Coupang Stock Breakdown

Get smarter on investing, business, and personal finance in 5 minutes.

Stock Breakdown

Bom Kim is one of the best unknown founders.

In 2010 he dropped out of Harvard to start Coupang, a Groupon-clone.

Seeing early the potential issues with this model, he stopped a pending IPO and transitioned the model to a capex-heavy ecommerce platform.

That is why they earned the moniker of “The Amazon of Korea.”

Today, nearly every Korean household interacts with the platform.

Unlike many high-growth technology companies, Coupang achieved profitability earlier in its lifecycle than Amazon and continues to expand gross profit at roughly 20% annually.

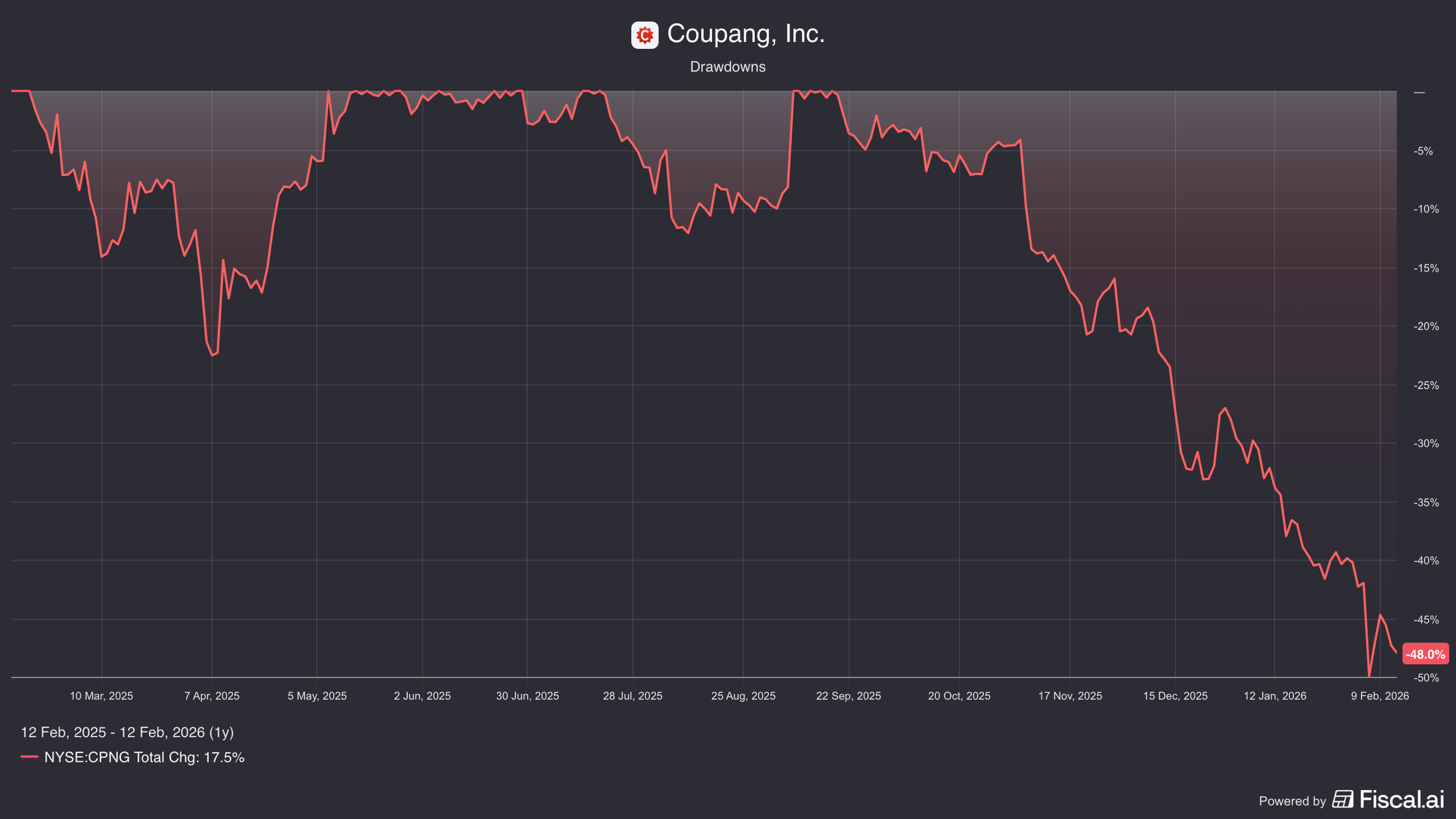

Yet the stock has declined -48% following a recent data security incident.

The data leak quickly turned into vocal consumer backlash with a political push to punish Coupang.

