AI Enablers

Get smarter on investing, business, and personal finance in 5 minutes.

If you’ve followed markets over the last two years, you’ve probably noticed one thing:

Every company is now an “AI company.”

While some of them have earned that label...

most of the time it is just marketing.

But the true irony is that a lot of the biggest enablers of AI don’t get that much attention.

Sure, there’s Nvidia — arguably the most obvious beneficiary of the AI boom. Its chips power much of today’s AI training and inference.

But Nvidia doesn’t actually make chips.

They design them.

But even their designs rely on 3rd party design tool makers.

And the chips themselves are manufactured by someone else.

But the company that manufactures the chips doesn’t build its own machines either.

Those machines are made by a handful of highly specialized firms.

And even those machines don’t work without extremely precise components, massive amounts of power, advanced cooling, and software to stitch it all together.

Nvidia doesn’t own AI—it is just one of the many nodes in a long and valuable supply chain.

And the value accrues not just to whoever builds the best model — but to whoever controls the tightest links.

In fact, the model builders like OpenAi may actually accrue the least value in the long-run.

The winners could be those who supply the picks and shovels to this AI gold rush.

This isn’t about who will win AI…

It’s about the businesses that get paid no matter who does.

The Value Chain

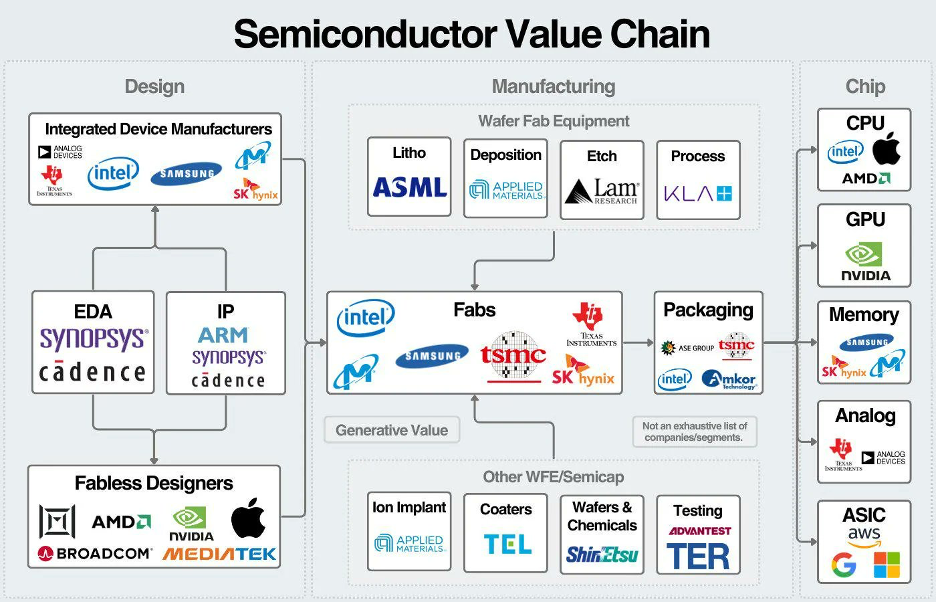

To understand the AI trade, you have to look at the "stack." It starts with an architectural blueprint and ends with a cloud provider renting out compute power to a model developer like OpenAI.

We are going to talk about 14 different stocks that we will group in 4 categories.

Design Tools/ IP

Wafer Fabrication Equipment

Chip Designers

Foundry

We plan on going into more details into each company in future editions, but for now we want to provide an overview of the landscape.

Let us get into it.

The Blueprints: Foundational IP & Design Tools

Companies: ARM, Synopsys, Cadence

It all begins here.

Before a chip can be manufactured, it needs a design. The Design dictates how the transistors are laid out.

A transistor is basically an extremely small electricity switch.

It either blocks electricity—which is a “0”.

Or it allows electricity to flow—which is a “1”

From these we get binary computer language.

The way those transistors are arranged on a chip matter enormously.

Because the design doesn’t just determine what the chip can do — it determines how easily it can do it.

In the same way that some languages are easier to speak fluently than others, some chip designs make certain computations faster, more efficient, and less energy-intensive than others.

There may be tens — if not hundreds — of billions of transistors on a single chip.

Laying all of those out by hand would be impossible.

So instead of laying out billions of transistors one by one, designers work with pre-defined patterns of transistors that perform specific tasks.

