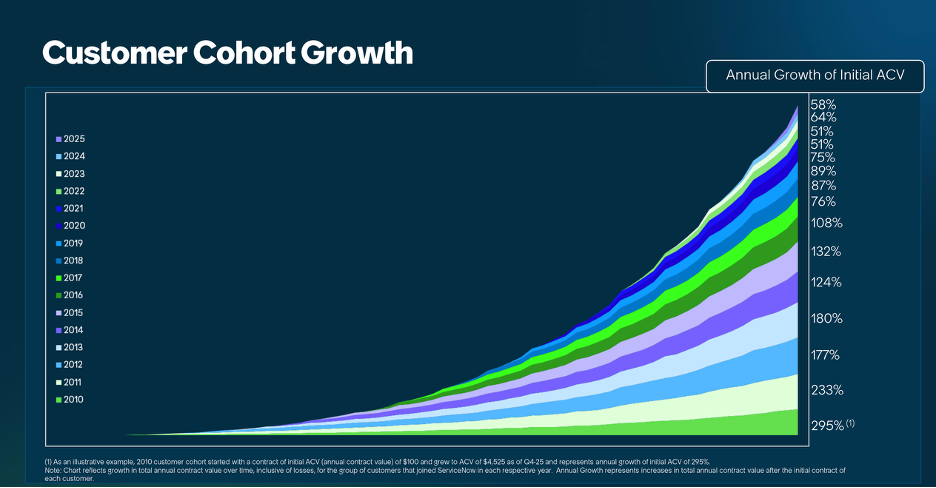

Fantastic customer cohort revenue growth

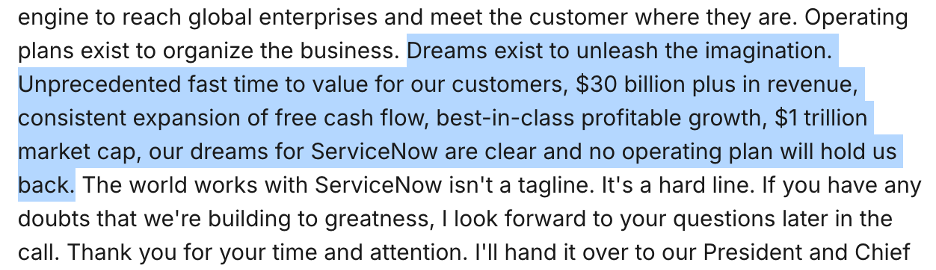

And ambitious plans to reach $30 billion in revenues from $13.3 billion today…

…and a $1 trillion market cap for a 10x from here.

Outspoken CEO Bill McDermott says pulling their software out is like “setting your hair on fair and then using a hammer to put it out”.

But the market seems to disagree…

With a broad sell-off on fears of AI, how formidable of a threat is it for ServiceNow?

And what really does the business do anyway?

We break it all down in this week's Five Minute Money.

Business.

