Netflix Stock Breakdown

Get smarter on investing, business, and personal finance in 5 minutes.

Stock Breakdown

After years of investors doubting Netflix, they have finally proven themselves.

They are clearly the dominant streaming leader and no one disputes that video streaming is the future.

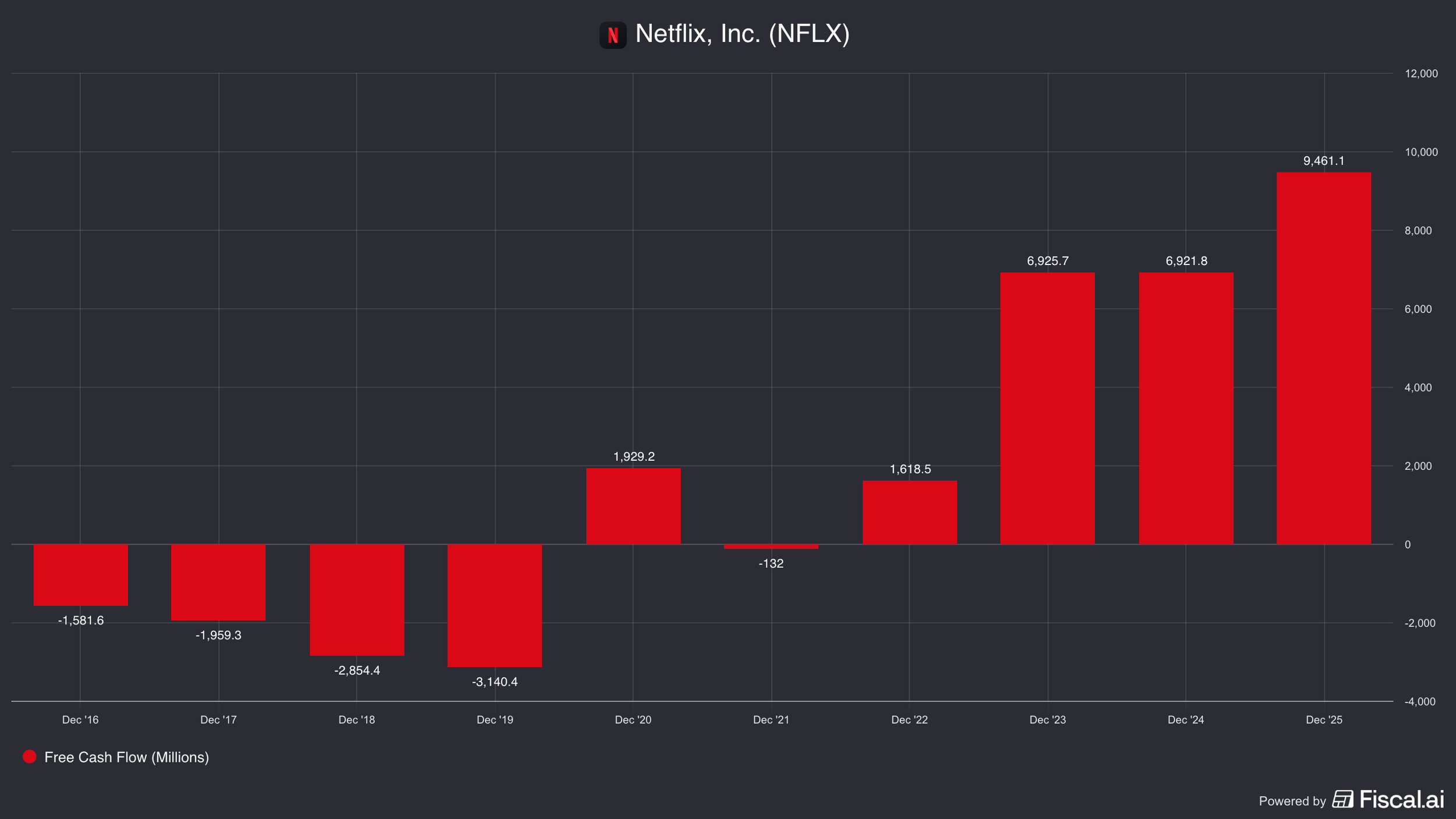

After years of negative or trivial free cash flow, LTM they generated $9.5 billion… that’s up from $1.6 billion just in 2022.

The ambiguity now comes not from the business working, but from how much it can work.

The easy fruit is gone.

The wealthiest countries are the most penetrated.

Password sharing has been cracked down on.

Advertising has been introduced.

Are the days of hyper growth gone?

And they now are embarking on a massive acquisition of a legacy media company—Warner Bros.

Is this an opportunistic acquisition play, or an admittance that their existing model is running dry of growth opportunities?

And can’t combining with a large, legacy media company slow down Netflix?

While the stock has sold off 30% from peak, it still trades at 32x forward earnings.

This means that an investor needs to assume a good amount of growth in order to get a return.

How much?

We dive into all of this and more below!

The Business.

Chances are you are already intimately familiar with the business as one of their 325 million paying members.

But the truth is that Netflix’s business model has ever so slightly changed.

They used to be in the tv streaming business.

But now they are an entertainment platform.

With new product verticals like games, podcasts, and live sports, they are retrofitting their product to better suit a new era of entertainment.

That is because competition isn’t just the legacy cable companies that stuff 8 minutes of commercials into a TV episode…

3Q25 Investor Letter

But also Tiktok, Instagram, X, Substack, YouTube, anything else that can potentially steal time away from you watching Netflix.