However, there is also some suspicions that the Korean government is fanning the flames of the situation in order to leverage a better trade deal with the U.S.

Coupang is technically considered a U.S. tech company with a large U.S. investor base and even incoming Fed Chair Kevin Warsh sits on the Board.

History shows that consumers' memories aren’t that long though, and can be won over again.

Facebook is one of the most hated companies in the world and their Cambridge Analytica scandal produced very large consumer backlash and vocal political opposition…

Of course, that didn’t do much to harm them.

So what really matters is how much value Coupang offers the consumer.

Because if it is a lot then we have seen consumer habits are unlikely to change.

From Daily Deals to Full-Stack Commerce

Coupang did not begin as a fully integrated logistics ecommerce player.

As noted, its original business model resembled Groupon’s group-buying platform.

In 2013, with an IPO imminent, Bom Kim made the unusual decision to withdraw the offering.

Despite rapid growth and millions of users, he concluded the model lacked long-term durability.

The company pivoted toward a fully integrated e-commerce platform modeled after Amazon.

That shift required significant capital investment in warehouses, delivery fleets, and direct supplier relationships.

At the time, Amazon’s own long-term profitability was still debated.

Coupang, nonetheless, committed to building a vertically integrated logistics network designed to deliver speed, reliability, and scale.

The strategy has since reshaped Korean retail.

Structural Advantages in Korea

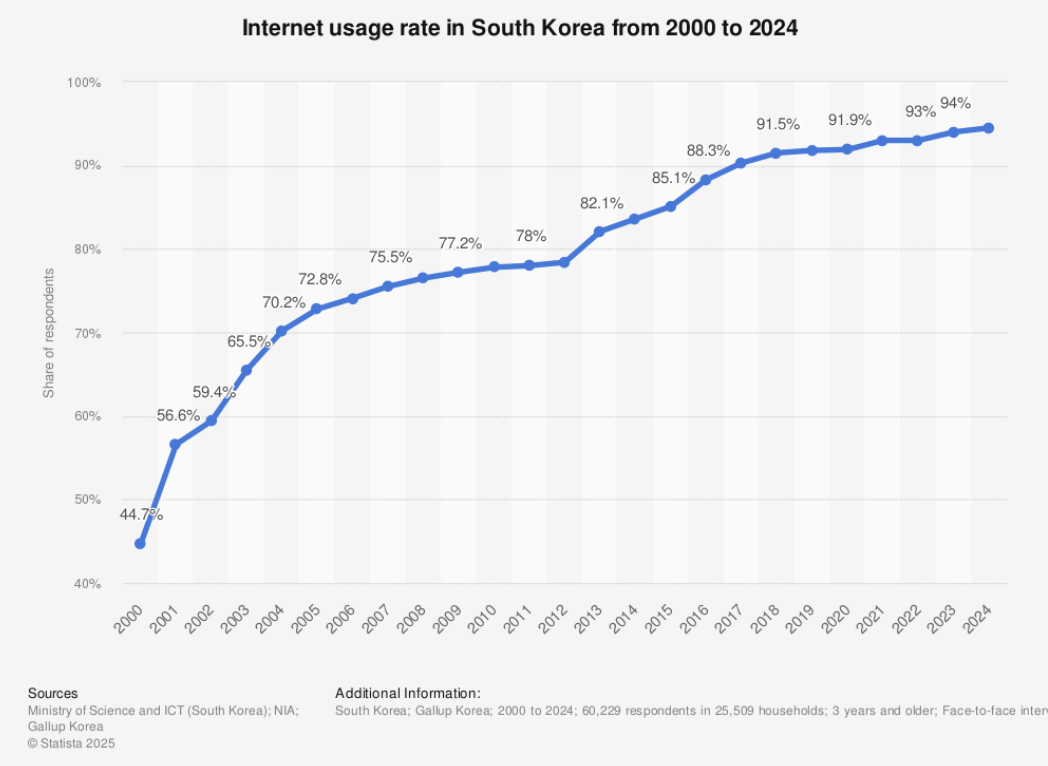

South Korea presents unique structural characteristics that favor e-commerce.

Physical retail space per capita is estimated to be only 10–20% of U.S. levels. Specialty retail chains are far less prevalent.

Meanwhile, internet penetration and digital adoption are among the highest globally. E-commerce penetration has reached approximately 30–40% of total retail sales.

Coupang capitalized on these dynamics.

Its “Dawn Delivery” service guarantees delivery by 7 a.m. for orders placed before 11 pm, a standard it introduced in 2018.

High population density and low crime rates enable operational efficiencies, including doorstep grocery drop-offs without extensive packaging.

