Adobe Stock Breakdown

Get smarter on investing, business, and personal finance in 5 minutes.

Stock Breakdown

Can a stock drop 50% for seemingly no reason?

What if that sell-off happened while revenue and profits kept increasing…

…and the broader market was up?

Usually when there is a prolonged sell-off of that magnitude there is either: 1) financials deteriorating, or 2) a bear market.

There revenues grew 10% y/y and margins are expanding…

And the market is up +39% over the period it has been down -57%.

So, what is driving this sell-off?

Unsurprisingly, AI.

We know markets tend to overact.

So, is this a moment of Mr. Market’s irrationality?

Or an opportunity for investors?

In this Five Minute Money we will break down Adobe stock and argue that the real risks, are not what investors may think…

There are three key factors investors need to think about:

1) A business model transition

2) Competition (especially in their analytics segment which has more “encroachment” risk)

3) And a key AI question.

Let us first start with how the business makes money.

Business.

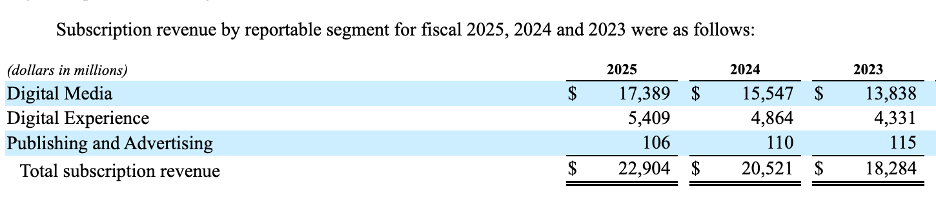

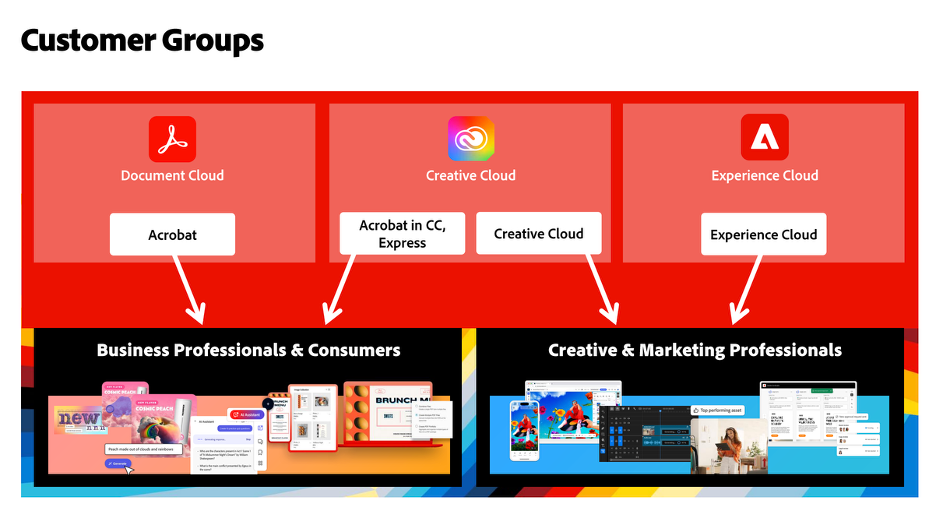

They have three reportable segments:

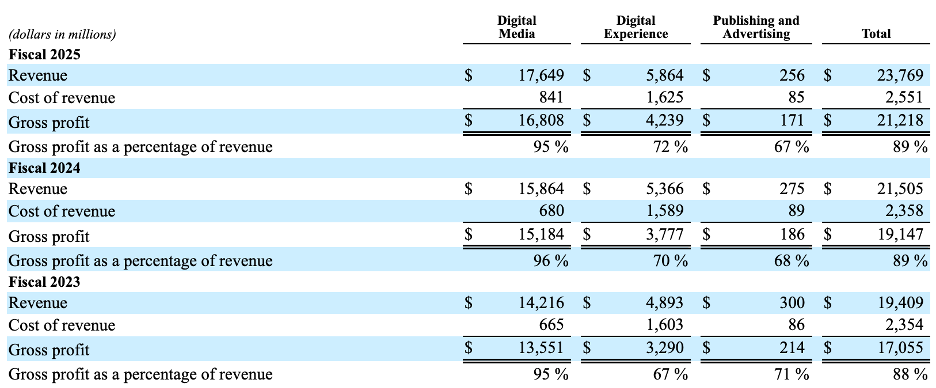

1) Digital Media: $17.4 billion in revenues, growing

2) Digital Experiences: $5.4 billion in revenues, growing

3) Publishing and Advertising: $100 million in revenues and shrinking. This is a small legacy business we will ignore

(Note this is only subscription revenue. They also have about $325mn of Prdoduct Revenue and $540mn of service revenue. Subscription are 96% of revenues so we will focus on just that).