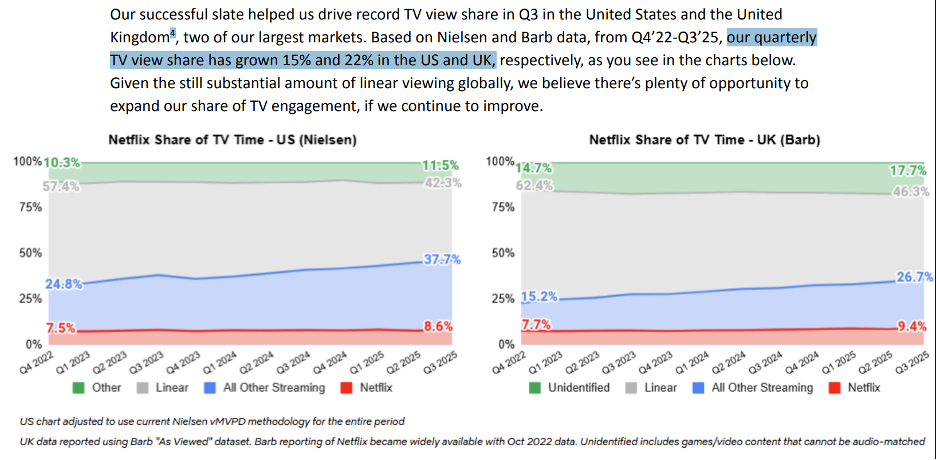

Netflix is no longer focused on their share of TV time watched, but on total time spent.

That puts them in competition with a much wider set of time-sucking, dopamine-maximizing engineered products.

Don’t let people tell you though that they are fighting for a share of the 24 hours in a day though.

Because there are really more than 24 hours a day…

At least if you count the fact that many people can use more than one app at once—like scrolling Instagram or cooking while the TV runs in the background.

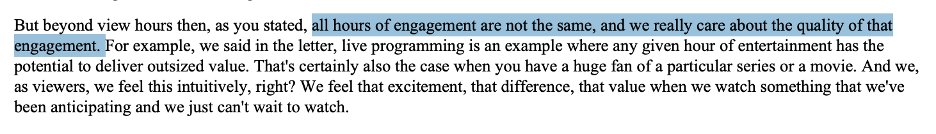

The key for them though is to focus on “quality engagement”.

As Netflix CEO Greg Peters states below in the 4Q25 investor letter, not all engagement is the same—they want quality engagement.

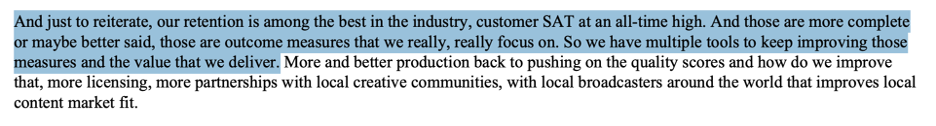

This is simply because, as much as they may focus on “time spent share”, they really are focused on a different metric: churn.

As a subscription service, the key to success is simple: keep people subscribed.

This isn’t done by soaking up as much of a viewer's time as possible—although that helps—it is about making sure they are enjoying their time on the service.

We will get back to competitor streaming services, but the punch line is that churn is what ultimately killed many of them.

From this lens, video games, podcasts, and live sports make more sense. All of these efforts are about providing more reasons to stay in the Netflix ecosystem and reduce the “cancel and resubscribe later” behavior that plagued so much of the streaming industry.

Now this is starting to change though with ads.

The Ad Angle.

With advertising, you are monetizing the time spent, not the commitment.

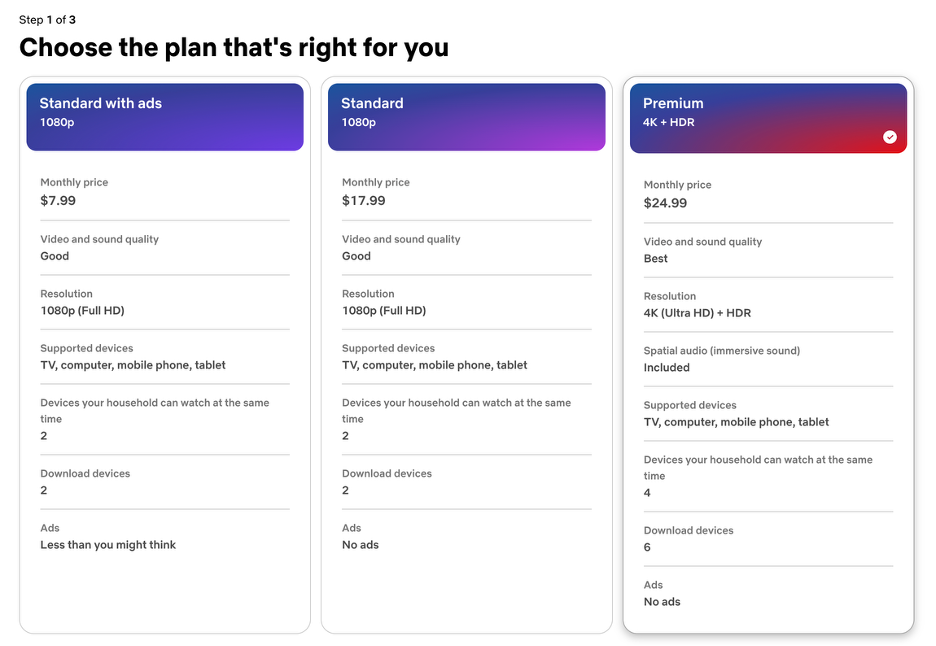

Their ad tier is $7.99 a month versus $17.99 for a standard plan. That extra $10 a month they need to make up with advertising.

Advertising does two things though: 1) it lowers the cost to become a subscriber, but it also 2) increasing the monetization potential per subscriber.

Take for instance YouTube and YouTube Premium (which is their no-ads subscription).

YouTube Premium is generating around $15 billion in revenue.

But advertising is run-rating closer to $40 billion.

The reason is simple: more people are willing to watch with ads than pay for a subscription.