Think of these as building blocks.

Some blocks are good at moving data.

Some are good at doing math.

Some are good at repeating the same operation millions of times.

These blocks can be arranged and connected in different ways to create an entire chip.

Over time, certain arrangements proved so useful that they became standardized.

This is where companies like Arm come in.

Arm designs and licenses these proven arrangements — blueprints for how large groups of transistors should be organized to perform common tasks efficiently.

Chip designers then take those blueprints and decide how many to use, how fast they should run, and how much power they can consume.

At that point, the design is still conceptual. It describes what the chip should do, but not exactly how it will be built.

To turn that idea into a physical chip, every one of those building blocks needs to be broken down into the precise placement of billions of individual transistors.

That process is handled by specialized design software from companies like Synopsys and Cadence.

Synopsys and Cadence are both known as design tool makers—or Electronic Design Automation.

Their tools take high-level designs and systematically translate them into detailed transistor-by-transistor layouts. They will simulate how electricity actually flows through the chip, how much power it draws, how much heat it generates, and whether signals arrive on time.

This is key because it can identify errors before the design is ever sent to a factory — and before it etched into silicon, which would require throwing the whole chip out.

Chip Design.

Companies: Nvidia, AMD, Broadcom, Marvell

The chip designers are the ones who actually use the design tools to make designs.

They decide how the building blocks of transistors are arranged, what the chip should be optimized for, and which tasks it should perform best.

Some designs prioritize raw performance.

Some prioritize energy efficiency.

Others are built to excel at very specific workloads, like AI training or inference.

This is where companies like Nvidia, AMD, Broadcom, and Marvell come in.

Nvidia designs chips that are optimized for a type of computation that happens to be especially well-suited for AI models.

AMD historically focused more on competing with Intel in general-purpose computing, but has since expanded heavily into designing chips for AI workloads as well.

Broadcom and Marvell focus more on custom-designed chips, built to meet the specific needs of large customers like cloud providers.

But a good chip design is only half the story. Turning those designs into physical chips requires an entirely different set of companies.

Wafer Fabrication Equipment.

Companies: ASML, Applied Materials, LAM Research, KLA

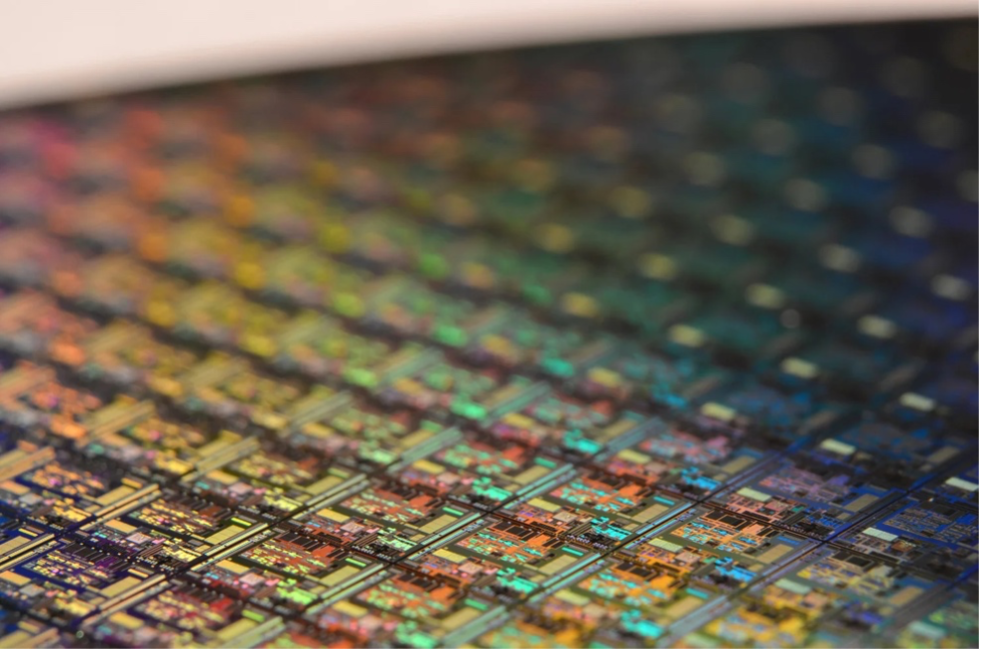

Once a chip design has been finalized, it still exists only as a digital file.