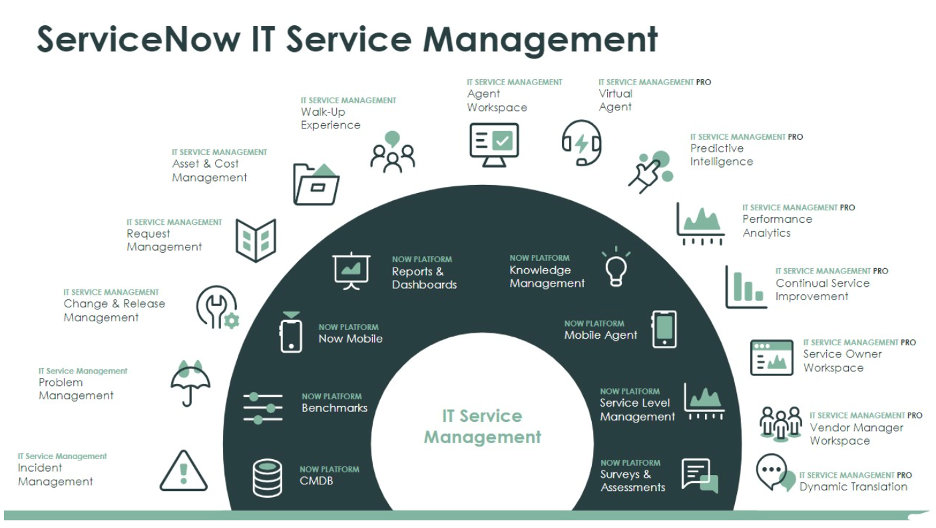

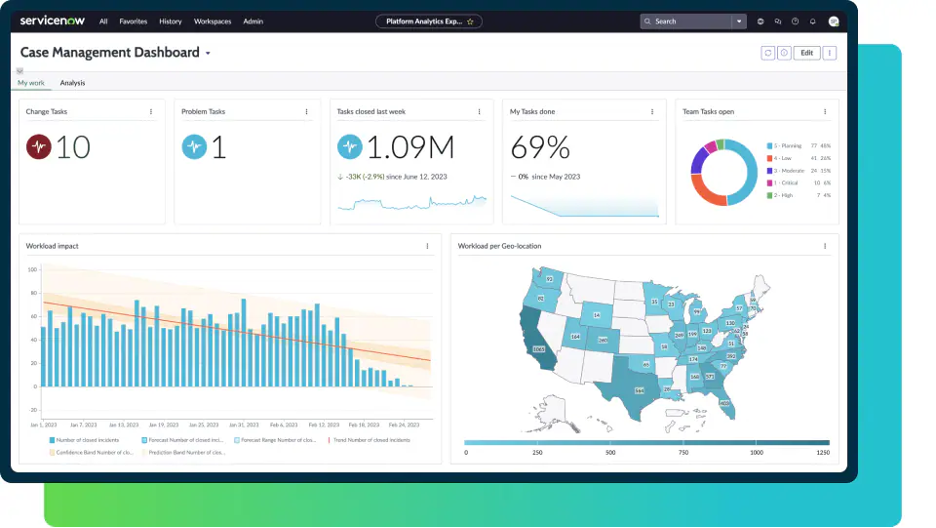

ServiceNow started as an IT service management platform.

What that means is they would:

1) Log and manage incidents (something’s broken)

2) Handle service requests (new laptop, access, password reset)

3) Control changes (approvals + audit trail)

4) Track problems/root cause (prevent repeat incidents)

5) Maintain a Configuration Management Database, or CMDB (what devices exist and how they’re connected and what could be impacted by an outage)

6) Provide self-service + a knowledge base (so common issues don't become tickets)

While they were helping IT departments manage tickets from employees with tech issues, they at the same time were perfecting a workflow product.

Once it was embedded in enterprises day to day operations, they figured why not move beyond the IT department?

With HR, they can help employees:

1) Log and manage HR cases (benefits issues, payroll questions, policy questions)

2) Handle employee service requests (employment verification, address changes, leave requests, immigration/document requests)

3) Run onboarding/offboarding workflows (checklists across HR + IT so nothing gets missed)

4) Route and escalate work (assign to the right HR specialist, keep an audit trail)

5) Maintain an employee service portal + knowledge base (self-service FAQs, forms, guided help to reduce repetitive tickets)

Now imagine a similar flow for Customer Service, Security, Compliance, Facility Management, and you are starting to understand their core product.

However, they since have added even more, including a creator platform for businesses to create their own apps on the ServiceNow Platform.

Now instead of siloing each of these functions and verticals, they aim to be the layer that sits on everything.