And over time, they get better at showing ads and “on board” more advertisers which increases the price they can charge for those ads.

Netflix generates $45 billion in revenues…

BUT, their advertising revenue is just $1.5 billion.

So what is holding this back?

The Ad Opportunity?

Netflix only started offering advertising in 2022 and they had no real ad apparatus.

It was manual getting brands to sign up for ads.

While they were able to charge high prices (or CPMs) because brands wanted to reach Netflix’s audience, they had no way to do this in a scaled manner.

They would partner with Microsoft for an ad hoc solution, but it wouldn’t be until 2025 that they rolled out the Netflix Ad Suite more broadly.

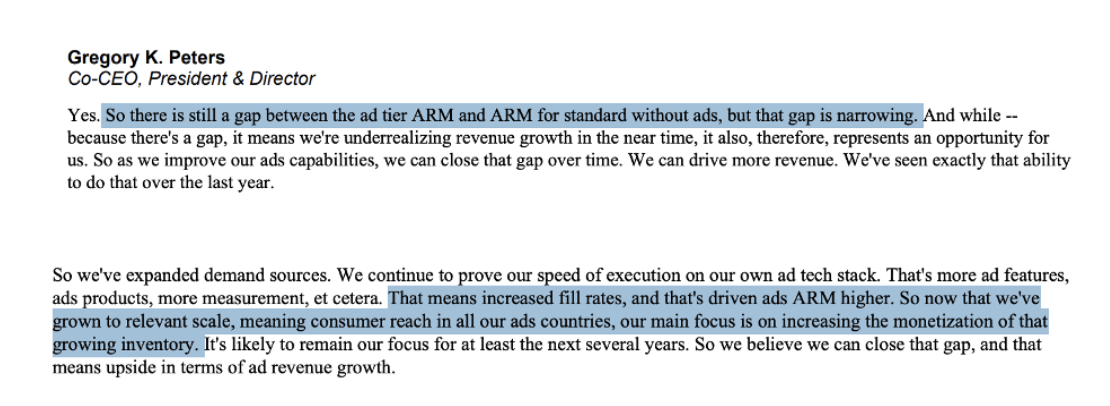

This is a game changer because what is holding back the advertising is that they aren’t filling their ad slots.

Basically, they have ad slots that are not being sold and so users are not seeing ads when they could.

What was holding them back was that they needed to build a technology platform for advertisers to buy ads programmatically (which means digitally).

Netflix CPMs are currently high (estimated around $40—which is in line with traditional TV), but growth isn’t coming from pricing.

It’s coming from consistently filling ad slots that are going empty because they don’t have enough advertisers to bid for them.

In this dynamic, it is very similar to Meta where they onboard a lot of advertisers and then that lets them sell more ads. If they are successful though, ad prices don’t go up, because growth is being driven by ad inventory growing.

Right now Netflix is reported to be pretty “ad light” on the ad tier. And that may change a bit going forward.

It is also very possible that once they have figured out advertising they introduce a new ad tier that is totally free (no $7.99 price), but is loaded with way more ads.

They can’t do that yet until this advertising platform has enough advertisers to fill all of that ad demand… and they are getting closer to that.

They expect advertising to double to at least $3 billion next year, but that should just be the beginning.

The better they can monetize advertising, the more they can raise pricing on the no-ad subscription tier with confidence that if they price too high, the subscriber will fall into one of the ad buckets.

Overtime, it is not impossible to think ad revenues are larger than paid subscriber revenues… but we could be a decade away from that.

This is all helped by the Muse Platform.

Algo Driven Recommendations.

Before, when you loaded up the Netflix screen, you got a bunch of titles that were preloaded recommendations for you.

Now that has changed.

They are taking a page from TikTok, and using the cues of your active browsing to change the recommendations in that very browsing session.

Have you ever opened up Netflix scrolled around a bit, then closed the app and moved onto Hulu, HBO, Prime, or Apple TV?

This often isn’t because Netflix doesn’t have content you don’t want to watch, but because you couldn’t find it quick enough so you clicked out and went elsewhere.

This is costing them dearly.

With their inhouse Muse Platform they can better recommend content and change the trailer or thumbnail you see to make it more appealing to you.

This algorithmic learning increases the chances you stay on Netflix, find a show you low, spend more time on the app, and thus are less likely to churn.

It is worth noting that this is hard technical thing to do that is likely to set them apart even more versus the competitors over time.

Not just because they have invested more in the technology, but also because they have way more data and content that increases the chances you will find something you like.

This will be another tailwind for them.

The biggest game changer though is Warner Bros.

The Warner Bros Growth Engine.

In December 2025, a deal to acquire Warner Bros. film and TV studio, IP, and HBO Max for $83 billion was announced. To accelerate the close, the offer was changed to an all cash, funded by a significant portion of debt Netflix will take on.

The legacy Warner Bros. linear TV business will be spun-off into a new entity called “Discovery Global” before the Netflix merger closes.

Netflix will just get the assets that they want.

It is estimated that Netflix will need to issue $60 billion in debt to fund the deal, adding a significant debt burden to the company.

The upside is material though.

Not only do they consolidate a competitor, but they gain access to key franchises like the DC Universe, which includes the likes of Batman, Superman and a slew of other superheroes, as well as Harry Potter.

