Uber Stock Breakdown

Get smarter on investing, business, and personal finance in 5 minutes.

Stock Breakdown

Welcome to the seventh edition of Five Minute Money!

For over a decade, Uber was the world’s most famous "bad business."

As an asset-light, marketplace with no incremental costs to booking an additional ride, their profitability should have come easily.

After all, they simply took a % of each transaction with no cost of goods sold.

Their monetization model wasn’t a lot different from eBay...

Except eBay was surprisingly profitable just 3 years after founding…

Uber would take 14 years!

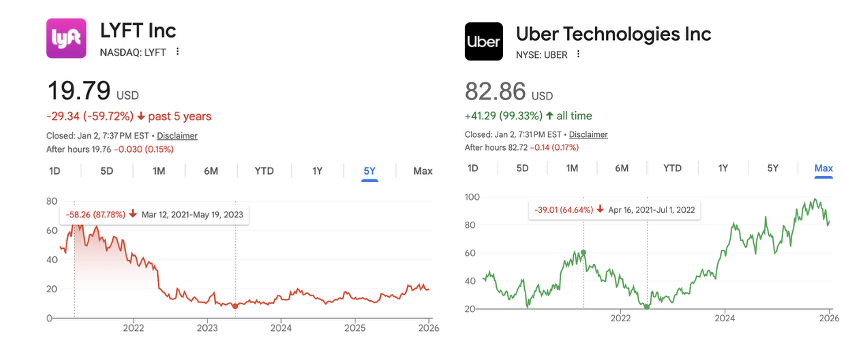

This long journey led to investors losing faith in the stock, sending it down to $21 a share in 2022, or >50% below it’s IPO price…

However, once they proved their profitability, it jumped +360%.

Why was Uber such a bad business model for so long and what changed to make them profitable in 2023?

And is their business model secure, or are Autonomous Vehicles going to make their profitability short lived?

Business Model.

Let’s back up to talk about the business basics.

Every month about 190 million people use Uber.

The value of all transactions on the app for the past twelve months was about $184 billion.

Uber generates revenue by taking a cut of each transactions.

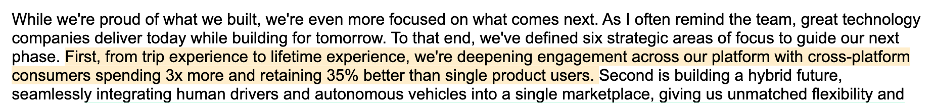

For ride-hail, they keep about 25-30% of the transaction value with the rest going to the driver and to pay city taxes and insurances.

For food delivery, Uber keeps about 20%.