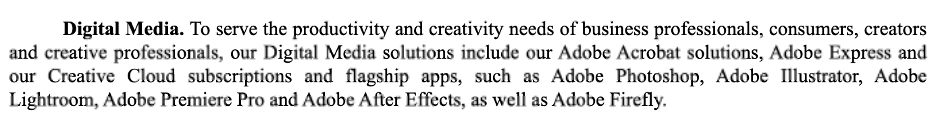

The Digital Media segment is their main money maker.

It boasts incredibly high gross margins of 95%.

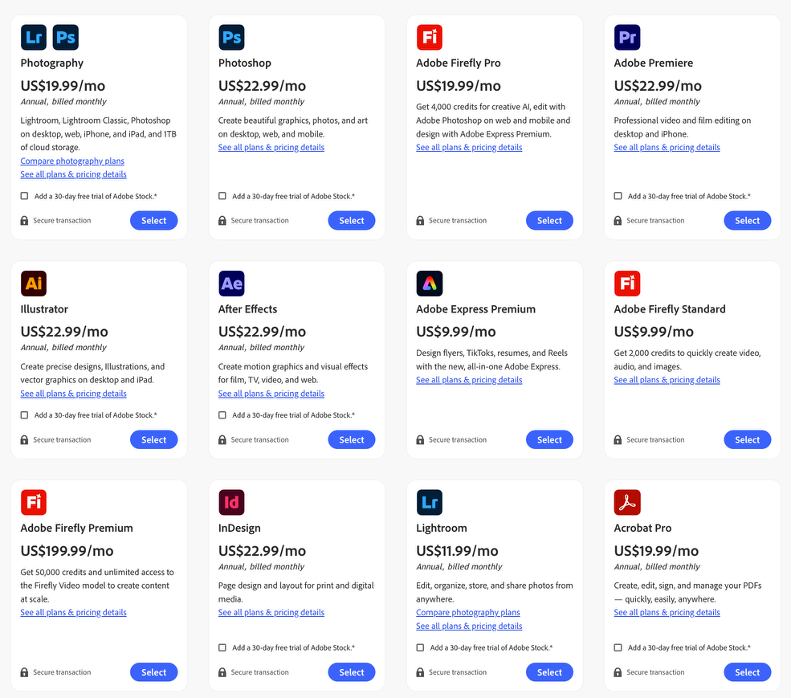

This segment includes their flagship apps like Adobe Photoshop, Illustrator, Lightroom, Premier Pro, and Firefly.