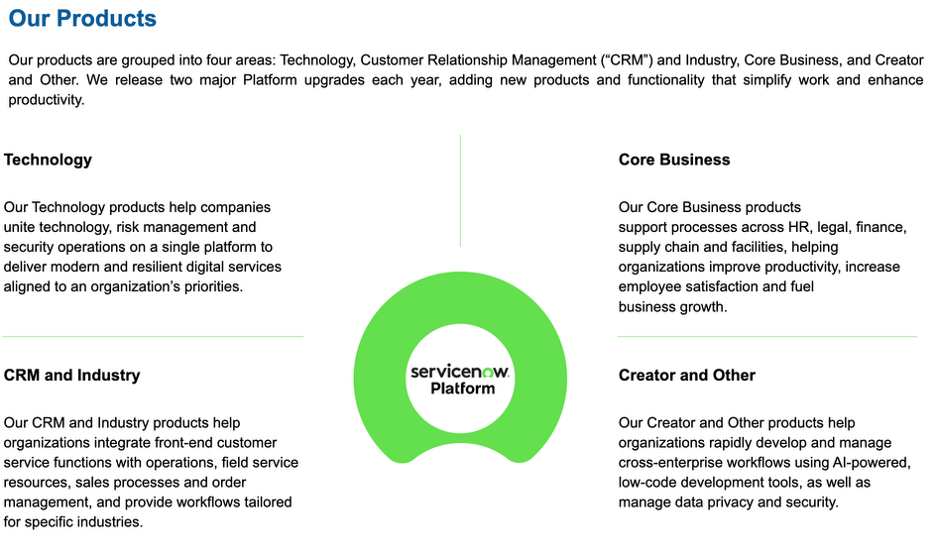

They break all of their different product groups down into four areas: 1) Technology, 2) Customer Relations Management (CRM) & Industry, 3) Core Business, and 4) Creator & Other.

Let us take them one at a time.

Segment Breakdowns.

First up is Technology.

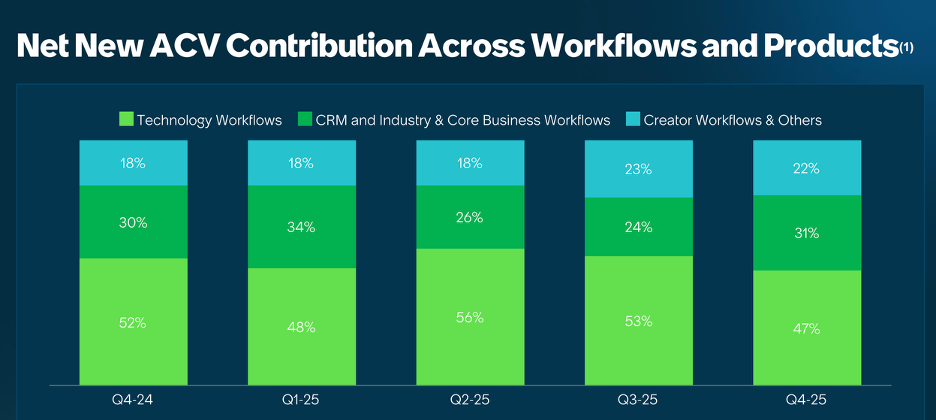

Based on net new ACV (average contract value), this is around 50% of the business.

There are several functions that are housed in here:

IT Service Management or ITSM – this is the classic ServiceNow use case we mentioned earlier.

IT Operations Management (ITOM) –this has to do with seeing problems before they occur.

Configuration Management Database (CMDB) – this is the “map” of IT: what systems exist and how they’re connected (so you know what will be impacted).

IT Asset Management (ITAM) – this has to do with tracking hardware/software and controlling cost + license compliance.

Security Operations (SecOps) – this has to do with managing security alerts, incidents, and vulnerability remediation as workflows.

Governance, Risk & Compliance (GRC) / Integrated Risk Management (IRM) – this is about audits, controls, and tracking risk/compliance work with an evidence trail.

Strategic Portfolio Management (SPM) – this has to do with prioritizing projects and allocating IT resources to the highest-value work.