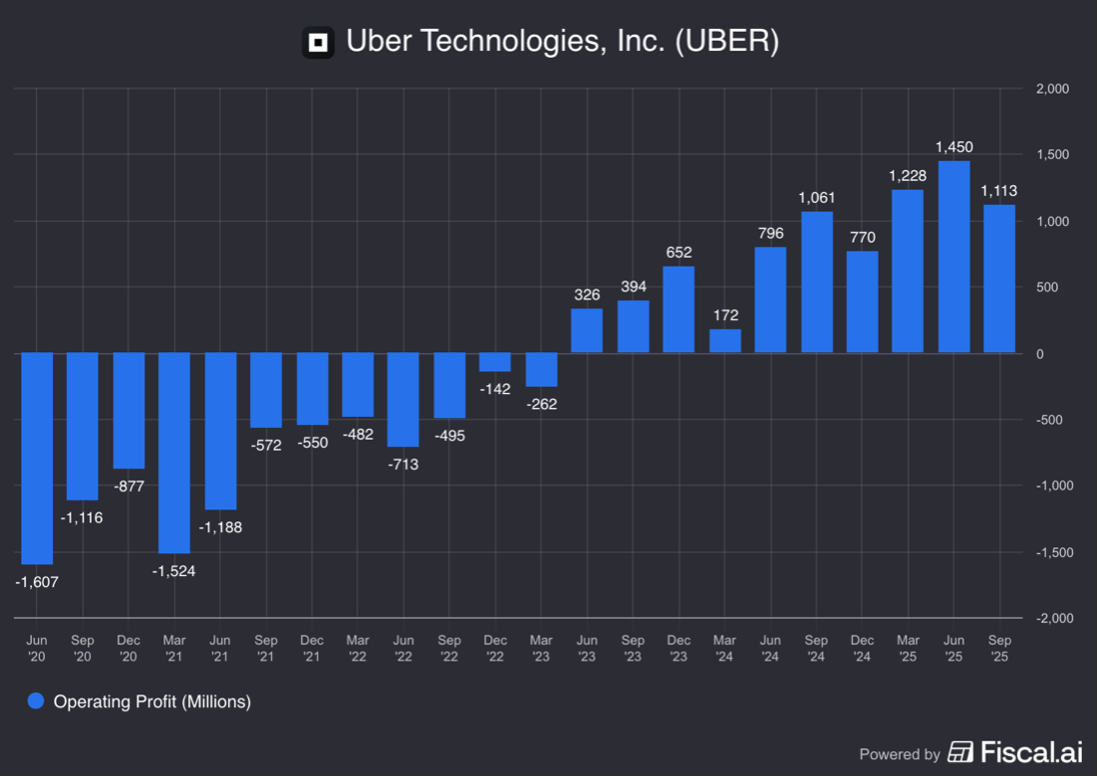

In the last year they generated about $50bn in revenues and $4.5bn in operating profit.

The beauty of this model is that Uber doesn’t have to pay to have a staff of drivers or fleet of vehicles.

They have very low fixed costs and only pay drivers when there is a ride or order to fulfill.

They also have “dynamic pricing”, which allows them to adjust pricing up when demand is high and lower it when demand is low.

Why did it take over $30 billion in losses to ever make this business model work?

A Decade Long Broken Business.

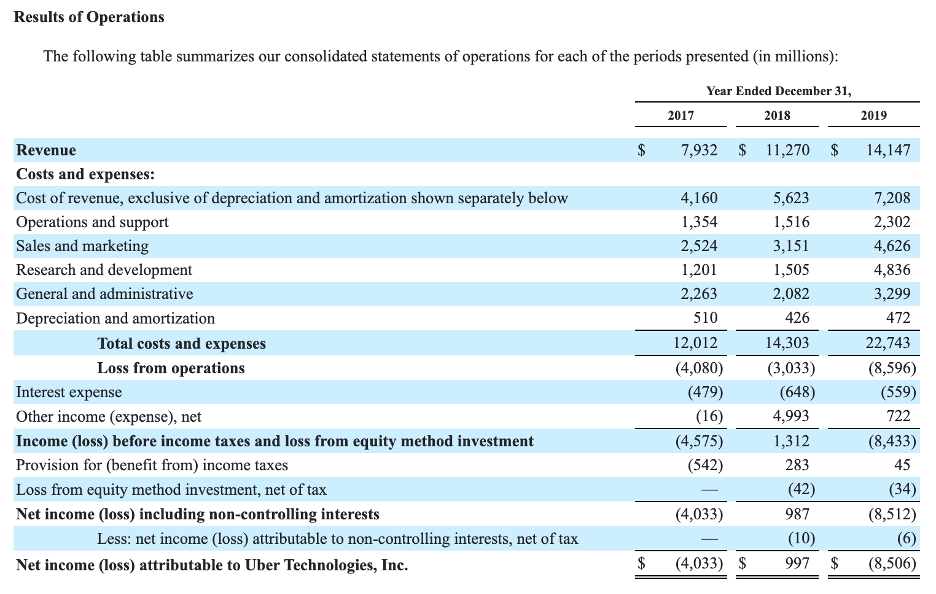

In 2019 alone Uber burned a whopping $8.5 billion on $14 billion in revenue.

To understand what changed, just think of these two data points.

$4.6bn was Sales & Marketing expense for 2019.

That same year they did $13 billion in revenues, meaning they spent 35% of all revenues on sales & marketing.

Do you know what Sales & Marketing is today after they increased revenues to $50 billion?

It’s $4.8bn, or about 9.5% of total revenues.

This number is one of the biggest factors driving Uber’s profitability.

For many years competitors like Lyft in North America, Didi in China, Grab & Gojek in South East Asia, and Bolt in the EU fought for market share against Uber.

