Novo Nordisk Stock Breakdown

Get smarter on investing, business, and personal finance in 5 minutes.

Stock Breakdown

There is good reason most investors avoid the pharmaceutical industry.

Scientific breakthroughs can be leapfrogged in a single trial readout.

Competitive dynamics shift rapidly as new molecules emerge. And even when a drug works, success can invite political backlash—price controls, reimbursement cuts, or outright regulatory intervention.

That is not to mention how technical the industry is, which brings an ever-present risk that you are missing something.

But once a drug is created, proven, and the market is clearly there, doesn’t it become a more predictable investment?

No.

As Novo Nordisk investors recently found out, despite having one of the most meaningful pharmaceutical creations in decades—that targeted the massive obesity market—they still lost over 60% on their investment from 2024.

However, could this now be an opportunity?

In this post, we will break down Novo Nordisk, the burgeoning “Incretin Market”, and touch on competition from Eli Lilly.

Incretins.

An “incretin” is a naturally occurring gut hormone that is released when you eat.

There are two main incretin hormones:

1) Glucagon-like Peptide-1 or GLP-1

2) Glucose-Dependent Insulinotropic Polypeptide or GIP

In obese people incretin signal is impaired. This results in break downs with appetite regulation, blood sugar regulation, and insulin sensitivity.

In late 2017 Novo Nordisk launched Ozempic for type 2 diabetes. It is a “semaglutide injection” which acts as a GLP1 receptor agonist.

While it was prescribed for diabetes, the weight loss effects on obese people was quickly noticed and it started getting used for off-label use as a weight loss drug.

In 2021 Novo Nordisk released Wegovy, which was the same drug but approved for weight-loss purposes.