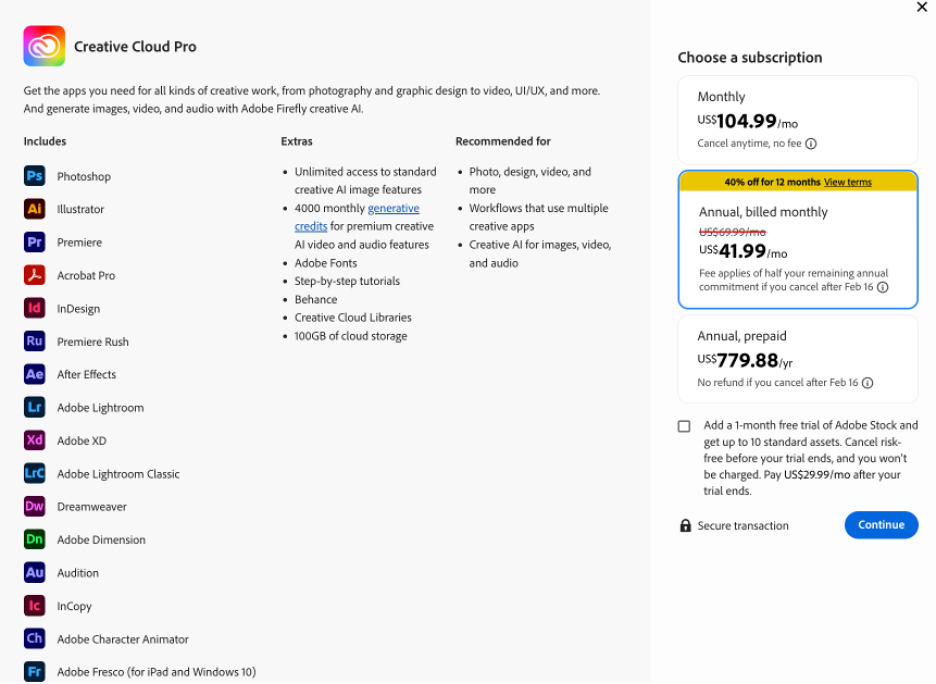

It also houses their Creative Cloud Subscription, which gives users access to all of their apps. (Similar to buying the Microsoft Suite)

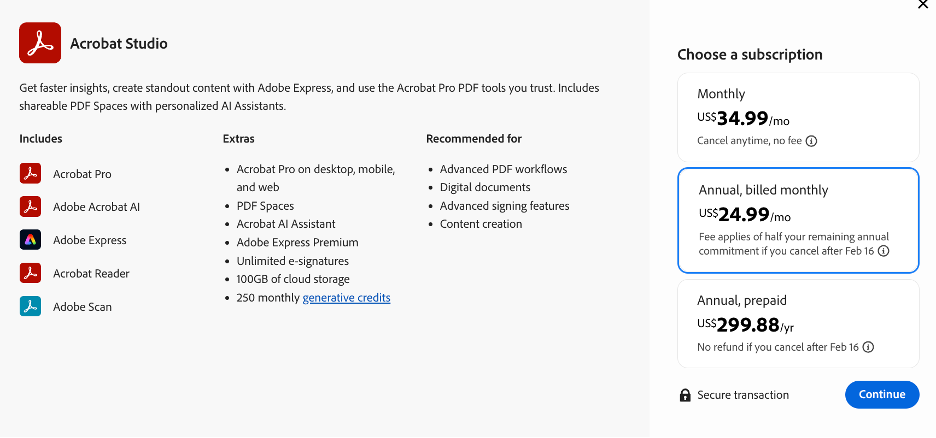

Also in here is their PDF editor, Acrobat solutions.

Last disclosed, in 2024 the “Creative” business was 80% of revenues ($12.7bn). and the Document Cloud was the other 20% ($3.2bn).

Document cloud was growing ARR at 22% and Creative was growing at 11%.

The Creative business caters to artists, designers, and developers for photo editing, design, video, animation production, and mobile and game development. They primarily focus on enterprise here, although there is a large swath of “prosumers” who use their products that blur the line.

(The business tier is $60/mo and includes admin license management and 24/7 tech support).

Competition with creative tools is coming primarily from Canva on the low-end and services that focus on one vertical like Figma in the UI/UX, and Davinci, CapCut, or Apple’s Final Cut Pro for video editing.

Canva offers free to start design software that can be used for a variety of different design products. They are focused more at the lower end of the market, whereas Adobe profits most at the higher end.

However, Adobe still competes at the lower end because getting broad familiarity with their tools is important because novice designers or students can eventually move up to the professional world.

Canva last raised at a $42 billion valuation and is estimated to have around $3.5 billion in revenues, showing they are taking a real bite out of Adobe’s market.

Their website is very easy to get started on, whereas Adobe is known to be more “intimidating”.

Canva isn’t complacent with their existing market though. They made an acquisition of Affinity which has more complex tools for professionals.

They lack the full integrations that Adobe has though (more on this later).

Adobe also has file advantage in that many enterprises want an Adobe .psd file so they can make changes later. (Yes there are tools to convert files, but they aren’t perfect and then may require more adjustments to make it right.)

Figma is a UI/ UX design application that designs websites, mobile apps, and software.

It is very popular and integrates better with the actual coding of the applications. A designer can turn elements into “pasteable” code.

It was viewed as such a superior product to Adobe’s “XD” product that Adobe tried to acquire Figma for $20 billion.