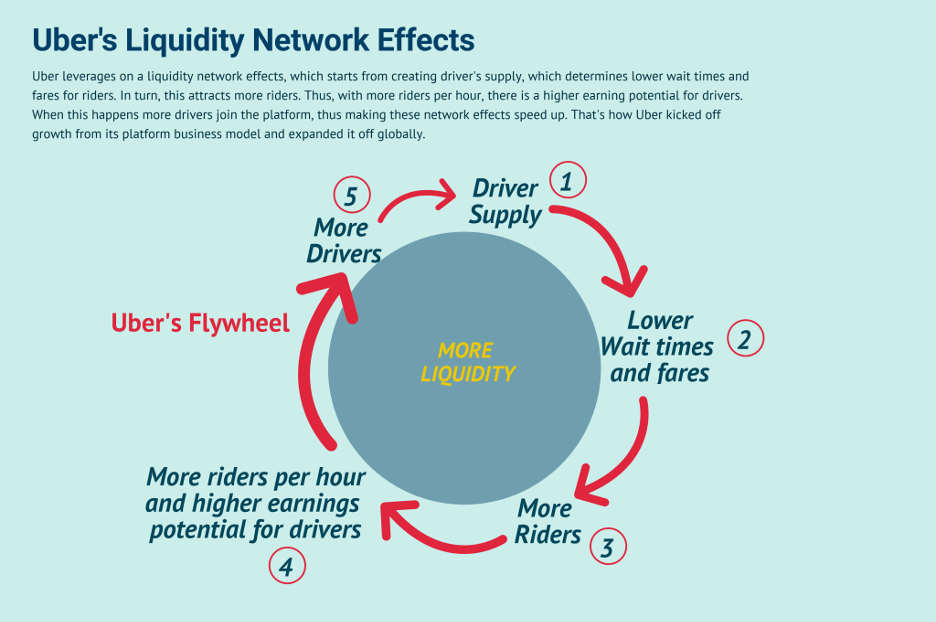

Uber fought hard to win market share because if they could establish a dominant position, then they would benefit from a virtuous cycle.

More 1) drivers means less wait times and lower prices, 2) shorter wait times and lower prices means more rider demand, 3) more rider demand means drivers get more jobs quicker.

In short, the more volume they could generate, the more efficiently they could match drivers and riders. This would result in a win-win-win as drivers make more money with more jobs, riders get quicker jobs, and Uber makes more money.

However, even one pesky competitor could ruin this.

Instead of consumers just going to Uber, they could easily be swayed by promotions and discounts.

This meant a rider may ride Uber and then switch over to Lyft when a promotion hit. For fear of losing that rider forever, Uber would fight back with promotions of their own.

This battle of subsidies was also to keep other competitors out of the market. Only the best funded could battle it out.

Eventually, competition started to rationalize.

The big change came after Uber and Lyft went public.

New Paradigm.

After Uber and Lyft went public, they were at the whims of public market investors.

When Covid hit, interest rates fell to basically zero. All this free money led to investor euphoria and the stock market boomed.

The message to Uber was simple: grow.

As Uber’s ride-hail business suffered, they invested heavily into the Eats business and battled the likes of DoorDash and Grubhub with subsidies. They acquired another delivery competitor—Postmates—for $2.6 billion.

After the stock market crashed in 2022 and interest rates rose, investors were no longer comfortable funding such growth.

Lucky for Uber, this change in sentiment applied to EVERYONE.

Lyft was structurally weakened during Covid because when drivers couldn’t find work, they left the platform.

Lyft then struggled to reacquire drivers without cheap money to fund promotions.

In 2019 Sales & Marketing was $814mn for Lyft.

Last year Lyft spent $867mn on Sales & Marketing—hardly any more despite revenues jumping 70% to $6.2bn over that period.

As they spent less money on marketing, Uber was able to do the same while maintaining their market position.

The competitive intensity dropped as both companies pushed for profitability amid their stock prices getting decimated.

Uber was able to pull far out ahead in the after math though because of Lyft’s struggles to reacquire drivers, which increased prices and wait times.