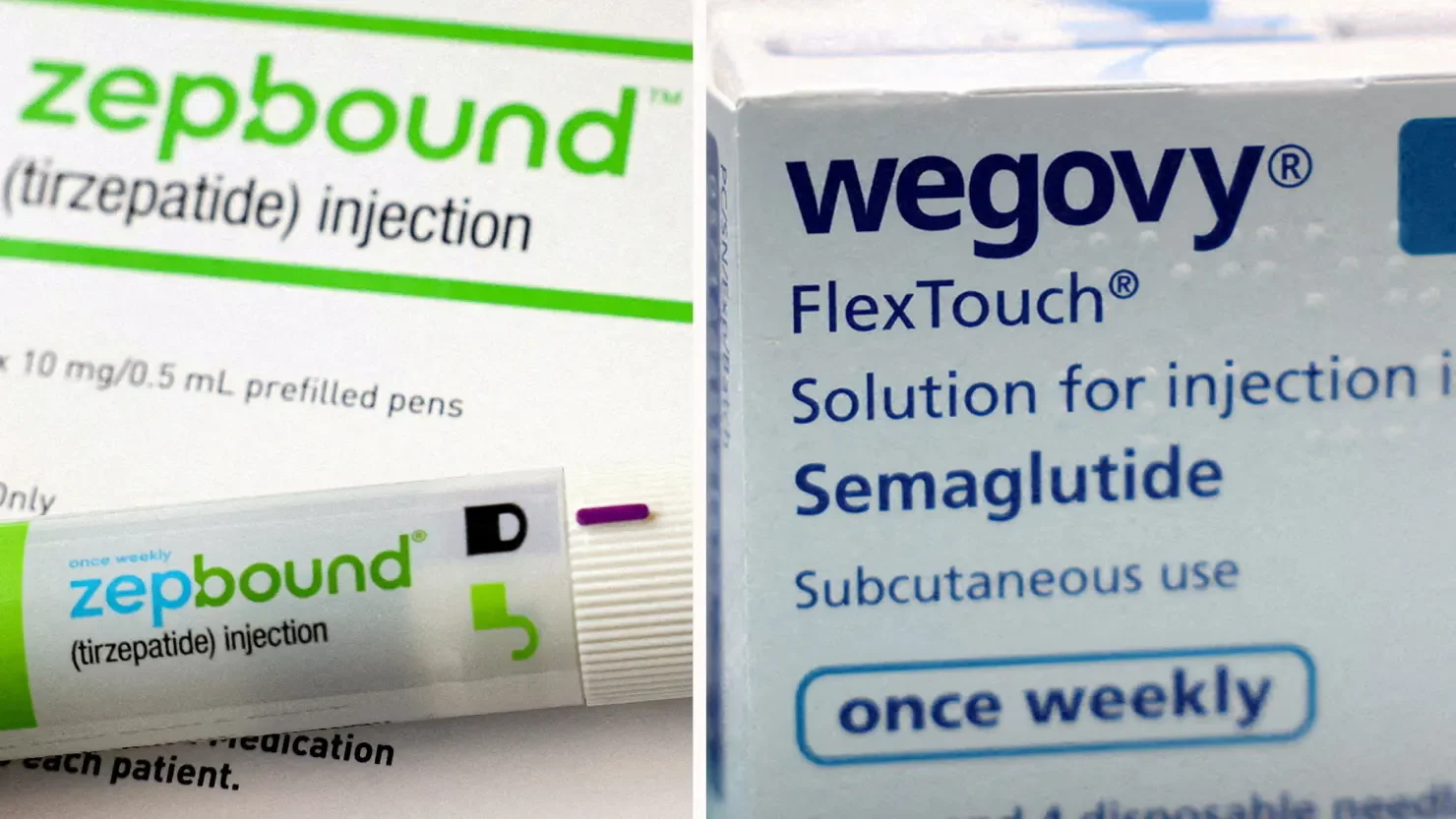

In 2022, competitor Eli Lilly received approval for Mounjaro for diabetes. Instead of it just targeting GLP-1 as Ozempic and Wegovy did, this drug also targeted GIP. This made it a generally more effective drug.

In 2023 Eli Lilly got FDA approval for Zepbound, which was the same drug as Mounjaro, but used specifically to address obesity.

Eli Lilly’s drug was more effective, driving as much as 50% more weight loss in clinical trials, but…

It didn’t matter.