The acquisitions was blocked though and Adobe ceded this market.

Now Adobe integrates with Figma, who they are trying to treat as just a point solution tool to the Adobe platform.

Video editing is also a fragmented market with Adobe’s Premiere Pro in the lead. Adobe has a good chunk of corporate, ad agencies, prosumer usage.

Apple’s Final Cut Pro is also up there, though, followed by DaVinci Resolve, which has a pretty good free product as well as premier tools. Avid Media Composure is used by most of Hollywood, and then Bytedance’s CapCut is on the low end for social media (especially mobile editing).

Since Adobe Premiere is so popular, many enterprises may request the raw Adobe prproj file format, so they can make changes later (similar to Photoshop). This keeps even freelancers who don’t have a big benefit of being in the Adobe ecosystem on the Adobe Premier video editor.

Others might be good at one task, but Adobe is the best across multiple tasks and integrates everything.

It is similar to how many view Slack as better than Teams, but Teams is a part of the Microsoft ecosystem, which makes it easier to use it.

The other business in the Digital Media segment is the Document Cloud Business, which caters to basically anyone that needs to use PDFs. This has very different end markets including legal and financial industries, as well as widespread business usage.

These two suites of products represent $17.4 billion in revenues or about 75% of total subscription revenue.

They also sell their products on a stand-alone basis.

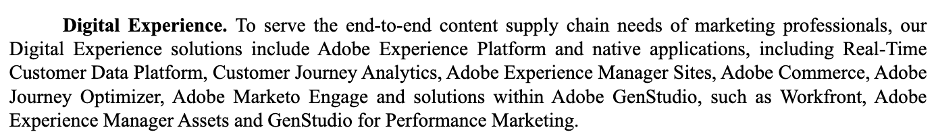

Business Segment 2: Digital Experiences.

Digital Experiences is their second segment.

This is basically for enterprise marketers.

This includes everything enterprise customers use to manage their websites, customer journeys, marketing measurement, and analytics.

The Creative Cloud is used to create various digital assets, this is to manage them.

A business like Nike can use them store and manage all of their different ads, webpages, and videos and segment showing different digital assets to different customers.

They can track their audience here and send out personalized messages through email and text.

Then measure what communications worked best for each audience segment.

It all tied back to the Creative Cloud so their digital assets (like ads or emails) can move from the Creative Cloud to the “Adobe Experience Platform” seamlessly.

For the full suite of acronyms, it is a:

CMS: Content management system that manages websites and app content and permissions, as well as how it can change for each device (think Android vs an iPhone 12).

DAM: Digital asset management that has brand approved images, videos, and different versions.

CDP: Customer Data Platform: Unifies customer data from different sources and can use that to send personalized messages to different channels

Analytics: Measures outcomes

The workflow is often something like:

1) Build & govern the experience: Adobe Experience Manager (CMS + DAM)

2) Know the customer / build audiences: Adobe Experience Platform + CDP

3) Decide what happens next: Adobe Target / Adobe Journey Optimizer / Adobe Marketo Engage

4) Measure & optimize: Adobe Analytics / Customer Journey Analytics

This segment is supported by a slew of acquisitions: Workfront ($1.5bn in 2020), Marketo ($4.75bn in 2018), Magento Commerce ($1.7bn in 2018), and Omniture ($1.8bn in 2009).

This is more competitive than their Digital Media segment though.

They compete with Salesforce, Oracle, SAP and other smaller players here and most Enterprises use more than one vendor.

The problem?

Each service provider is increasingly encroaching on the other.

But how likely are their efforts to succeed?

Salesforce is often the System of Record (recording human-entered emails, names, and other info on a customer)

Adobe will have more of individuals behavior data—on what part of the webpage or app did they click? What emails got the most opens and follow through?

Both can still leverage data that is stored externally in a data warehouse like SnowFlake or Databricks and let’s you query it.

This is one of the big changes. Data is now commonly not beholden to a single platform but in an “agnostic” data warehouse. This makes it easier for competitors to build products that require that data.

Salesforce now has AI agents that can read that data and create personalized emails, webpages, or app notifications to push out to users.

This is something that many enterprises use Adobe for, but now it could make their product redundant.

The real risk isn’t that enterprises stop using Adobe all together, but use it more as a point solution than a platform.