DevOps (Development + Operations) – this has to do with connecting software releases to change control and incident learnings (faster, safer deployments).

Note how much of this workflow has to do with fixing things that are broken.

And one of the key risks with implemented AI is that if it makes a mistake, who will fix it?

While we are getting ahead of ourselves, ServiceNow is trying to embed themselves in the AI workflow where AI is layered on top of the Now Platform so issues can still be caught and fixed.

Second segment is CRM & Industry.

There are 5 functions here.

The customer’s here are not ServiceNow customers, but the customers of the enterprise’s.

Customer Relationship Management (CRM) / Customer Workflows – focused on managing customer issues end-to-end, especially when resolution requires coordinating multiple internal teams.

Customer Service Management (CSM) – runs the customer support “case” queue: intake, routing, SLAs (Service Level Agreements), knowledge, and self-service.

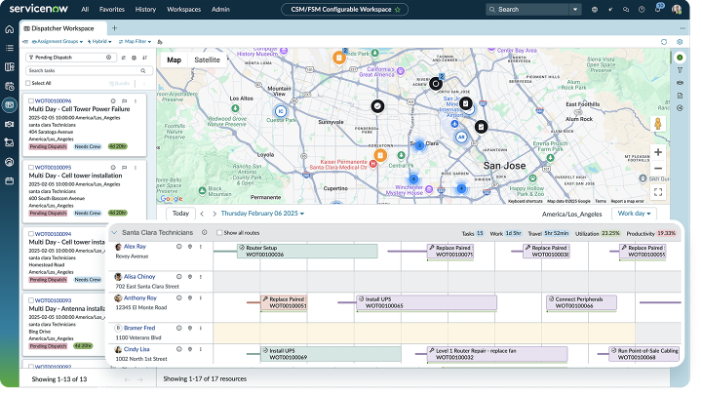

Field Service Management (FSM) – handles dispatch and on-site work orders: scheduling, routing, parts, and mobile technician workflows.

Order Management / Service Fulfillment – ensures customer orders and change requests actually get delivered by orchestrating handoffs, approvals, and status tracking across teams.

Industry Solutions – pre-packaged workflow products tailored to verticals (like telecom, financial services, healthcare, and the public sector) with industry-specific processes and data models.

For example, let’s say a customer tells a telecom company: “I want to add home internet at my new address next Friday.”

That single “order” actually triggers a chain of work:

Sales/customer support captures the request (plan, address, install date)

Eligibility check (is service available at that address?)

Credit/fraud check (if required)

Provisioning tasks (activate service in backend systems, assign modem/router)

Field Service dispatch (schedule a technician, route, confirm appointment)

Inventory + logistics (ship equipment if needed)

Customer updates (status messages: scheduled → technician en route → activated)

Billing starts (account updates, invoice timing)

Now to clarify Salesforce or Microsoft Dynamics is often the CRM that is that system of records.

So despite ServiceNow calling this segment CRM, it usually is not used a CRM.

ServiceNow is the system of operational workflows.

Now you don’t actually need Salesforce to run the CRM aspect, but most enterprises are already embedded with them and don’t want to rip them out.

The Third Segment is “Core Business”.

This does not refer to ServiceNow’s Core business, but to things that impact a business’s “core business”.

Finance workflows (often framed as Finance Case Management / Accounts Payable Operations) – handling finance inquiries like invoice/payment questions as structured cases.

Procurement workflows – supplier/vendor-related requests and procurement service management (intake, approvals, routing, status tracking).

HR Service Delivery (HRSD) – employee HR cases and requests (benefits, payroll, onboarding/offboarding, policy questions).

Workplace Service Delivery – facilities/workplace requests (repairs, moves, room/desk services), plus related internal service tickets.

Legal Service Delivery – legal intake and routing (contract review requests, policy questions, matter tracking).

This together with the last segment is about 30% of revenues.

Their fourth Segment is Creator and Other.

