Why Tesla Can Offer Leases Other Car Companies Can’t

Get smarter on investing, business, and personal finance in 5 minutes.

Business Breakdown

Welcome to the sixth edition of Five Minute Money!

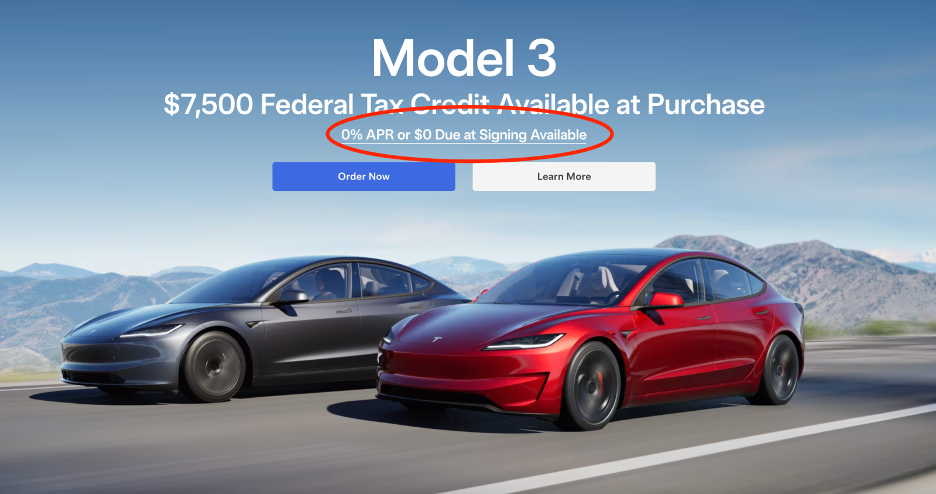

A Tesla Model 3 carries a sticker price of roughly $40,000.

A Honda Civic costs closer to $25,000.

Yet last year, there was a time when both vehicles could be leased for nearly the same monthly payment.

The Model 3 leased for about $299 per month, while the Civic leased for roughly $260.

Despite the Tesla being more than 50% more expensive upfront, the monthly cost to the consumer was nearly identical.

Yes, there was a loophole that explained part of this.

But it also had to do with how Tesla operates a fundamentally different business model versus legacy automakers.

Let me explain 👇

Understanding how Tesla achieved this outcome requires examining four interlocking elements of its business model:

a regulatory loophole,

their financing arm,

its direct-to-consumer distribution, and

its business architecture.