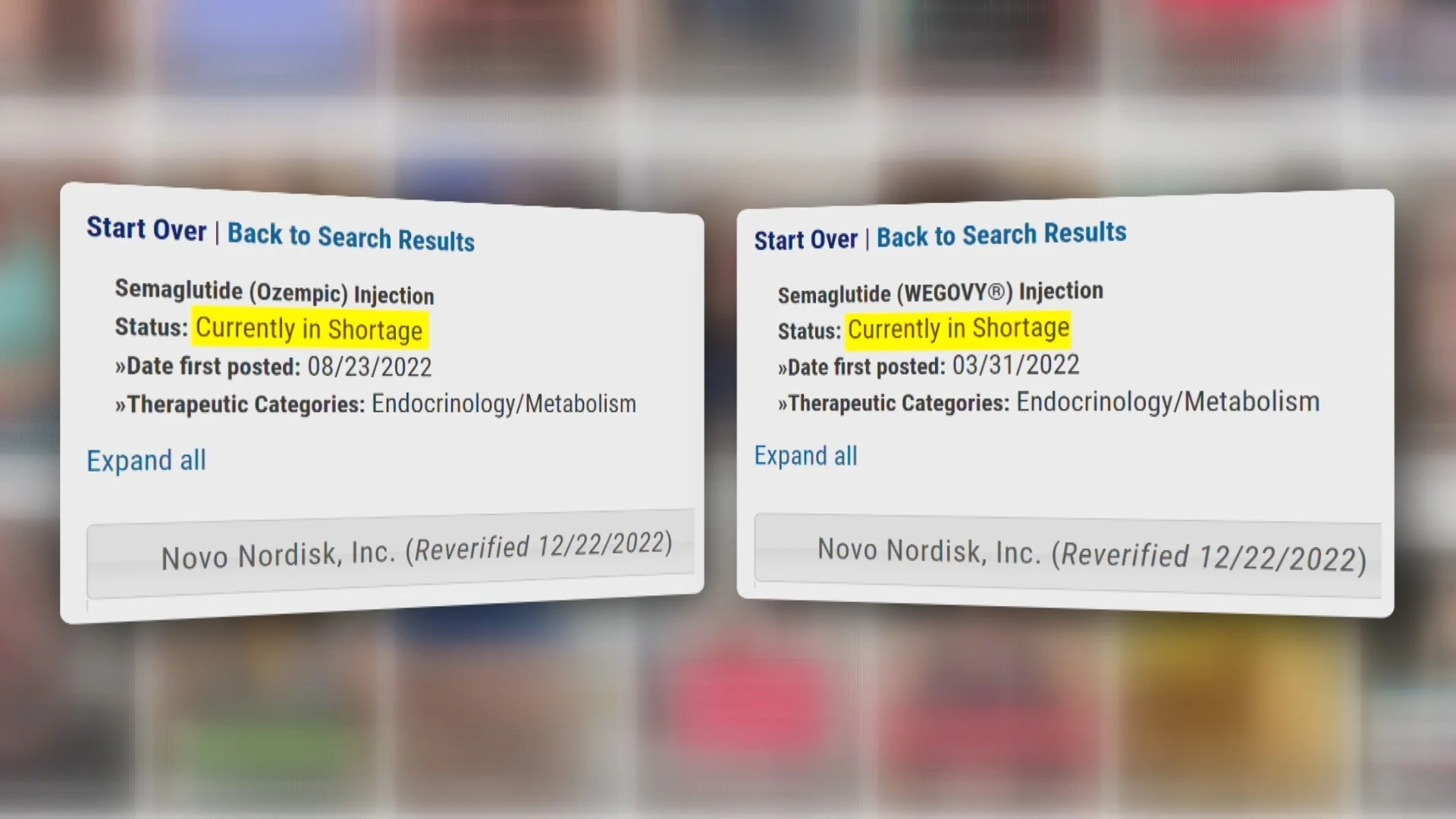

Most people would have been happy with either drug, but they couldn’t get them because demand handily outstripped supply.

Outsourcing.

The pharmaceutical industry had shifted to outsourcing production for the decades prior, which left Novo Nordisk short-handed when demand surged.

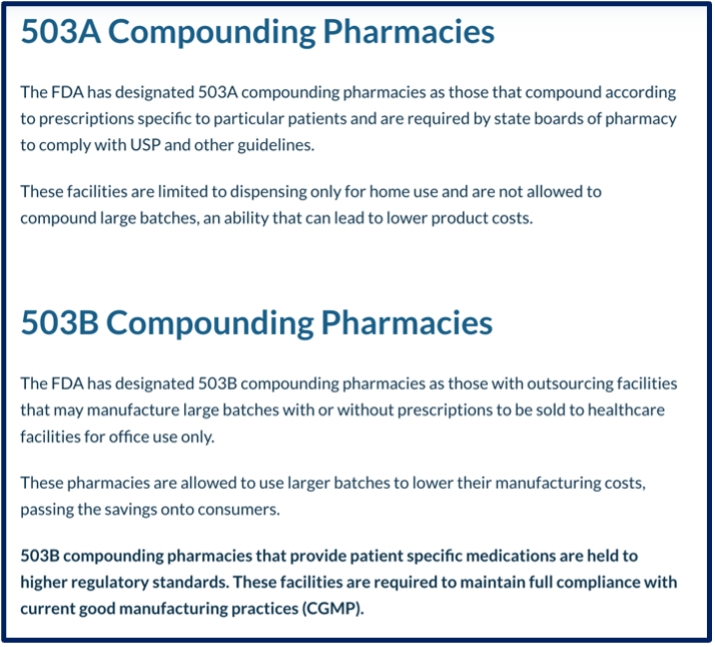

The FDA enacted sections 503A and 503B which allowed pharmacies to create compound drugs that are molecularly similar in order to meet this demand.