This includes:

App Engine (Low-Code Development) – this is how customers build their own internal workflow apps on the ServiceNow platform.

Integration Hub (Integrations + APIs) – this is how ServiceNow connects to other systems (Salesforce, Workday, SAP, Okta, etc.) so workflows can span the enterprise.

Now Assist (Generative AI Assistant) – this is ServiceNow’s AI layer that helps create, summarize, and resolve work faster (for agents, employees, and developers).

RaptorDB (High-Performance Platform Database) – this is the database layer ServiceNow built to make the platform faster at scale, especially for analytics and large workloads.

Platform Security (Vault / Encryption + Governance) – this is the set of security and privacy capabilities that help enterprises use ServiceNow for sensitive workflows with stronger controls.

This is about 20% of revenues and big growth opportunity for them.

All together these 4 segments make up ServiceNow’s $13.3bn in revenues.

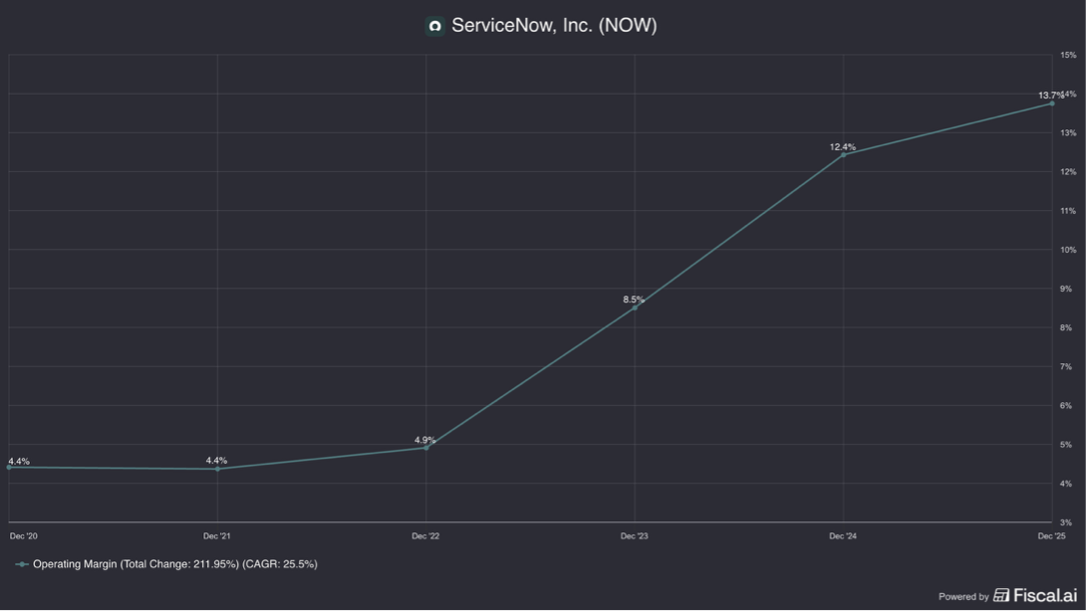

They have a 78% gross margin and 14% operating margin.

Now the key question is how much of all of this workflow is at risk with AI?

What changes?

The AI Risk.

There are two key risks facing ServiceNow

1) Seat-based pricing

2) AI taking over workflows

The first risk is simple. As AI increases efficiency of work, there is less humans needed.

Their pricing model collapses.

While they dispute that this is imminent giving that seat count is growing and they think their potential TAM to grow seats is still massive, they also charging for capabilities with higher priced Pro Plus and Enterprise Plus tiers.

They also are pricing an entire enterprise regardless of seats.

Enterprises like this because it gives them clear visibility to cost instead of the variation of a usage model.

They also are charging for usage with “Assist tokens”. This is similar to Adobe augmenting their pricing model with usage fees, who we wrote about here.

Total cost of ownership can range anywhere from ~$100k for a mid-market business to over $20 million for an enterprise.