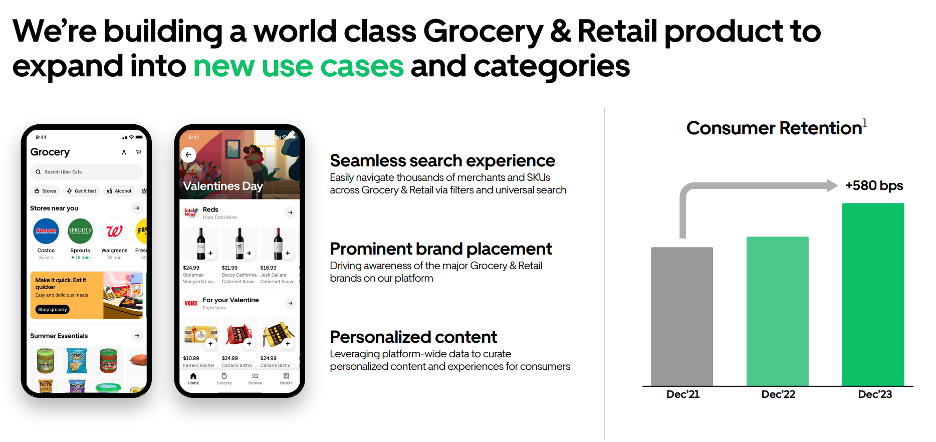

Furthermore, Uber improved their business model by offering both ride-hail and food delivery in the same app.

By having two high frequency services in the same app, they improved user retention and made it easier to cross-sell.

Ride-hail users get ads for food delivery and vice versa.

In 3Q25, Uber noted that users that use the two services spend 3x more and have 35% higher retention.

This has only been strengthened with their Uber One loyalty program that gives discounts between rides and food delivery.

This again increases loyalty as users pay a monthly or annual fee in exchange for larger discounts. If they are in the Uber One program, there is little chance they will use a competitor ride-hail or food delivery.

Uber One has over 30 million members and they spend 3.4x more than non-members.

As Lyft suffered, Uber was in a position to increase their economics, but they did so in a stealth way.

Whereas their recorded commission on a ride was 19% in 2019, it increased to 30% for three reasons.

The first one we already mentioned—they turned off subsides for drivers (which are recorded as a contra-revenue account… basically as a reduction to revenue)

The second is they introduced upfront pricing.

With upfront pricing drivers now see what their earnings are for the ride, but not how much the price of the ride.

This decoupled the riders willingness to pay from the drivers willingness to accept lower earnings.

Now instead of a fixed commission, Uber can offer drivers $18 for a ride without them knowing the rider was paying $30.

This lets the Uber algo play games to give drivers potentially lower earnings in exchange for a “fixed” earnings figure—and of course raises Uber’s portion of the economics in the process.