With one fell swoop, Novo Nordisk and Eli Lilly all of a sudden had a slew of competitors that could copy their drugs.

Telehealth firms like Hims & Hers created copy semaglutides for $199 a month, under cutting the $1k list price of Wegovy and Zepbound.

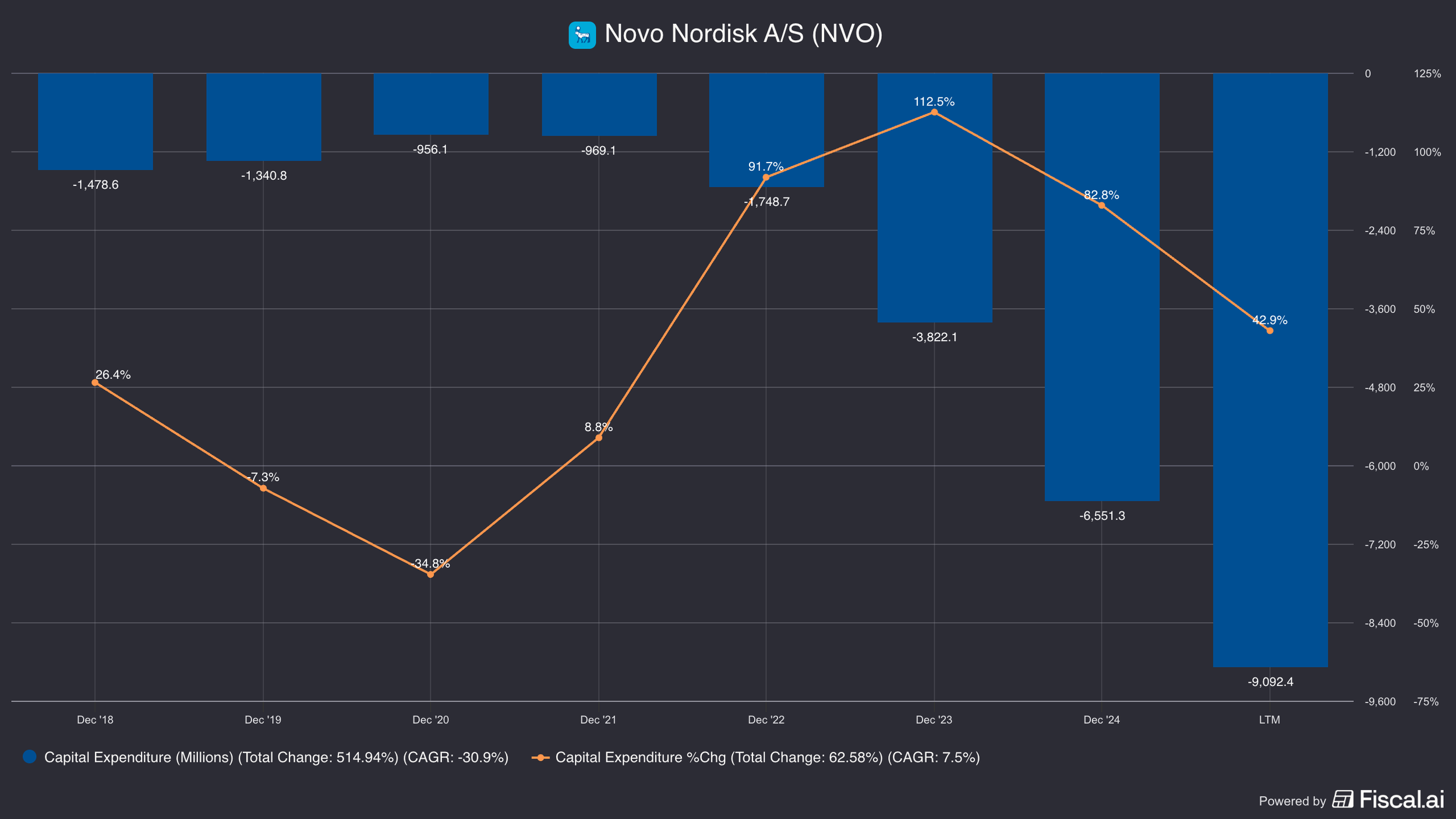

In order to ramp up production, Novo Holdings (which owns 28% of Novo Nordisk, but 77% of the votes), made a $16.5 billion acquisition of Catalent, which is a contract development and manufacturing organization.

Novo Holdings then sold 3 key “fill-finish” sites to Novo Nordisk for $11 billion. These are specialized faculties that handle the final steps of making injectable drugs.