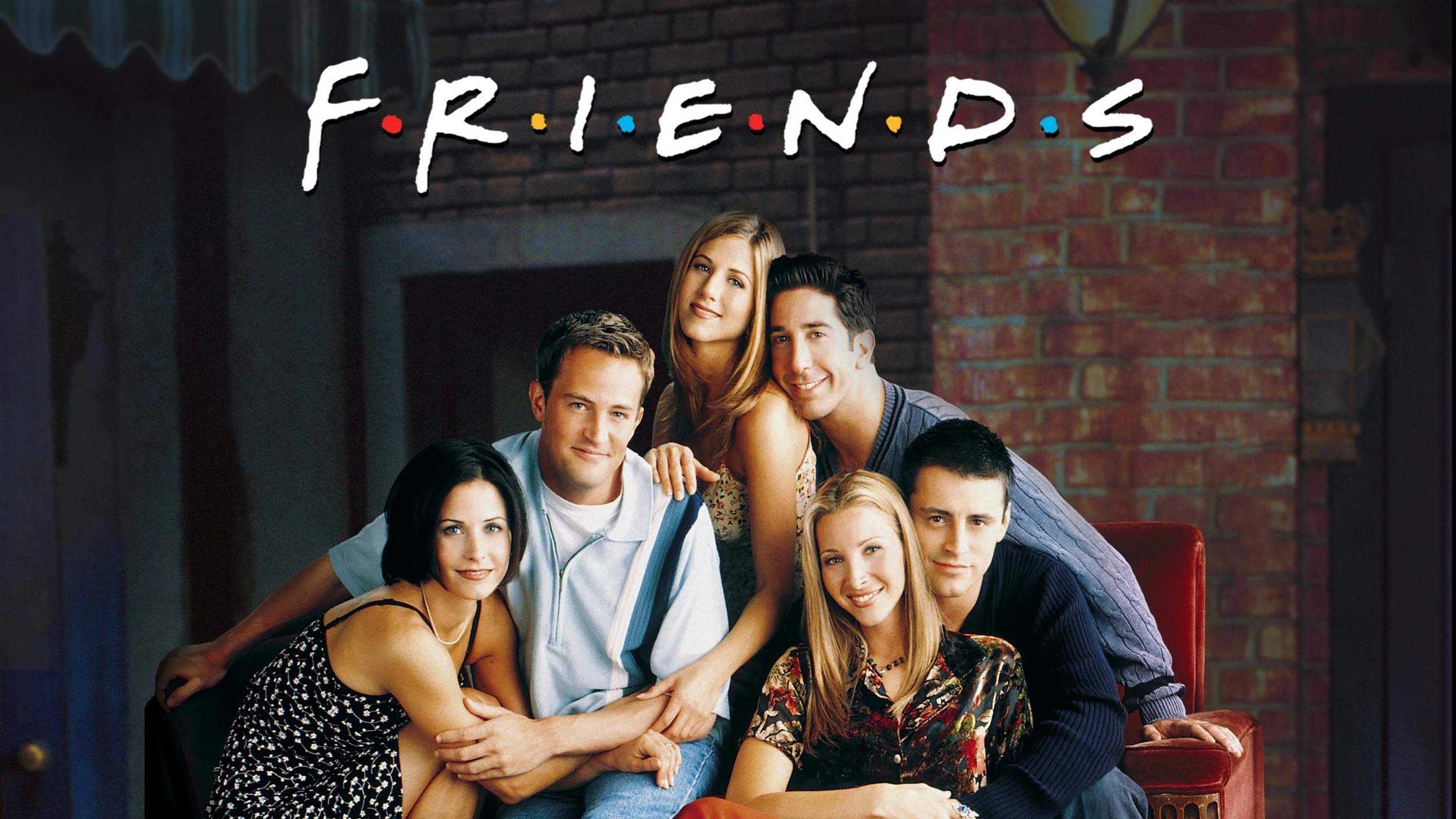

They also will be getting a massive catalogue of classic shows and hits like Friends and the Big Bang.

Perhaps the most important of which though is HBO. Not only will this give them access to some of the best tv series and movies ever produced, but it also gives them control of the HBO Max app.

Now, what they chose to do with it is not entirely clear.

They may shutter it and house HBO in the existing Netflix app…

Or they may keep it as a standalone app, which could allow them to further price differentiate with consumers.

Maybe Netflix’s premium tier stays at $25 a month, but HBO becomes a $20/ month add-on.

Management has been very tight-lipped about what they intended to do with the stand-alone HBO Max app.

Combining apps and the catalogues has massive churn benefits…

But maybe the opportunity to price discriminate and charge members for a second subscription (HBO Max has >120mn members currently) is too lucrative to pass up on.

The other thing to keep in mind is that Warner Bros. has a massive amount of IP that Netflix can use to create new content with.

Content created from existing IP—think a new Batman series—tends to be less risky as there is already a large built-in fanbase.

This could also unlock a new Experiences (think Theme Parks) business down the line.

They have flirted with in-person experiences before, like with the “Netflix House”, which is experiential venue with immersive attractions, themed food, and retail.

This is of course small stuff compared to operating a theme park like Disney has.

Warner Bros. actually has a theme park in Abu Dhabi. And they also have “Warner Bros. Studio Tours” parks in London and Tokyo. (These are currently licensing agreements though)

Or Netflix can potentially deepen a partnership with Universal Studios, who currently licenses their IP for their parks like with “The Wizarding World of Harry Potter”. Warner also licenses IP to Six Flags.

Either way, it is an interesting new growth potential they could have.