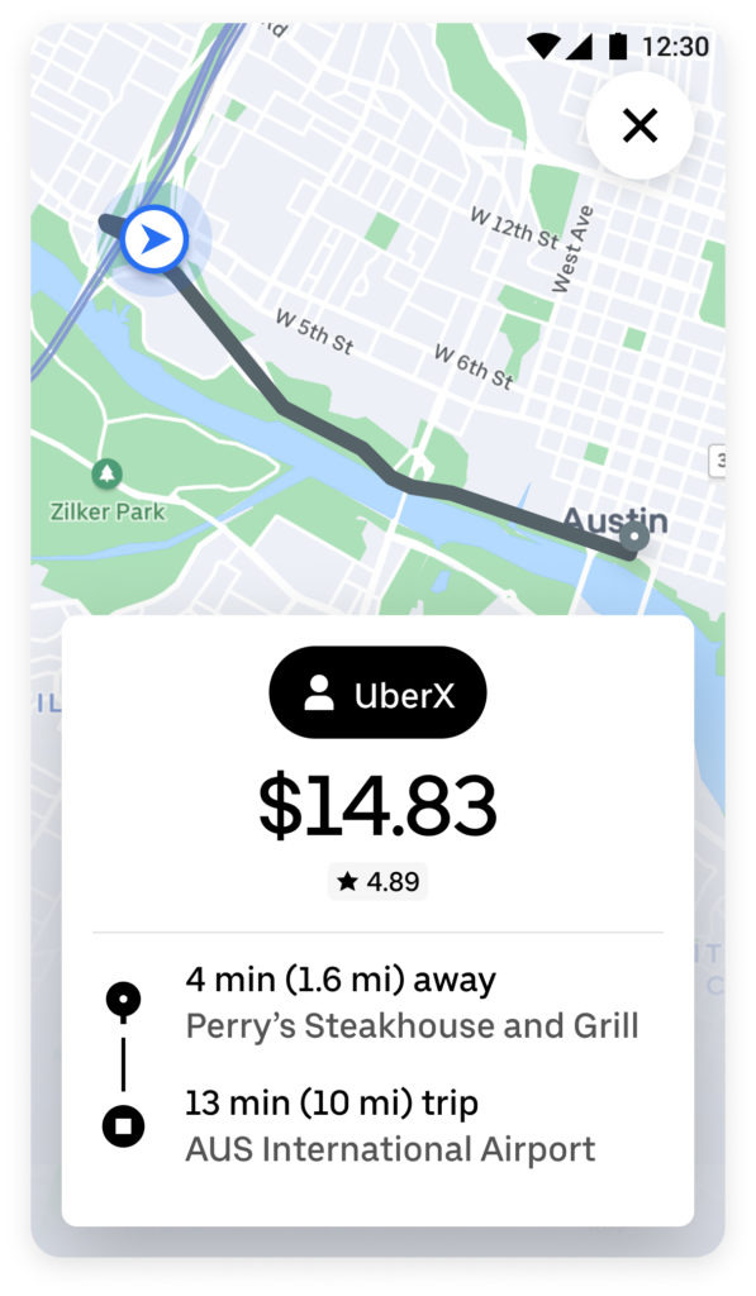

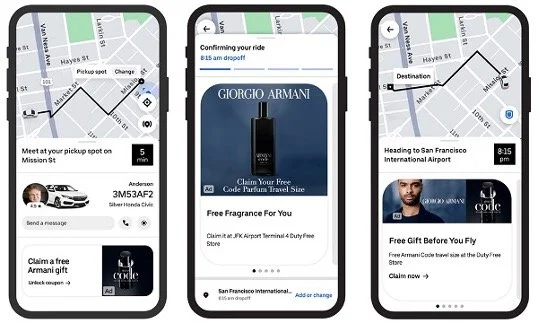

3. The third reason was the introduction of advertising

Uber would now show ads during a riders trip as well as sponsored ads when searching for food.

The advertising business is now run rating about $1.5 billion.

And is very high marginal incremental revenue for them.

So now we understand why the business improved, but what is the opportunity from here?

Opportunity.

Uber has 4 opportunities going for them.

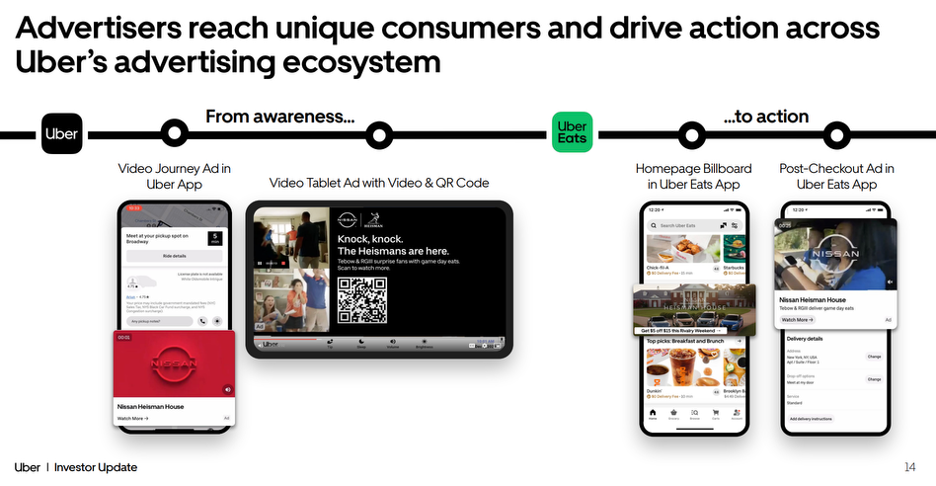

1) Category Expansion with Retail and Grocery.

Users go to the grocery store 4-8x a month versus riding maybe 2-3x a month. This is a huge opportunity to increase frequency.

Retail is another large category where they can support retailers against Amazon with fast delivery.

They currently support $12.5 billion in transactions in this category, but the TAM is in the trillions. Even just slightly increasing penetration here can be a big revenue unlock.

2) Advertising

Advertising can continue to grow, especially in new categories like grocery and retail.

If they can get better at discovery (helping users find items) then they can charge even more for that because it creates sales that wouldn’t have happened otherwise.

3) Uber Freight

This has been a bit of a problematic business for them.

It is a $5 billion revenue business but still loss generating.

Their largest contract—Kraft was effectively acquired through a $2.25bn acquisition of Transplace.

The “blue sky” scenario here is that they can get a critical amount of independent and small shippers on their platform and plug into a variety of enterprises and medium businesses to serve their shipping needs.

The value of a trucking trip is worth much more, so even if their commission is small the dollars can be large.