It is worth noting that the cost of the software is usually only 1/4th the cost of ownership.

For every $1 spent on ServiceNow licenses, $3 is spent on consultants and maintenance.

This $3 is spent between a slew of consultants, internal employees, and ServiceNow Impact, which provides an advisory service.

While a good portion of this is one-time, a lot is on-going because ServiceNow has two updates a year and enterprises need help to make sure it doesn’t break their workflow.

This is being compressed already by AI because it is allowing consultants and internal teams to be more efficient.

Which is actually a good thing for ServiceNow because it decreases the total cost of ownership.

The common prediction is that this $3 gets squashed as the software provider (ServiceNow) can do more of this work with AI (Now Assist) and that $1 that charged previously goes up.

In order address both of these risks they are transitioning their business

They want to be a platform—Now Platform.

Over 80% of deals now include 3 of more products.

The more an enterprises uses them and can keep them in their platform for not just IT, but also HR, Security, etc. the harder it is to replace them and the more pricing power they have.

The second risk is AI is taking over workflows.

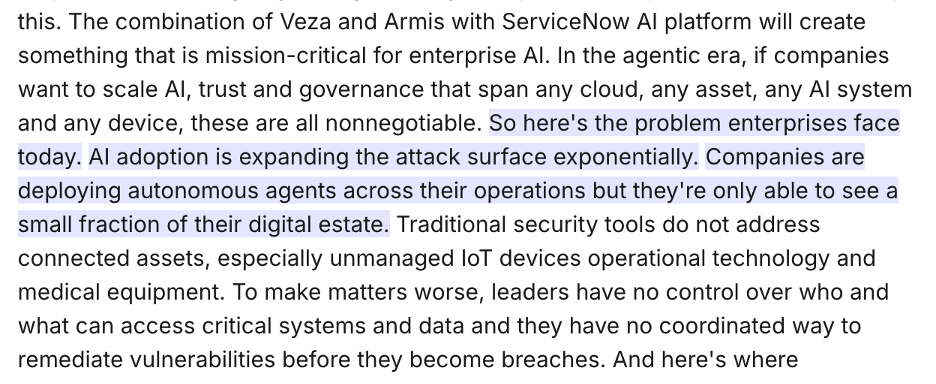

OpenAI, Anthropic, or another AI company creates General AI agents that can autonomously do tasks, including “self-heal” the IT stack from potential issues before they become problems.

Agents can use your computer for you and don’t need to use the software layer in between the databases.

AI gets surprising good at moving across legacy databases and disparate systems to constantly monitor and fix problems.

There is no ticket created because there is no human involved in the workflow.

Maybe this eliminates the vast majority of all issues, with a handful of getting escalated to a human.

The workflow ServiceNow was historically so good at managing becomes mute without multiple people in the process.

Or the risk can be simpler cost pressures.

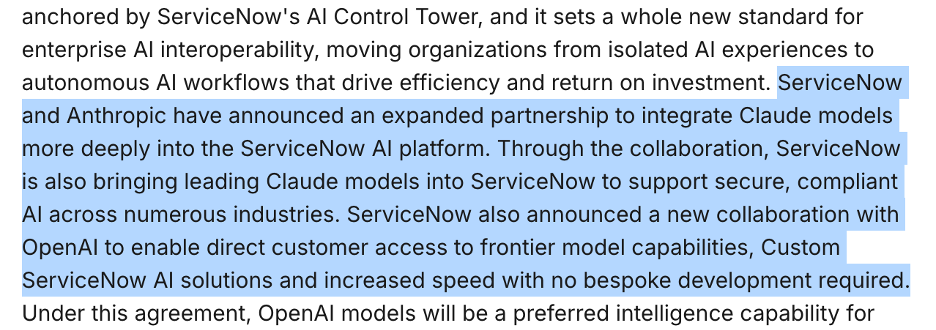

With deals with OpenAI and Anthropic, every time you use “Now Assist”, they get paid and it could leave little margin for ServiceNow.