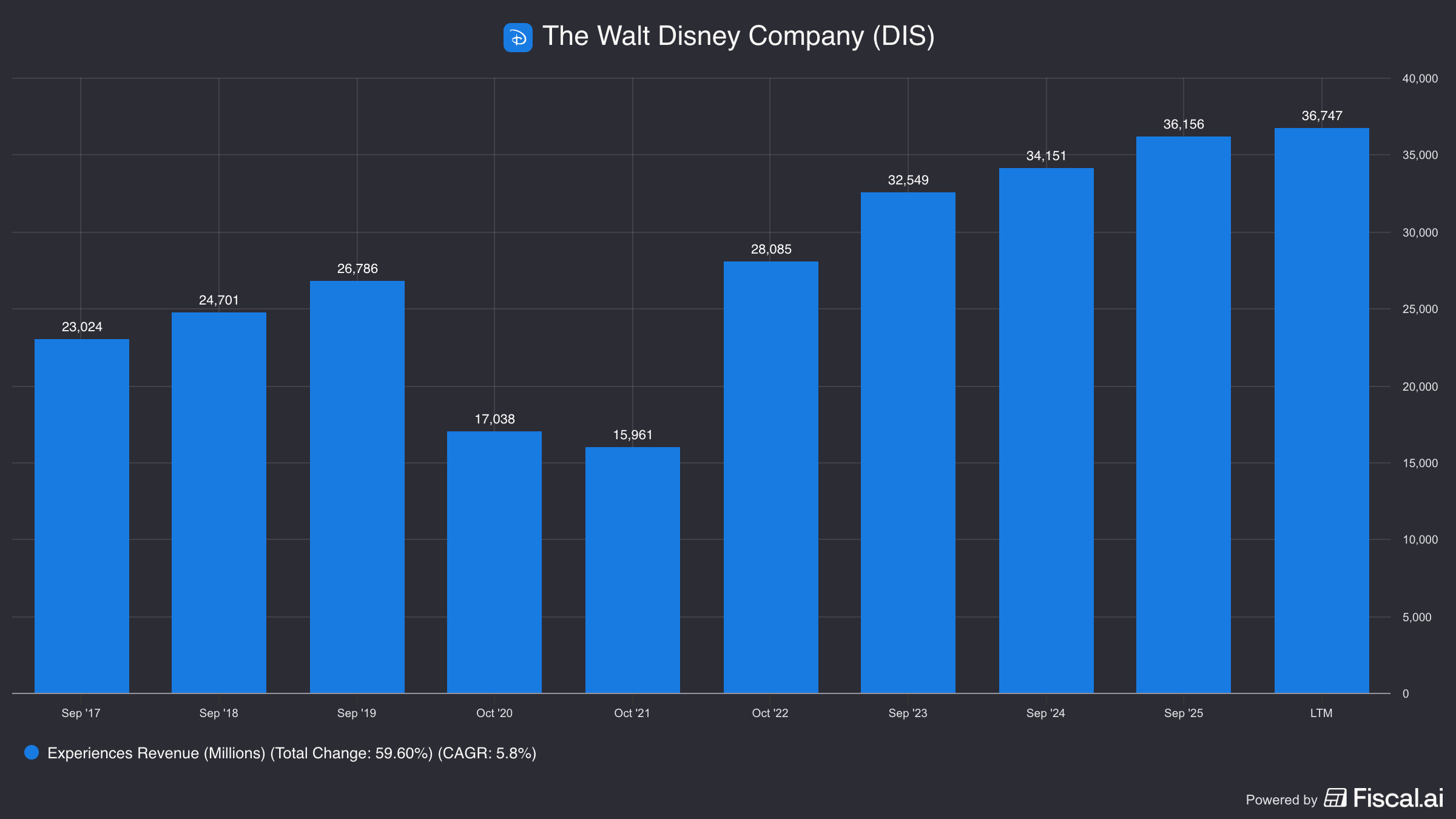

Disney is of course the king here whose “Experiences revenues” are $36 billion in revenue a year, which generate a >25% operating margin—higher than maybe you expected.

This is just a potential call option (or distraction) from the more important aspects of the deal.

Let’s get into some actual math on Netflix.

The Secret to their Success.

The secret to Netflix’s success is simple: is content cost per subscriber.

They spend about $20 billion a year on content.

But since they now have 325 million subscribers, that is only $5.12 per subscriber per month.

That is still a lot.

But their average revenue per subscriber is now $11.56.

Most competitors are stuck because they can’t spend as much as Netflix without going into the red because of their smaller subscriber base.

Now one big exception is Disney who does spend a bit more than Netflix on content—around $24 billion—but that is subsidized by their Legacy business and Parks business.

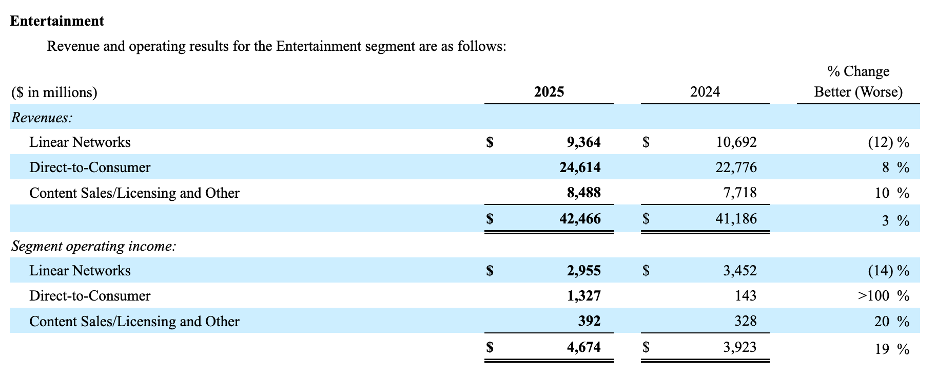

You can see here that they earn only $25 billion from “Direct-to-consumer”, which is from Hulu and Disney+.

This is what is keeping them stuck. They still need the linear networks and Content sales/ Licensing (which includes theater sales) to help support their content spend.

Their Disney+ and Hulu revenues (which have an estimated 200 million subscribers with ESPN+ at another 25 million) cannot support all of that content spend, so they still need the legacy businesses.

They have to try to slowly wean off the legacy businesses, while growing D2C, but profits are contracting in the process because Linear TV subs pay more than Streaming subs.

They have an estimated 60 million Linear TV subs, which make them about $13 a month. This is less than the average $9 they make for streaming subs.