Or they could embed their logistics software into business’s to control their entire logistics operation, charging a monthly software fee.

The U.S. trucking market is a >$900 billion TAM, so any meaningful penetration could be huge for Uber.

(Of course, this is hard to do though, and they are competing here against a slew of legacy solutions and start-ups.)

4) The biggest opportunity is also a potential business killer… Autonomous Vehicles.

AV: The Death of Uber?

There are two ways this can go.

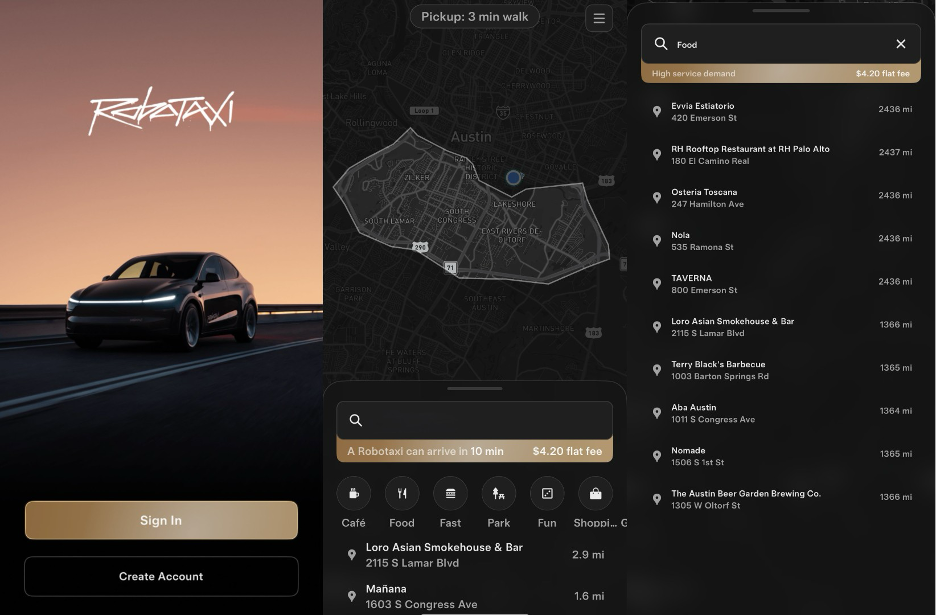

Either, Uber becomes the go to network for Autonomous Vehicles and car-owners simply “plug” their car into the Uber network… or new apps like Waymo RoboTaxi (Tesla) decide to create their own ride-hail networks.