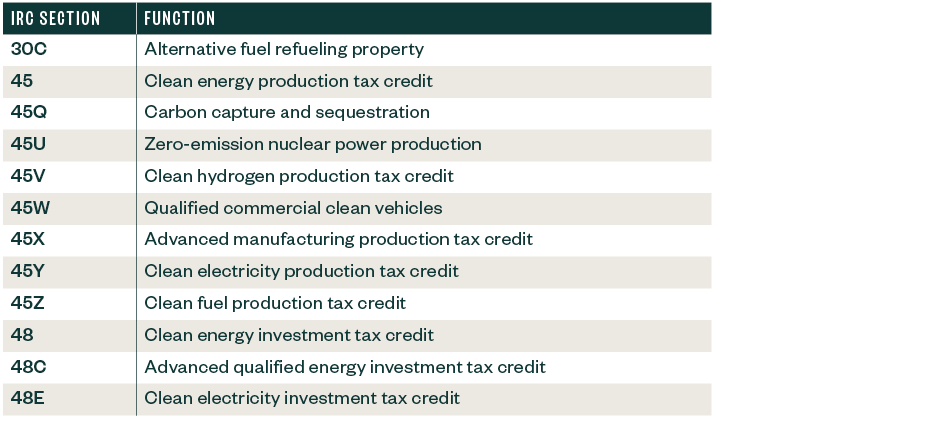

1) The Loophole

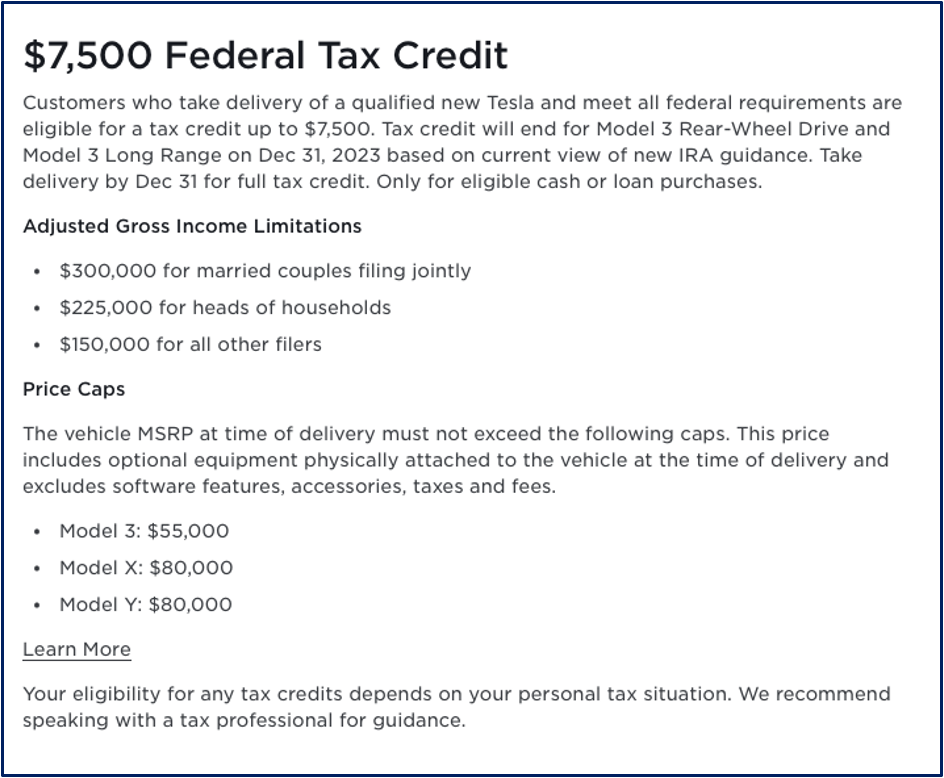

Under the Inflation Reduction Act, consumers can qualify for a $7,500 federal tax credit when purchasing an electric vehicle.

However, eligibility is restrictive.

It depends on income limits, domestic manufacturing rules, and battery mineral sourcing requirements.

These constraints made it difficult for many individual buyers to qualify.

A separate provision—Section 45W—applies to commercial entities instead of consumers.

Leasing companies qualify under this rule.

Because leased vehicles are owned by the leasing company, Tesla structured transactions so that:

its leasing arm purchased the vehicle,

claimed the $7,500 credit, and

applied it directly as a capitalized cost reduction.

This lowered the effective vehicle price used in lease calculations and flowed directly into lower monthly payments.

The mechanism was fully compliant with the law.

It created a real pricing advantage.

But it was only part of the story.

2) The Financing Arm

The more important factor lies in Tesla’s approach to financing.

Legacy automakers typically rely on third-party banks or semi-independent captive finance subsidiaries.

These entities are expected to generate standalone profits.

Their incentives are often misaligned with vehicle manufacturing.

Tesla operates differently.

Its financing activities are not meaningfully separated from manufacturing.

Both are treated as a single, integrated system.

This allows Tesla to use financing as a strategic tool rather than a profit center.

In practice, this means Tesla can offer ultra-low or promotional APR financing.

The financing arm may lose money on these loans when they are securitized and sold.

However, those losses can be offset by higher manufacturing margins and increased vehicle volume.

Tesla optimizes for system-wide profitability, not divisional performance.

This integration also explains why Tesla passed the full $7,500 tax credit to consumers.

A third-party lender might have captured part of the credit for themselves.

Tesla gave it all back to the consumer.

3) Direct to Consumer

The third pillar is Tesla’s direct-to-consumer sales model.

Traditional automakers sell vehicles to independent dealerships.

Dealerships then sell to consumers and rely heavily on financing and add-on products for profit.

This creates additional layers of markup and incentive misalignment.

Tesla eliminates dealerships entirely.

By selling directly, Tesla:

• avoids dealer margins,

• reduces inventory financing costs, and

• shortens its cash conversion cycle.

Industry estimates suggest Tesla saves roughly $2,000 per vehicle by avoiding the dealership model.

Those savings can be reinvested into lower prices or more aggressive lease terms.

This structure also ensured that the tax credit benefit flowed directly to the customer rather than being absorbed by intermediaries.