The company also introduced Rocket Wow, its subscription program analogous to Amazon Prime.

Priced at roughly $5–6 per month (currency-adjusted), the service offers free shipping, streaming content (Coupang Play), and discounts on food delivery through Coupang Eats.

Today, Coupang serves roughly 25 million active customers in a country of approximately 22 million households.

Rocket Wow penetration is estimated at 60%–65% of active users.

Competitive Landscape

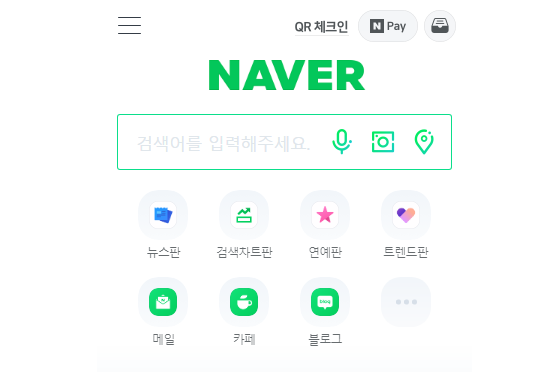

The primary competitive threat is Naver, South Korea’s dominant search engine, which operates a marketplace platform known as Smart Store.

Naver integrates search, merchant storefronts, and payments into a unified shopping experience.

Smaller legacy players, including 11 Street, SSG, Market Kurley, as well as Korea’s Chaebols (large, family-owned business conglomerates) remain active.

Coupang differentiates itself through logistics ownership and operational execution.

Its advantages can be described as “interlocking moats”:

1) Large warehouse network which allows them to place items close to the end consumer

2) Supplier leverage in the 1P business that allows them to get bulk discounts

3) A large base of >25mn customers who in turn attract 3rd party merchants

4) 3rd party merchants increase selection, which increase purchase frequency

5) Exclusive inventory from 3rd party merchants because they need to ship it to the warehouse to be part of the fast delivery program (Rocket Wow)

6) Subscription lock in with the Rocket Wow program that offers cheaper shipping

7) Massive amounts of volume that allows them to increase delivery density, which decreases costs and makes 7 hour shipping across millions of items feasible

Each component reinforces the others.

Fast delivery drives consumer loyalty.

Loyalty attracts merchants.

More merchant means more selection.

More merchants and scale translates to better prices for consumers

Advertising monetizes traffic.

Replicating this ecosystem would require substantial capital, demand, scale, and operational precision.

Valuation

Coupang reports two primary segments:

• Product Commerce: Approximately $29 billion in revenue and roughly $2.5 billion in adjusted EBITDA.

• Developing Offerings: Includes Taiwan operations, Coupang Eats, and other initiatives. Currently generating operating losses of approximately $800 million annually.

Investors often overlook the distinction between these segments. Losses in developing offerings mask the profitability of the core Korean commerce business.

On a normalized basis, a mature operating margin of roughly 10% appears plausible, if not a bit ambitious, between core retail and advertising.

At current share prices near $17 and an Enterprise Value of $30 billion, the stock trades at approximately 14x estimated mature NOPAT. ($29 billion x 10% margins less 25% tax = $2.2bn in NOPAT).

Gross profit continues to expand at roughly 20% annually.

The company also holds approximately $2.25 billion in net cash.

This is just their Korea opportunity though.

Coupang is replicating its Korean playbook in Taiwan, a market that is roughly half the size of Korea.

So far they have continued to ramp up investment in the country on strong growth.

Beyond Taiwan, large-scale geographic expansion appears less certain.

However, they still have plenty of opportunity to continue to increase selection and win more consumer wallet share in Korea.

Korea is a Small Market though…

The most common investor pushback is that Korea is too small of a market for them to grow for a long period of time

What about after Korea and Taiwan?

When asking this question, investors make a mistake without even realizing it.

Investment returns are different from earnings growth.

You don’t need a business to grow at a high rate for a long time if you are paying a low multiple for it.

If you believe Coupang’s mature margin structure, they are trading at 14x.

That is not a multiple that is assigned a business that assumes much growth.

However, they have continued to grow gross profits 20%.

And believe there is still opportunity to get consumers to buy even more online.

They recently started selling tires and will even install them for you!

While there still is the data leak and the risk consumers flee the platform, it is clear that they have a strong value prop to consumers.

But an investor has to decide if they think the current valuation reflects all of their future prospects or if they will quickly stop growing.

For more on Coupang, check out this video below.

Nothing in this newsletter is investment advice nor should be construed as such. Contributors to the newsletter may own securities discussed. Furthermore, accounts contributors advise on may also have positions in companies discussed. Please see our full disclaimers here.