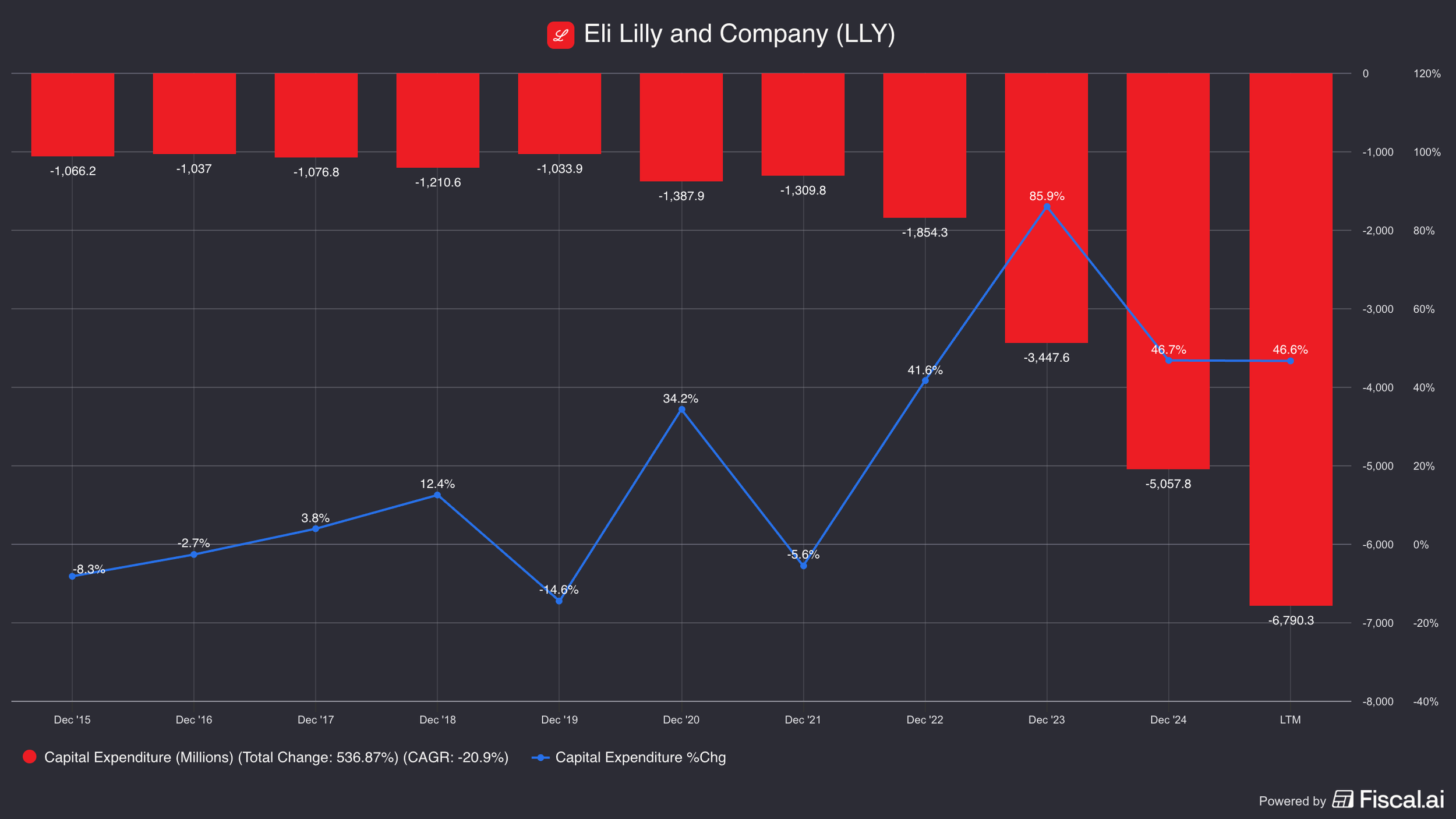

Separately, Novo Nordisk also increased their capex budget significantly—from about $1 billion in 2021 to $6.5 billion by 2024 (and $9 billion in 2025).

Eli Lilly similarly increased their capital expenditures. However, setting them back was the fact that the facilities Novo acquired used to fill orders from Eli Lilly!

This deepened the feud between the two with Eli Lilly filing anticompetitive lawsuit against Novo.

At the beginning of 2025 the FDA removed semaglutide from the shortage list. Novo quickly filed 132 lawsuits against copycat compounds, which they claimed were unapproved and potentially dangerous.

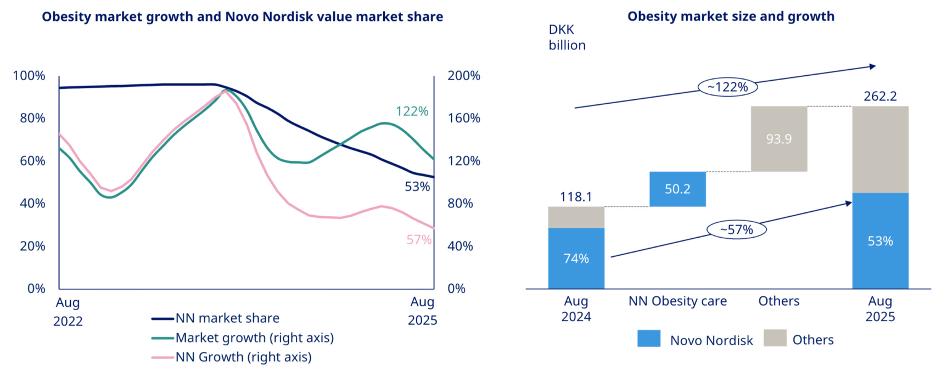

Now Novo Nordisk and Eli Lilly control the market for incretin drugs in the U.S. they also maintain their duopoly in Europe (but not in geographies like South Asia, India, and South America where IP protections and enforcement differ).

So why is Novo Nordisk down over 30% since they regained control of the market?

Market Pressures.

In short, Wegovy didn’t accelerate as fast as expected.

And Eli’s Zepbound was found to be clinically superior to Wegovy.

Their market share deteriorated quickly as Eli Lilly gained ground.

And production issues lingered.

Management cut guidance.

And there was also price pressures from politicians vocally noting how much more expensive the drug was in the US than internationally.