Yes, ESPN complicates this math, but generally speaking that is the key problem they are facing during this transition.

Linear TV subs pay more than streaming subs are willing to.

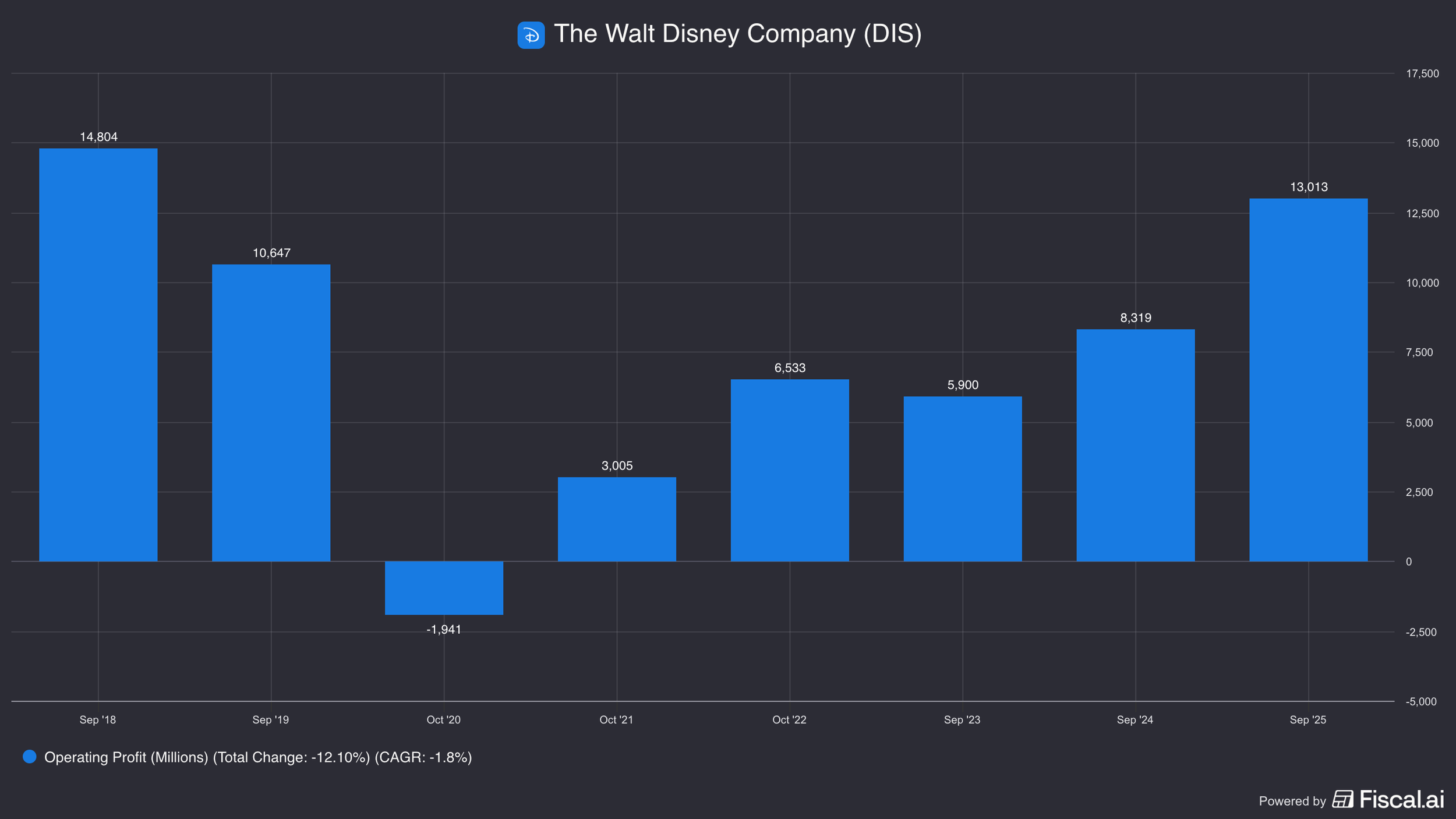

Disney will probably be fine, but that is why 2025 operating income is slightly less than what they made in 2018.

Other competitors are in a much worse position.