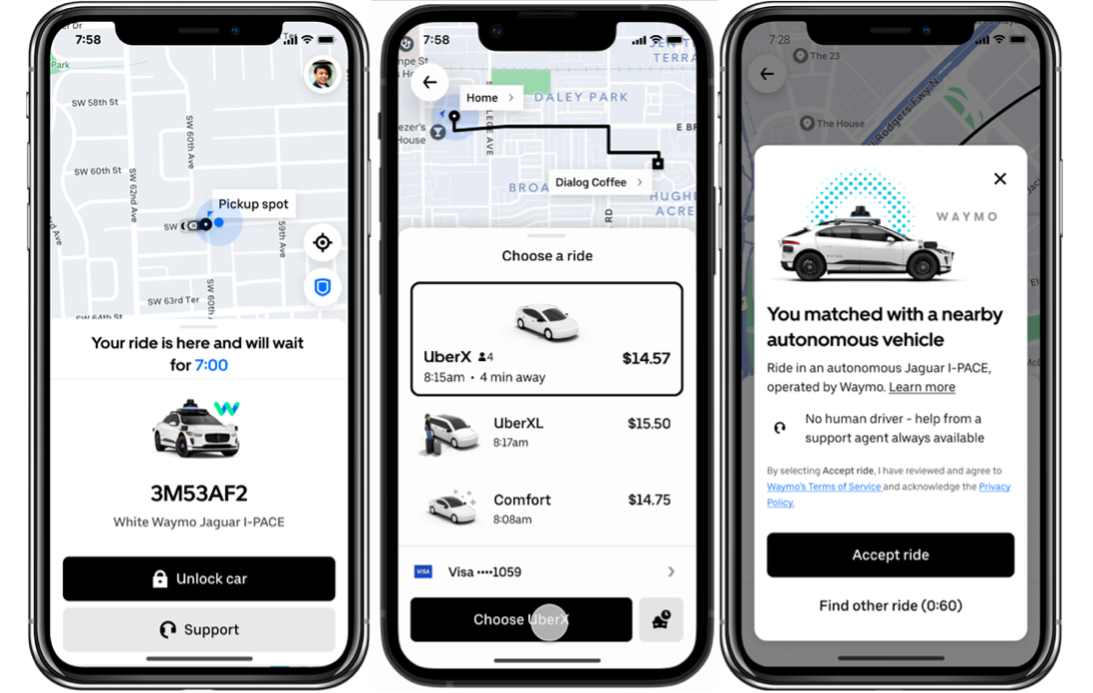

Right now Waymo actually partners with Uber.

BUT Waymo also has their own app.

And you can’t actually book a Waymo in Uber. It is just that sometimes you may get offered a Waymo if it is available.

This is a quickly changing landscape and it is possible it puts Uber in the worst of both worlds where they are helping a competitor as it scales up to only eventually leave the Uber network and become a competitor.

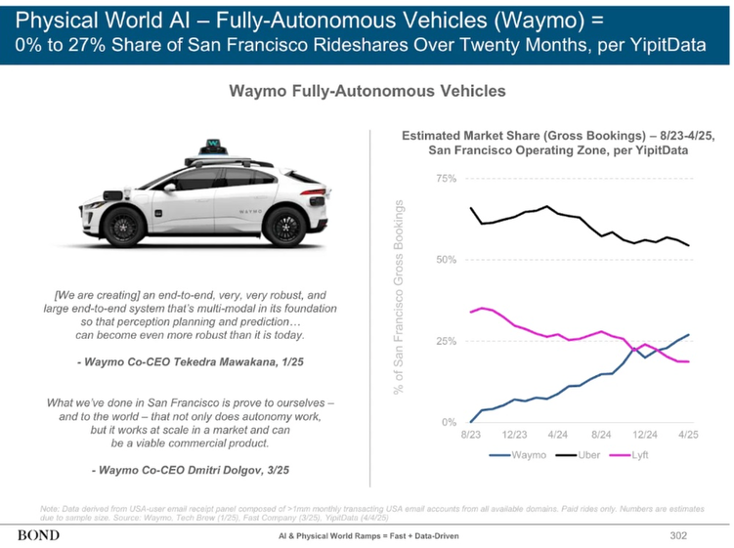

Right now in the cities that Waymo focuses most on (i.e. San Francisco and Los Angeles), they have gained market share at Uber’s and Lyft’s expense.

By some estimates Uber lost 10% of market share in a single year!

Waymo though needs a lot of capital to scale. And the wait times and prices are still higher than Uber’s.

That is why in two cities—Atlanta and Austin—Waymo doesn’t actually operate their own standalone app, but instead just plugs into Uber.

However, it is worth mentioning that large cities are disproportionately important to Uber, so even just losing a handful of those to Waymo could be destructive to Uber’s profits.

At this stage, it is an experiment for both Uber and Waymo and the ultimate winner will be whoever controls the consumer touch point (i.e. the app).

Waymo may be okay forgoing some commission to Uber in exchange for better utilization of their vehicles—especially in cities where they only have small fleets.

Since there is no driver with AV, there are more economics to share.

The other thing to keep in mind though is that apps may be irrelevant soon…

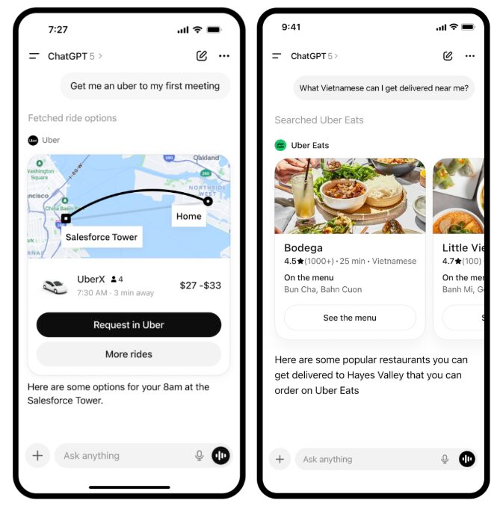

Agentic AI.

As we go more into an AI world, it is increasingly likely that “AI Agent” do various task for you.