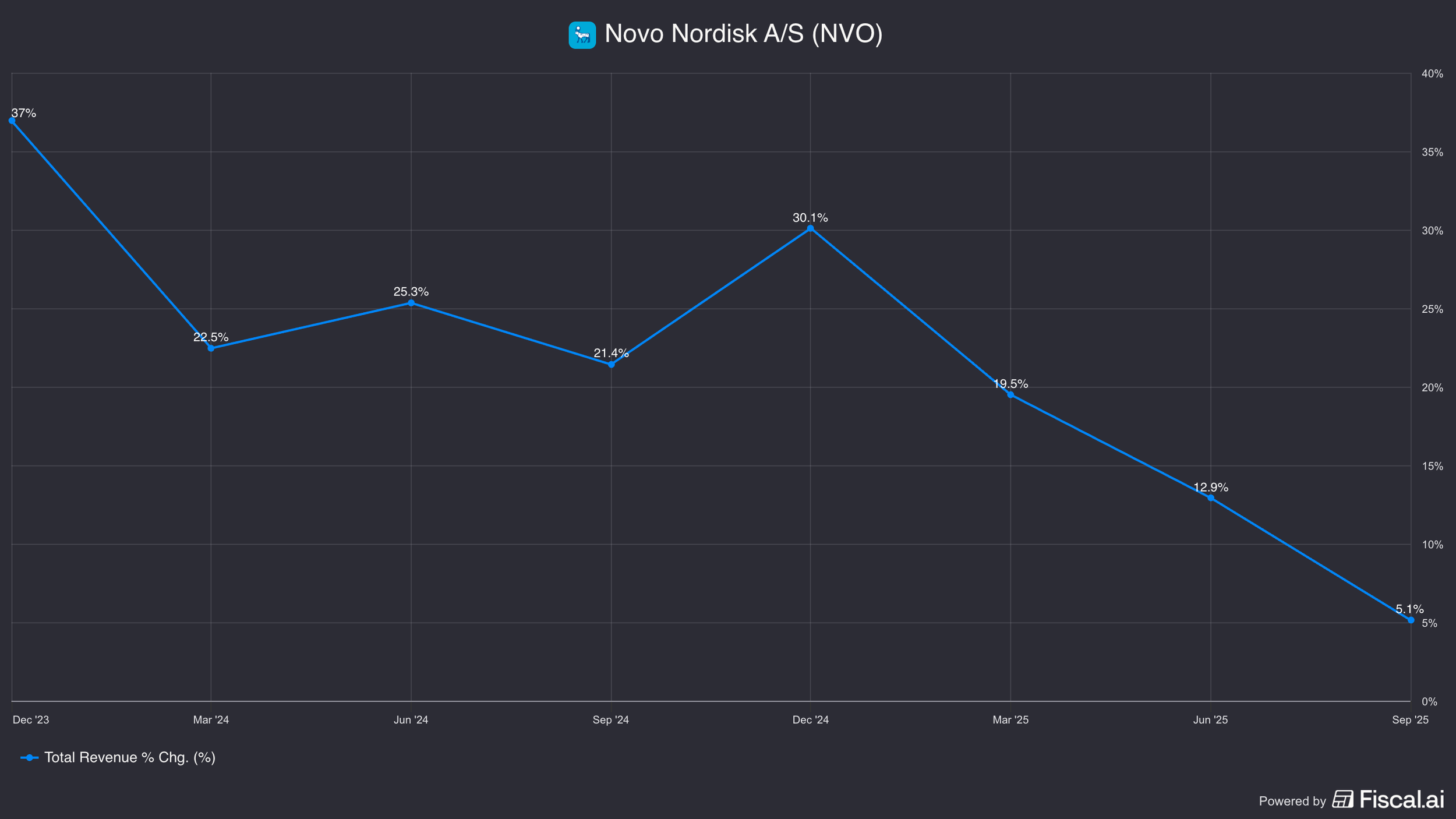

In short, growth slowed instead of reaccelerating.

In 2023, they grew 31%.

3Q25 growth was just 5%.

And Eli Lilly’s success threated to make that secular issue, not a transitory one.

But what is priced in?

A business doesn’t need a lot of growth if the valuation is cheap enough.

And Novo Nordisk hasn’t stopped innovating either, they have a potential game changer for 2026.

Financials and Valuation.