Or these AI companies could decide to go direct one day…

Maybe after capital markets no longer are throwing cash at them and they need to grow revenues and show profitability.

Is it easier for ServiceNow to cut out Anthropic or for Anthropic to cut out ServiceNow?

Right now there certainly is no answer to that.

But that gets at the key contention.

And it is a bit scary with AI just beginning to step into its full future capabilities.

The AI Risk Rebuttal.

CEO Bill McDermott agrees that AI will change a lot…

And is moving ServiceNow to be a platform that survives the transition.

They have incorporated OpenAI and Anthropic into their products.

And users can build apps on the ServiceNow platform using Claude code.

They are also emphasizing security more.

They acquired Armis for $7.75 billion and Veza for over a $1 billion to buff up their security offering.

He wants to create an “AI Control Tower”.

AI brings new unique security risks and having more oversight is part of the solution.

Also enterprises don’t want to give AI Agents unilateral power.

The key is governance, permissions, orchestration, and audit trails for AI agents.

Because what enterprise wants AI agents running around their systems doing all sorts of things they have no insight or guardrails on?

The Now Platform is a kind a container to keep AI from going off the walls and doing crazy things.

An AI that can do everything without human oversight may sound like a selling point of efficiency and cost reduction…

but it is also frightening giving an autonomous robot agent that level of power.

Enterprises KNOW they need to incorporate AI, but the question is how?

CEO Bill McDermott quotes an MIT study that says most implementation of AI agents isn’t ROI positive.

By ServiceNow being the one who incorporates all of their products they will increase efficiency without the question enterprises face of how they should incorporate AI.

Lastly, Nvidia, one of the posterchild’s of AI, uses ServiceNow themselves.

Now’s AI platform has surpassed $600 million in Annual Contract Value (ACV) and is on track to hit $1 billion by the end of 2026.

And seats on the platform is still growing 25% y/y.

So what does the valuation look like here and what needs to go right in order for an investor to make a return?

Valuation.

At today’s stock price of $100, ServiceNow trades at a $107bn market cap or $100bn enterprise value.

With an estimated $13.3bn in LTM sales, that is a about 7x EV/ Sales.

With 20% growth that could drop to 6x sales.

While not cheap in absolute, that is as the lower end for a top tier fast growing SaaS name.

With only $1.8bn in EBIT though, that is a 69x EV/ NOPAT multiple.

So an investor still needs to see a good amount of growth and margin expansion in order to make a return.

And a lot of cash today isn’t going to investors. It’s going to offset their massive stock based comp, which is 15% of revenues and 43% of free cash flow.

With more operating leverage though, we can maybe assume they earn 30% operating margins at maturity.

Looking out a year, that puts them at 25x mature margin earnings ($13.7bn revenue x 20% revenue growth x 30% mature margins less 20% tax).

That is on the lower side of a business that is growing this quickly.

And ServiceNow has a revenue goal of $30 billion (although didn’t specify the timeline).

If investors had confidence into a multi-year run of 20% growth and confidence in the mature margin structure, a >40x multiple is fair.

That is a at least 60% upside (40/25x).

And with a company estimated TAM of $600 billion, CEO Bill McDermott sees ServiceNow one day being a $1 trillion market cap company.

He extended his contract to the end of 2030.

So there is little doubt that Bill McDermott has confidence in his vision of ServiceNow because the platform for businesses to unify their many workflows into a single, AI-powered control tower.

Warren Buffett famously avoided a lot of technology investments for the simple reason that he felt he couldn’t have a lot of confidence in how this world would unfold.

Do you?

For more on ServiceNow, check out this video below.

Nothing in this newsletter is investment advice nor should be construed as such. Contributors to the newsletter may own securities discussed. Furthermore, accounts contributors advise on may also have positions in companies discussed. Please see our full disclaimers here.