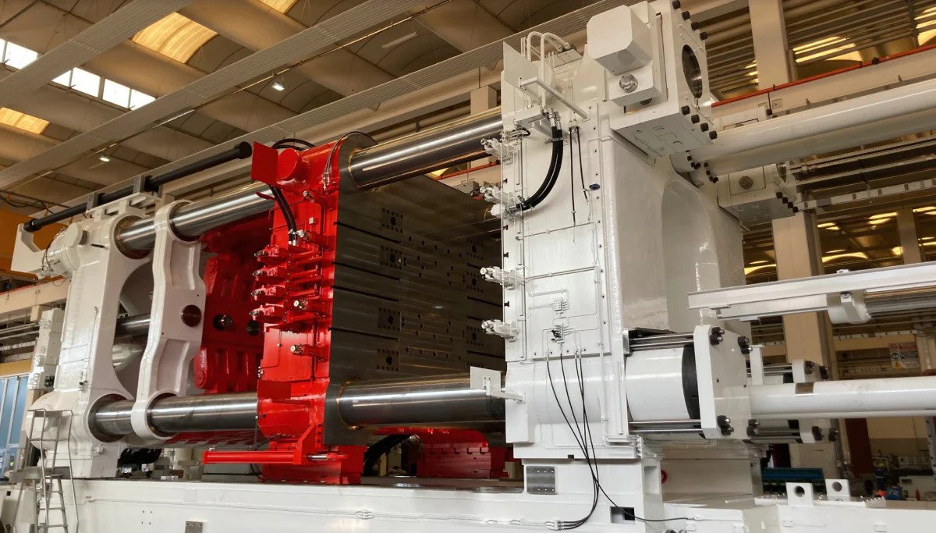

4) Business Architecture

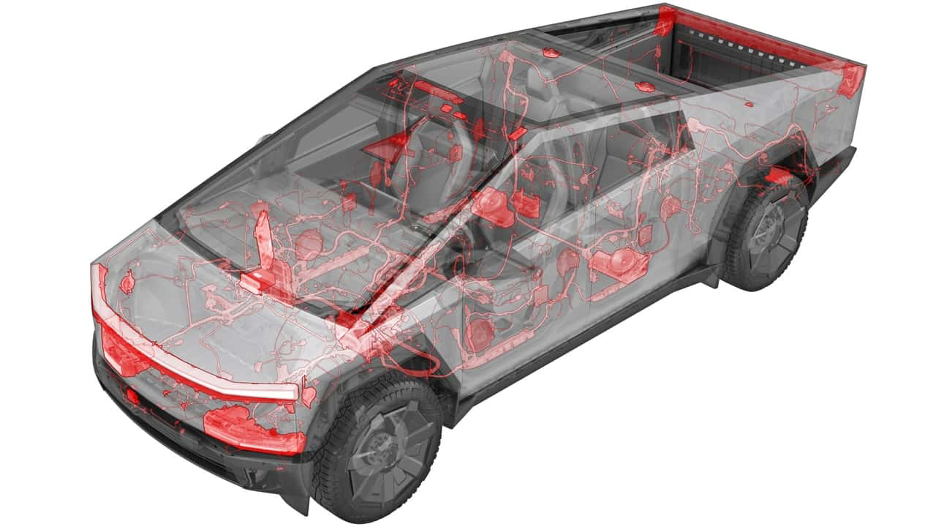

The most fundamental advantage lies in Tesla’s business architecture.

Unlike legacy automakers, Tesla did not inherit an internal-combustion supply chain.

Building electric vehicles from scratch forced the company to vertically integrate and redesign systems holistically.

This led to structural simplification.

Tesla uses large single-piece castings instead of dozens of stamped components.

It relies on fewer suppliers, fewer parts, and less labor.

Giga-casting alone replaces what would traditionally be dozens of components with one, materially reducing cost and assembly time.

Another example is Tesla’s 48-volt electrical architecture.

By increasing system voltage, Tesla reduced wiring thickness and weight.

This saved an estimated 70 to 100 pounds of copper per vehicle and several hundred dollars in cost.

These changes require deep integration across hardware and software.

Most legacy automakers struggle to execute this because they do not control the entire system.

Model lineup simplicity reinforces these gains.

Tesla offers a limited number of vehicles with few trims and options.

This sharply reduces manufacturing and inventory complexity.

The Result

Taken together, these elements explain how Tesla leased a $40,000 vehicle at roughly the same monthly cost as a $25,000 competitor.

Regulatory arbitrage lowered the effective purchase price.

An integrated financing arm enabled aggressive pass-through of incentives.

Direct-to-consumer distribution removed structural costs.

A simplified business architecture reduced manufacturing complexity and expense.

What looked like an unusually cheap lease was simply Tesla’s business model expressing itself.

It was a byproduct of structural advantages that legacy automakers, designed around fragmented incentives, struggle to match.

For more on how Tesla was able to offer such low leases, check out the video below.

YouTube FAQ

Nothing in this newsletter is investment advice nor should be construed as such. Contributors to the newsletter may own securities discussed. Furthermore, accounts contributors advise on may also have positions in companies discussed. Please see our full disclaimers here.