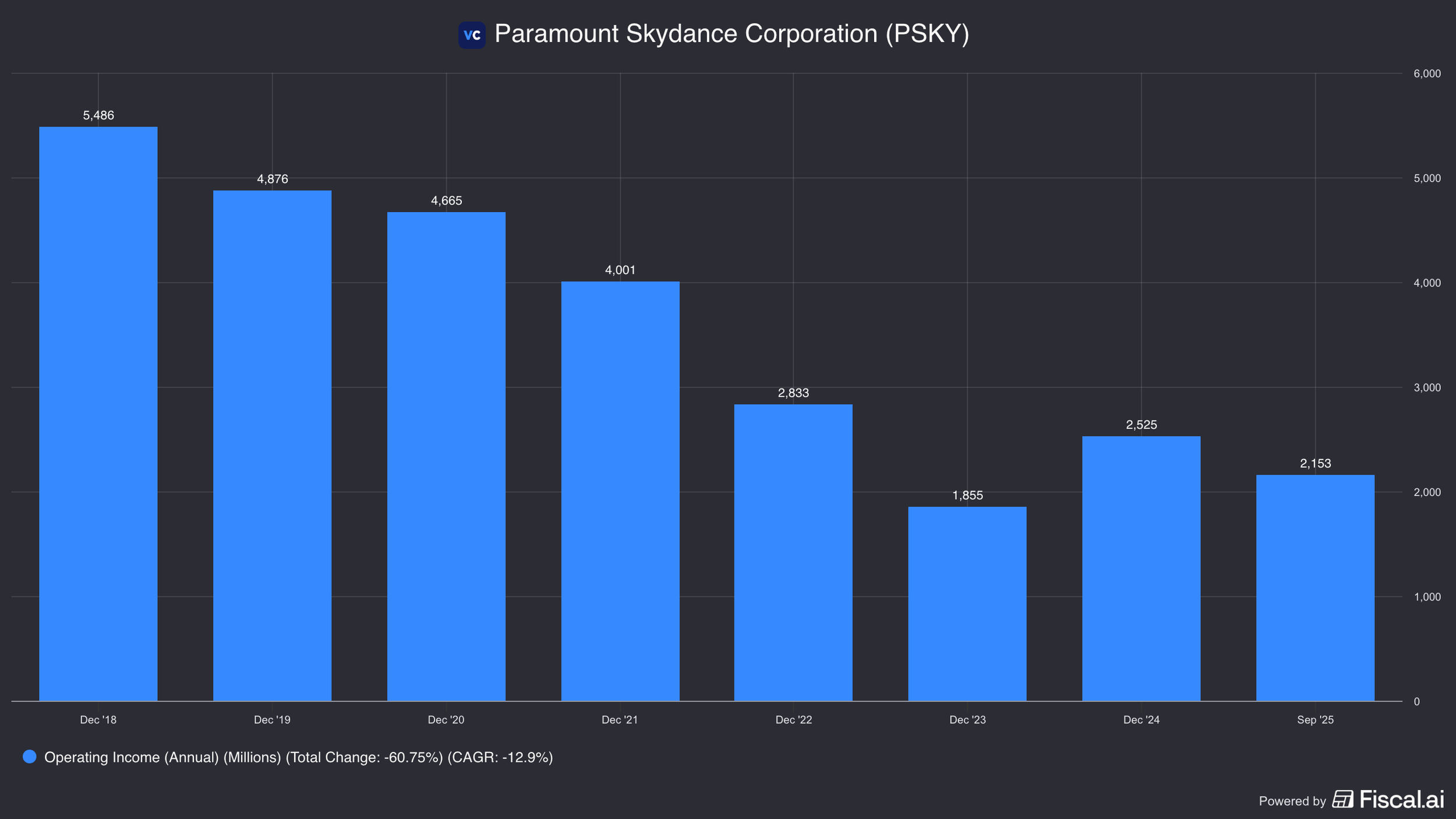

Paramount makes less than half of the profit they made in 2018.

Warner Bros. profits are just $500 million versus $2 billion in 2018.

With the rise of streaming came the debundling of TV and with that came more choice. The net of this has been disastrous for their profitability.

They are losing linear TV subs and are struggling to gain streaming subs…

And when they do, they are paying less.

Paramount+, the streaming service, has just 80 million subs.

If the streaming business had to support their content spend of $16.5 billion, it comes out to a $17.80 content cost per sub.

This is materially higher than Netflix and means they are stuck relying on the legacy business to support content spend.

This is the key reason why Netflix is killing traditional media conglomerates.

The one who gets the biggest the quickest, has the most amount of subscribers to spread the content costs across.

This means they can spend more on content and it still cost them less on a per subscriber basis.

Since there is no limit to how many people can enjoy a good TV show, every subscriber gets the benefit of the content spend.

In the Warner Bros. deal, they are basically paying the equivalent of 4 years of content spend.

They are assuming that this will 1) reduce churn on existing subs, 2) increasing the number of people who do subscriber, and 3) allow them to increase average revenue per sub (whether through a separate HBO plan or price hikes).

The bar for success here is lower than other competitors like Paramount acquiring Warner Bros because of their larger subscriber base.

The benefits accrue to all members, but the cost get spread out across a larger base.

Valuation Math.

With $11 billion in profits and a market cap of $360 billion at a stock price of $85, Netflix trades at 33x trailing earnings.

This means they still need a good amount of growth in order for an investor to make a satisfactory return.

They are now growing revenues at a mid-teens rate with operating earnings growing a mid 20% rate as they enjoy operating leverage.

This is because as they get more subscribers, they don’t need to spend more on content.

It fact, the more they grow, the more the total content cost per subscribers drop.

Since 2020 revenues grew $20 billion but content spend grew just about $3 billion.

This was a HUGE operating profit unlock.

And as they continue to dominate streaming, we could see their operating margins grow even more from the current 29.5%.

Before the Warner Bros. deal, if they could do 3 more years of 15% growth, that be $17bn in NOPAT for an implied 21x 3 year out multiple.

At that point, if they could continue to grow earnings in the low double digits to mid-teens, an investor may value that stream of earnings at 25 - 30x for 19-42% upside (25x/21x and 30x/21).

However, Warner Bros significantly complicates this math because it is unclear how successful they will be.

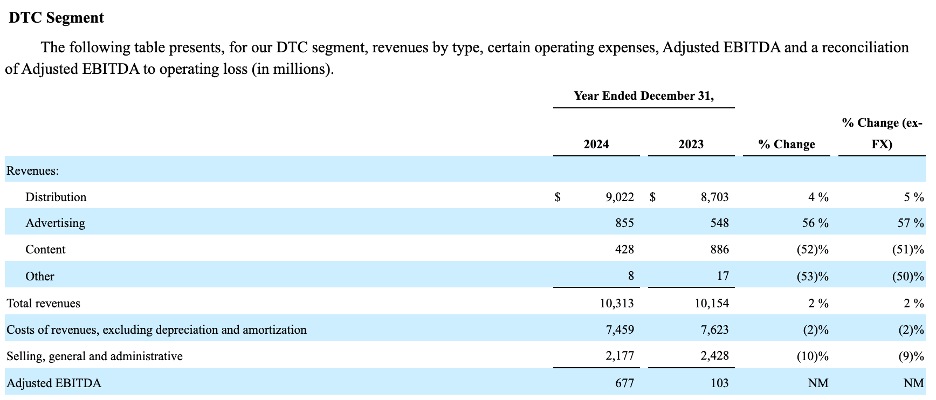

In Warner Bros. DTC segment, they are generating $10bn in revenues but just $677 million in EBITDA.