This reduces usage and importance, and thus their ability to charge premium prices.

However, Adobe’s advantage is it can be hours before that data moves to the data warehouse so they have a better real-time look on say the launch of a sales campaign or new product.

Adobe also has content supply chain management on perhaps tens of thousands of digital assets a company may have.

Salesforce can push an email, but they don’t control all of the different images that can be personalized and A/B tested for that email.

Furthermore, with Adobe GenStudio they are leveraging AI to allow a marketer to make one version of copy and then have AI generate all sorts of different variations. Maybe one has more red and that has a higher click through rate, so it feeds back to Adobe to push that email out to a broader audience.

So in short, Adobe tries to leverage their front-end capabilities with design to then control the rest of the workflow. While players like Salesforce try to leverage their existing customer relationships and access to neutral data warehouses to move into more actions that Adobe would otherwise own.

It is a different approach and primarily relies on the fact that customers want to focus on cost savings and care less about the design. It doesn’t get at the crux of what Adobe offers though.

While this is a (relatively) lower gross margin at 72% here…

It still generates $4.2 billion in gross profits for 20% of the total, so investors can’t ignore it.

They are still growing here though with 9% y/y revenue growth.

These product suites make up Adobe’s $21.2 billion in revenues and $8.7 billion in operating profits, for a 37% operating margin.

With a good sense of their products and traditional competitors, what are the key risks?

AI Risk.

You knew this one was coming.

But the risk is probably not what you think it is.

In its worst form and what investors are most concerned about…

Generative AI does everything.

It writes the ad copy.

It generates the images.

It spits out the video.

It localizes it into 30 languages.

It A/B tests variations automatically.

It learns what converts… and then repeats the loop forever.

There is no need for a tool maker because a user can rely on AI for the full stack.

This is unlikely though.

First of all, AI is far from becoming so good that the image or video is perfect on the first shot.

And so long as you need to make adjustments to your “digital asset”, you will need a tool to do so.

Adobe is that tool.

And most of Adobe’s customers are enterprises who care A LOT about brand image and are not going to want to have zero say in how that brand is portrayed.

But of course, generative AI is going to be the future.

And that is why Adobe incorporates it into their apps.