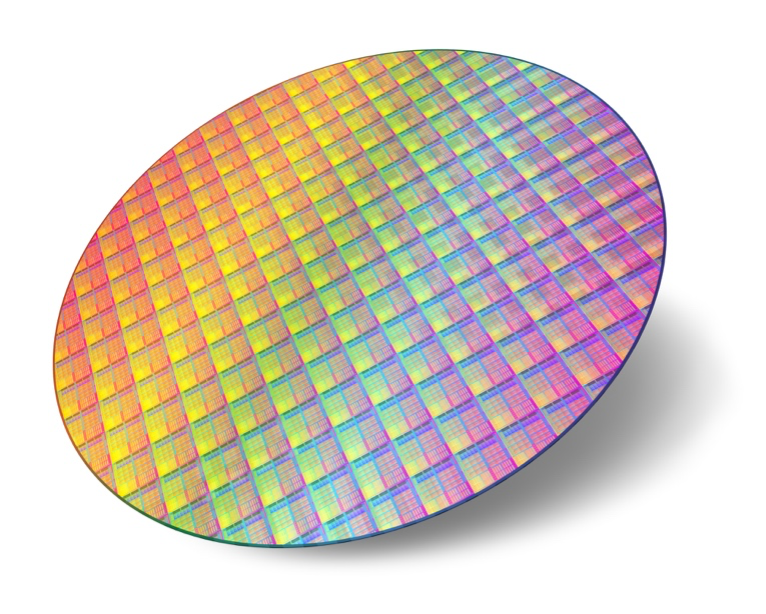

To turn that file into a real chip, it has to physically be built — literally atom by atom — onto a silicon wafer.

A silicon wafer is refined from sand into ultra pure silicon that is laid flat on an extremely thin disk.

The silicon is the main substrate of the chip (and is also where Silicon Valley got its name).

Fabrication equipment then turns the silicon wafer into a working chip.

It does this by repeatedly modifying that wafer, layer by layer, to create the billions of transistors and connections that were laid out in the chip design.

This happens through a long sequence of steps.

Some machines deposit ultra-thin layers of material onto the wafer.

Others remove material with extreme precision.

Some expose the wafer to light to “draw” microscopic patterns.

Others inspect the wafer to make sure everything was built correctly.

Each step must be performed with near-atomic precision. Even the most miniscule mistake can ruin the entire chip.

No single company builds all of this equipment. Instead, a small group of highly specialized firms each dominate critical parts of the process.

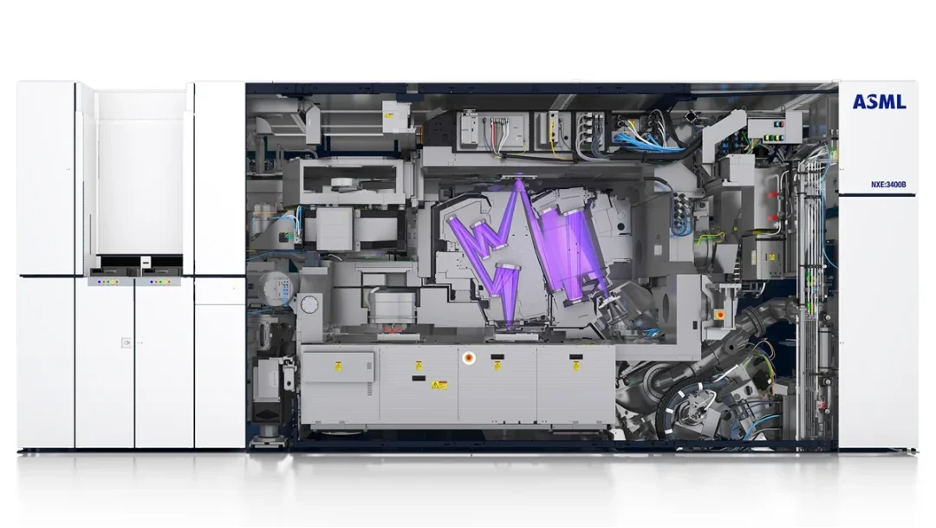

ASML builds the most advanced lithography machines — the tools that project chip designs onto wafers using extreme ultraviolet light. This tool uses light to "draw" a pattern onto the silicon, which is then "washed" away with special chemicals. What is left is a precise pattern.