With 120 million HBO Max Subs Netflix should be able to cut costs and better monetize the ad-lite tier. If they can increase this from $7.15 globally to $10 (still less than their ARPU) and with a better margin structure of 25%, that is $2.9bn in NOPAT.

That uplift jives with Netflix’s comments that they can save $2-3 billion in cost synergies.

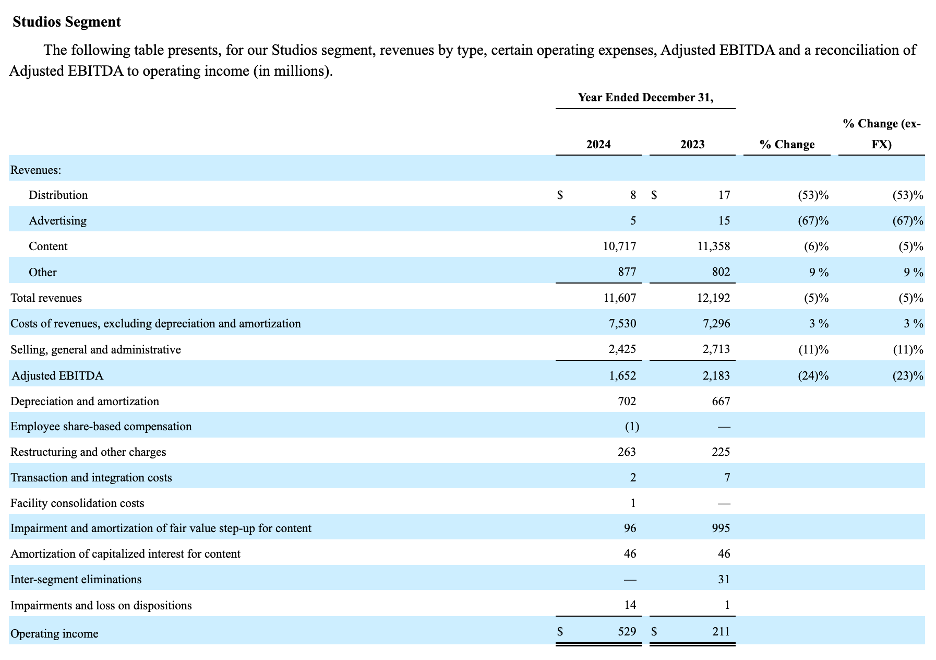

Plus they get the Studios business, which currently is another ~$1.5 billion in NOPAT LTM (showing just 2024 below for illustration purposes and this is a rough estimate because the exact assets they are acquiring are not necessarily all housed here in this segment).

Just those 2 sources get us to $4.4 billion in NOPAT in a few years, which implies a 19x NOPAT multiple for Warner Bros.

However, the studios business is much lumpier with theatrical releases and video games revenues being VERY volatile. So that business could contribute less.

The real benefits though come in term of churn reduction, potential pricing power, plus not having to bid for content against another competitor.

Let’s also say that Netflix’s churn is 2% a month right now. If adding Warner Bros content could reduce this to just 1.5%, than that is 19.5 million more members.

Paying their average of $11.50 each gets us $2.7 billion in revenues and at a very high incremental margin—maybe 80%—which is $1.7bn after tax.

This further synergizes the acquisition down to 14x NOPAT.

However, once they get here, they should have MORE opportunity to still go subscribers and better price discriminate, plus increase their advertising revenues with more ad inventory.

If you assume Netflix core earnings grows at 15% for 3 years and then add on these 3 earnings source, they could be generating close to $23 billion NOPAT.

However, they are taking on A LOT of debt for this deal and, which will bring perhaps a $3 billion interest expense.

So putting that together we get around $20bn in earnings or a 3 year out multiple of 18x (Netflix market cap of $360bn / $20bn in earnings).

If you think they will still grow double digits for some time there after, a 25x -30x multiple could be fair, showing 39-67% upside (25x-30x /18x).

BUT, 15% growth for core Netflix is not a sure done thing.

AND there are significant risks to the acquisition as well as from the increased debt load.

Other Risks.

The biggest thing to keep in mind is that they may be taking on close to $60 billion in debt for this deal.

That can significantly hamper their ability to invest in content as they pay that down.

Plus the base rate of large acquisitions is that they don’t work out as planned.

The cultures can be different and expected cost synergies may never materialize.

Another important factor to keep in mind is international markets monetize less effectively than the US.

We see this with all internet services, and international markets are an important part of the growth story.

At the same time, Netflix’s most engaged and highest-value users, those who love watching TV the most, are already subscribers.

Netflix is a well-known product, so when someone isn’t subscribed, it’s usually for a reason.

In some cases, affordability is the constraint, which an ad-supported tier can help address.

In other cases, however, the issue is indifference: some people simply don’t value TV enough, especially as entertainment alternatives continue to expand.

Looking ahead, AI is likely to accelerate content creation across platforms, making YouTube an even more formidable competitor, while apps like TikTok and Instagram increasingly occupy the living room via smart TVs.

Together, these dynamics intensify competition for time spent directly on Netflix’s core turf.

That’s not to say any of this is insurmountable for Netflix.

And Netflix is in the strongest position they have ever been.

But are they being priced like an underdog… or a company whose dominance is all but assured?

For more on Netflix, check out this video below.

Nothing in this newsletter is investment advice nor should be construed as such. Contributors to the newsletter may own securities discussed. Furthermore, accounts contributors advise on may also have positions in companies discussed. Please see our full disclaimers here.