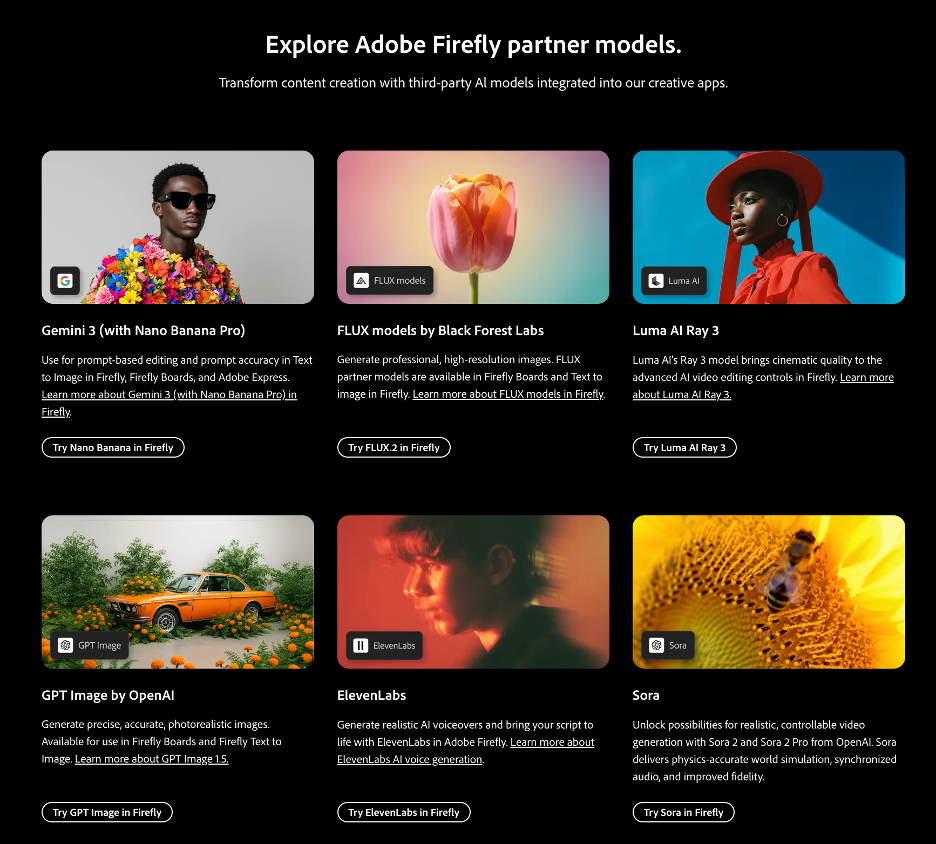

Basically, all of the leading models integrate with Adobe, including Google’s Gemini and OpenAI’s Sora.

Adobe users have the option to pick any model they want and leverage that to create digital assets.

Adobe also has their Firefly model which is trained on commercial safe images so enterprises can use it confidently without fear of getting sued.

As long as this is the case, the AI risk is materially reduced.

In fact, the real AI risk is (was) that one player would have the absolute best model and keep it to themselves, and so users had to flock to their service to use it.

It already looks like we are passed that future as leading models integrate, and no one player is THAT much ahead of the next.

In short, the KEY AI QUESTION is simple:

Is AI going to become commoditized?

It seems so.

Or at the very least, no one player is going to be meaningfully better than the next for a prolonged period of time.

So long as there isn’t one AI model that is so good that they can demand users go to them, the distribution advantage of partnering with an Adobe is clear.

They get usage of their models, get paid for it, and don’t need to do the hard part of acquiring users.

Sounds fair.

The real AI risk though is the downstream impacts to the business model.

Business Model Transitions.

Rewind to the early 2010s and Adobe was on a totally different business model.

Instead of subscriptions, they sold disks.

The disk gave the user a license to use all of their software products indefinitely.

And users upgraded every couple years when new versions came out.

And when the shift to subscriptions came, investors were terrified.

You think subscriptions were obviously a better business model?

At the time their disks were sold for $1,200 to $2,500 a pop.

And all of that cash was collected about front.

A monthly subscription was $50.

Plus there was significant fear that people wouldn’t want software on a subscription model.

And they could easily cancel whenever they wanted.

While we today know this made Adobe an eminently better business with recurring revenue…

At the time that wasn’t so clear.

And incredibly, current CEO Shantanu Narayen oversaw that transition.

He has been CEO since 2007 and joined Adobe in 1998.

He pioneered the transition to the SaaS model and the cloud.

Now there is a new transition facing Adobe.

The Seats Issue.

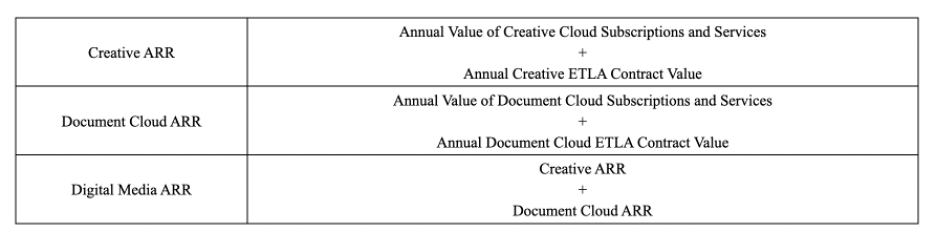

Currently Adobe charges subscriptions on a per user basis (colloquially called Seats).

As AI makes each user more efficient, there may be less of a need for as many users.

So instead of a 10 person design team, you have 2.

AI makes up for the other 8.

So this makes Adobe with AI a better product that has more value.

The problem?

The old business model doesn’t capture this value.