This pattern though needs material to be put on it in order to actually build the chip.

Once that pattern exists, other machines take over. Applied Materials builds tools that add ultra-thin layers of material onto the wafer, while Lam Research builds tools that remove material with extreme precision.

By repeatedly drawing patterns, adding material, and removing material — layer by layer — those patterns stack on top of each other. Over time, they form a complete chip.

Throughout this process, KLA’s machines inspect the wafer after each step, scanning for defects that are too small to see and catching problems before thousands of chips are ruined.

Foundry

Companies: TSMC, Intel, Samsung

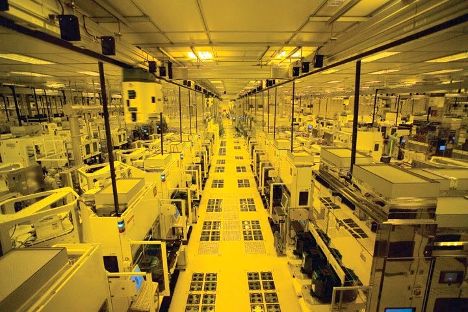

Those companies we just mentioned only make the equipment, they don’t actually run it.

That job belongs to the foundries.

Foundries are the factories that operate all of those machines — the ASML lithography tools, the Applied Materials deposition tools, the Lam Research etching tools, and the KLA inspection systems.

While it may seem like a trivial thing, running chip equipment properly takes a ton of experience.

There are hundreds of individual steps that must be executed flawlessly in a tightly controlled environment. Anything from the temperature, micro particles of dust, fluctuations in power, or even tiny vibrations can ruin the entire process.

Learning all of the steps to do properly on the latest equipment takes years of small iteration.

And even the best in the business at it—TSMC—commonly makes errors.

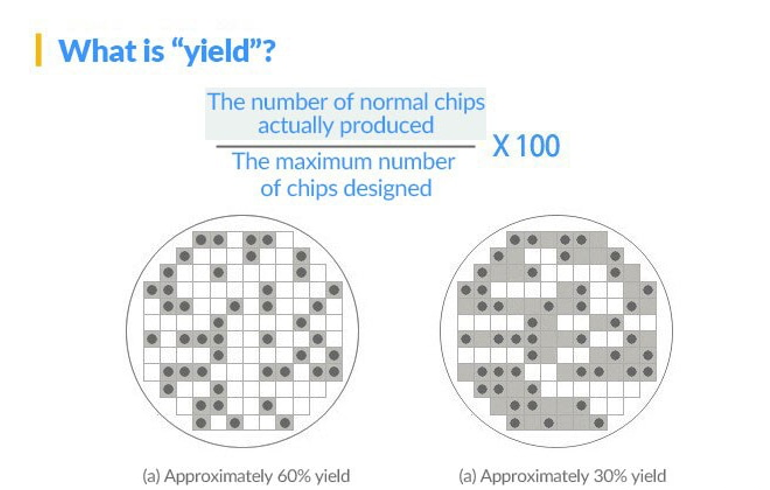

In fact, errors in chip making are so common they have a name for it.

It’s called yield.

A great yield is anything over 80%.

But that still means 20% are unusable.

When a foundry is first ramping production on a new chip, yields can be far lower — sometimes as low as 30%.

As the foundry continues to troubleshoot the process, tune the equipment, and eliminate defects, yields slowly improve over time.

The higher the yield, the more usable chips you get from the same wafer. And because the foundry’s costs are largely fixed, higher yields mean those costs can be spread across more chips.

That makes each chip cheaper to produce.

Which means customers get more chips sooner and at better prices.

TSMC also does not have its own chip designs, unlike Intel and Samsung—who both have their own foundries, so it never competes with its customers. Its entire business is focused on manufacturing chips as well and as efficiently as possible, regardless of who designed them.

That focus has allowed TSMC to steadily gain volume over time. Higher volumes, in turn, let TSMC scale its operations further, and when combined with continually improving production processes, this allows the company to charge more per wafer while still delivering a lower cost per working chip.

These are just 14 of the bigger enablers of the AI industry.

There are others though!

For more on the companies that enable AI, check out this video below and comment what AI enabler I should cover more in depth!

Nothing in this newsletter is investment advice nor should be construed as such. Contributors to the newsletter may own securities discussed. Furthermore, accounts contributors advise on may also have positions in companies discussed. Please see our full disclaimers here.