Why Industry Matters and 4 Industries to Avoid

Get smarter on investing, business, and personal finance in 5 minutes.

Why Industry Matters and 4 Industries to Avoid

Some industries may look attractive on the surface:

Essential service.

Familiar brands.

Constant demand.

A lot of revenues.

But the economics underneath rarely change.

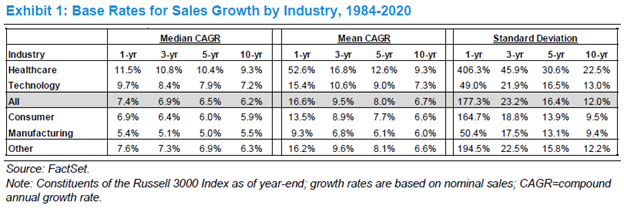

And history suggests most businesses don’t escape their industry’s base rates.

Let’s break it down 👇

Why Industry Matters

Not all industries are created equal.

Some industries make it very hard for any company to be exceptional.

It doesn’t matter how smart management is or how big the opportunity looks.

The reason is simple:

Most businesses end up earning economics that are the same as the industry average.

While exceptions do exist...

They are very rare.

How Do Industry Economics Shape Outcomes?

Physics describes the laws of the universe.

And it is a simple fact that gravity is stronger in some places then others.

If you want to launch a space rocket, it is easier to do so from the moon because it has 1/6th the gravity as Earth.

The higher the gravity, the harder it is to launch a rocket.

Industry economics are much like gravity.

Some industries just have harder characteristics to operate in.

Those characteristics determine:

How competitive pricing is

How loyal customers can be

How much capital is required

How hard it is to enter the industry

How susceptible profits are during downturns

If an industry has poor economics, most companies inside it will struggle.

Even if they try to be different.

Don’t Fight Gravity

This framework helps you screen before you analyze.

Instead of asking: “Is this company cheap?”

You start with: “What does this industry usually produce?”

Some industries are much more likely to have:

High margins

Pricing power

Customer loyalty

Strong returns on capital

Picking an industry with good economics is like launching a rocket with low gravity—it just makes everything easier.

Others “fight gravity” just to break even.

Knowing the difference saves time.

And mistakes.

The Problem?

Investors often assume: “This company will be different.”

Sometimes that’s true.

But it usually isn’t.

Base rates matter.

And certain industries have base rates that skew toward mediocrity.

Not because management is bad.

But because the business model works against them.

Why You Can’t Out-Execute Bad Economics

Industry economics > company execution

Execution matters.

But it operates within constraints.

If an industry has:

Low customer loyalty

High fixed costs

Price-based competition

Little differentiation

Then even great operators struggle to earn durable returns.

TLDR: You generally can’t out-execute bad economics forever.

Now, let me share the top 4 industries investors avoid (or at least proceed extremely carefully).

Industry #1: Airlines

Airlines are the textbook example.

Why?

Customers are mostly price- and schedule-driven.

Not brand-driven.

Every flight is a high-ticket, infrequent purchase.

Which means:

Habits don’t form

Loyalty is weak

Price competition is intense

On top of that, airlines have enormous fixed costs.

Planes must fly full to make money.

Unsold seats disappear forever once the plane takes off.

That creates constant pressure to cut prices.

Margins stay thin.

And profits disappear quickly during downturns.

There have been exceptions.

But even those tend to be manager-specific, not structural.

And once those managers left (i.e. Herb Kelleher at Southwest Airlines), the business suffered.

Industry #2: Financials

Banks look profitable on paper.

They have high returns on equity.

But dig deeper.

Returns on assets are very low.

Those equity returns are driven by leverage.

Leverage magnifies outcomes.

Including bad ones.

Banks also have substitutable services: 1) Collect deposits, and 2) Issue loans.

Most don’t care about anything but the interest rate.

Customer loyalty often exists due to inconvenience, not love.

That’s very fragile stickiness.

And when banks grow, they require more capital to do so.

Which limits compounding.

Add systemic risk and occasional failures…

And you get an industry where upside is capped, but downside can be severe.

Industry #3: Fashion & Apparel

Fashion depends on taste.

Taste changes.

Sometimes quickly.

Design decisions are made months in advance.

Miss the trend, and inventory piles up.

Then you are forced to discount.

But discounting hurts margins, damages the brand, and makes customers hesitate to buy full price in the future.

Inventory also creates working-capital risk.

Some models manage this better than others.

But broadly, predicting consumer preference even one season ahead is hard.

Predicting it years out is harder.

That uncertainty shows up in booming and waning customer demand.

Even very popular brands and styles can go out of fashion quickly.

Industry #4: Oil & Gas

These businesses often look great at the top of the cycle.

High cash flows.

High returns.

But much of that is because they found a great asset, not a great business.

Oil fields deplete.

Capital must be reinvested in new fields to continue to produce.

New fields may have less oil and cost more to produce on.

Profitability depends heavily on commodity prices.

Which are essentially unpredictable.

There are 1) high upfront costs, 2) operating & financial leverage, and 3) economic cyclicality & geopolitics impacting prices.

This creates a ton of risk.

Some investors may view energy as a hedge or asset play.

That can be valid.

But structurally, it’s not a business that can reliably compound value.

So Does This Mean “Never Invest”?

No.

It means increase your caution.

When an industry’s base rate is weak, you may need:

A very strong manager

Better margins of safety

Clearer differentiation

Starting your search in structurally strong industries stacks the odds in your favor that you will find a company you want to invest in.

Starting in weak ones means you’re betting on exceptions.

Sometimes that works.

Often it doesn’t.

Like gravity, most businesses don’t escape the industry economics.

Instead, they reflect it.

But understanding in more detail why an industry is bad, can help you understand what makes an industry good.

For more details, check out this video below where I expand on each of the four industries I listed here.