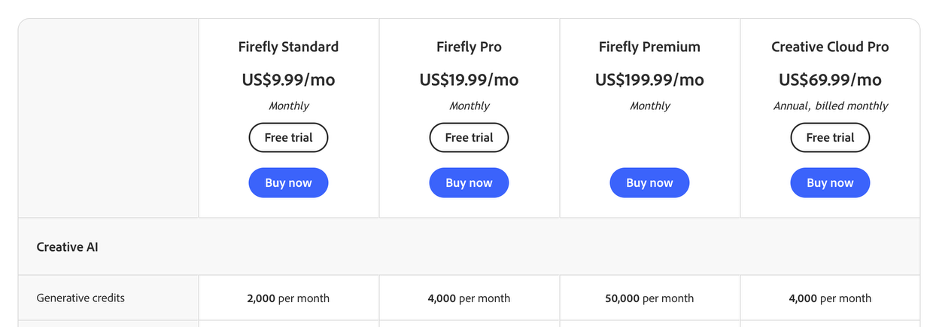

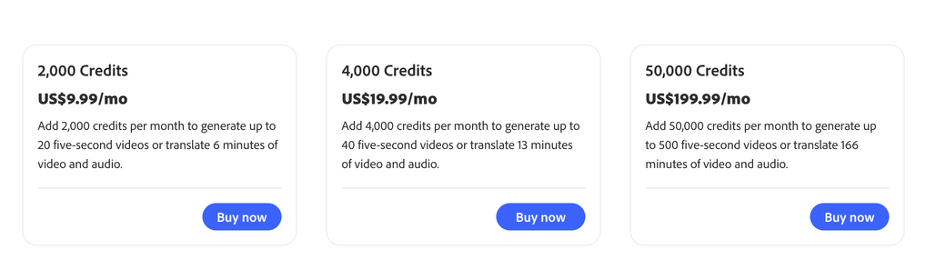

To solve for this, they are rolling out a dual-pronged pricing strategy.

They are keeping the subscription fees (for now) but are ADDING a usage fee.

They are calling these “Generative Credits” and different plans come with different amounts.

You can also buy addition credits if you run out.

The challenge Adobe faces is balancing the revenue model so they can gracefully manage the (potential) reduction in the number of users.

This is a fair solution, but it doesn’t mean that the financials can’t go through some volatility in the short term.

There is also the possibility that they become a lower margin business.

They charge for the credits, but using the AI models has it’s own cost.

It is unclear what the margin of this business will be.

The focus should be on profit dollars, not profit margins.

But it could optically make Adobe look like a worse business that might undergo margin pressure as a result.

The other risk though is Meta and Google.

Walled Gardens.

Meta and Google both have tools to create generative ads.

The risk is that in the future an advertiser just gives Meta and Google their ad money and they do the rest.

The creation of the ad.

The targeting.

The measurement of success.

And thousands of iterations to get the best copy made.

This offering though will be particularly compelling for SMBs that maybe previously hired graphics designers to make ads.

So, there are again fewer designers using Adobe.

To understand this, you have to understand there are generally two types of ads.

Direct response—these are ads that are created to get you buy something right now with a call to action.

Brand ads—these are ads that are “top of funnel”. They are to build brand awareness and loyalty.

With direct response ads it is very easy to measure, and Meta and Google will do well here.

Brand ads are harder to “measure” and are more about crafting a narrative for the business.

While large enterprises can have both of these ads, they are likely to want to have more say in the Brand ads.

This is where Adobe can continue to do well. An enterprise can use AI to help create and craft the narrative, while using Adobe to retouch the AI generated copy.

So this is a potential risk that is less spoken about, but Adobe is also likely more insulated here because they focus less on the SMB market (which is more focused on direct response ads).

As we’ve seen there are still some risks to Adobe and competition, but the AI risk is different than what most investors think.

As always though, the key question is: what is priced in?

Valuation.

Adobe’s stock is currently at $272 a share for a market cap of $112 billion.

That is down -60% from their peak of $688 in 2022.

They generated $7.1 billion in earnings and about $7.9 billion in free cash flow (after subtracting SBC).

That is 16x trailing earnings and 14x trailing free cash flow.

Last year they grew revenues 10% and operating profits 29%.

They also bought back about $9.5 billion in stock last year.

At 14x free cash flow multiple implies the business isn’t going to grow more than a low single digit ever again.

If they can maintain a high single digit growth rate, a 20-25x free cash flow multiple is fair for 43% to 79% upside.

But if the end markets shrink and their Generative Credits revenue can’t offset the shrinkage, then they may experience revenue shrinking for the first time since 2013.

With all we have talked about Adobe, it is up for you to decide how you think this will play out.

Or pass if you aren’t sure.

For more on Adobe, check out this video below.

Nothing in this newsletter is investment advice nor should be construed as such. Contributors to the newsletter may own securities discussed. Furthermore, accounts contributors advise on may also have positions in companies discussed. Please see our full disclaimers here.