Instead of booking an Uber yourself, you just talk to ChatGPT or Gemini and tell it to book you a ride. It then goes and does it for you without you ever opening an app.

Since Google owns Waymo (and Google maps btw) it is quite likely they would want to keep this integration, which could cut Uber out of the transaction.

Or if Waymo doesn’t have enough cars, it could want to partner with Uber. Maybe that would be a fair tradeoff between the two—exclusivity with ordering cars through Uber on Gemini in exchange for Waymo’s being exclusive to the Uber network and shutting their app down.

That is pretty speculative though.

But the speculation highlights the risk.

…and the other elephant in the room is Tesla.

Elon Musk not only wants to have a fleet of RoboTaxis (which currently run on their own app), but also wants all Teslas to be autonomous so their owners can click a button and rent them out when they aren’t in use.

This could create a new competitive dynamic that leads to a return of competition and new pricing pressure (and subsidies wars).

But there are also other AV competitors like Amazon’s Zoox and GM’s Cruise.

The more competitors there are though, the more it could work in Uber’s favor as it reduces the importance of any one AV provider and increases the value of consolidating supply and demand in a single network.

Valuation.

With a stock price of $82 and a market cap of $170 billion, Uber trades at 47x earnings.

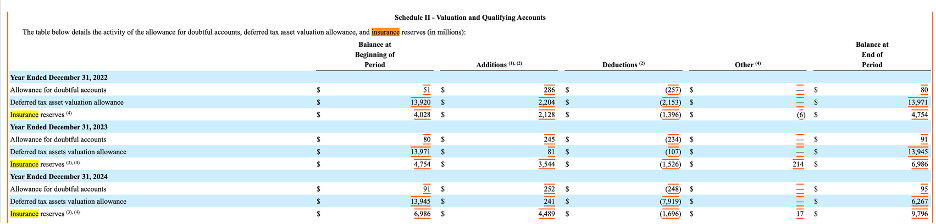

However, on a free cash flow basis (after subtracting out Stock-based comp) they have $6.8bn cash flow, which is about a 25x multiple.

But, accrued insurance premiums are a large source of cash flow—$2.7 billion over the last year actually.

(it is a bit technical, but basically when they stop growing so fast, this will eventually normalize to zero, so an investor should be careful).

Backing this out, they trade at a 41x FCF multiple.

So an investor still needs a lot of growth in order for an investment to generate a 10% return.

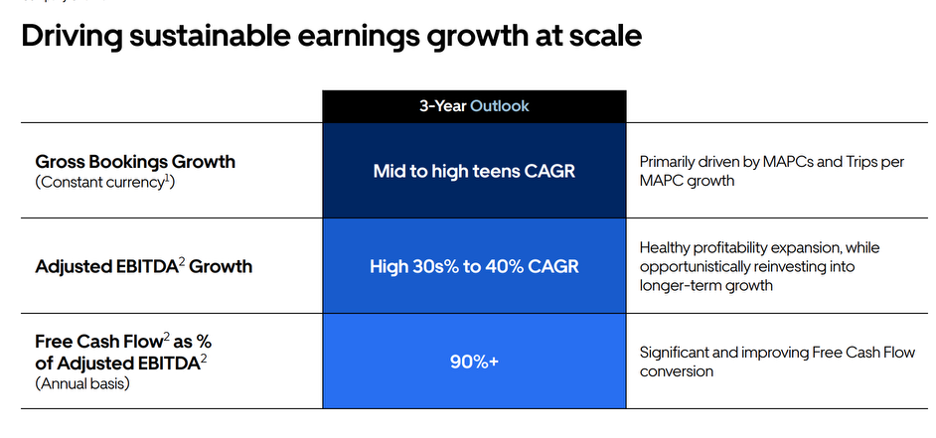

They are growing revenues 18% and expect to continue to do that for the next couple years.

They also could benefit from operating margin expansion from advertising revenues (which is very high margin) and more scale.

If they can grow cash flow for 20% for 3 years, that would be $7bn in “real” cash flow.

At a 25x multiple, which would be fair if they are still growing low double digits, that is a 50% return.

However, there is a looming risk that Autonomous Vehicles reset the competition dynamics with new competitors.

For more on Uber and the threat of AV, check out this video here

Nothing in this newsletter is investment advice nor should be construed as such. Contributors to the newsletter may own securities discussed. Furthermore, accounts contributors advise on may also have positions in companies discussed. Please see our full disclaimers here.