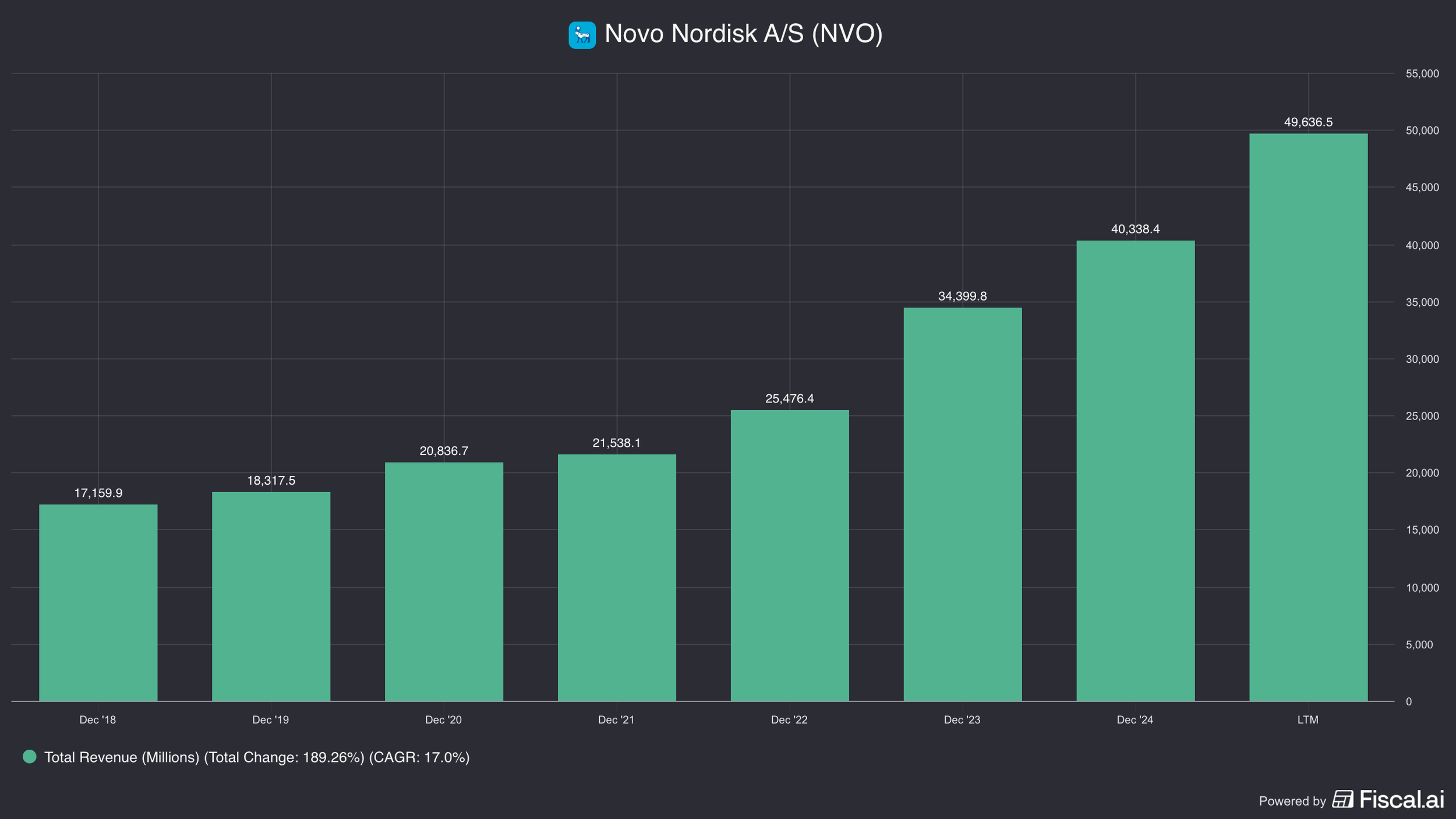

In 2018, revenues were $17bn and were growing 0%. Fast forward today, revenues jumped to $50bn with a growth rate of 31%.

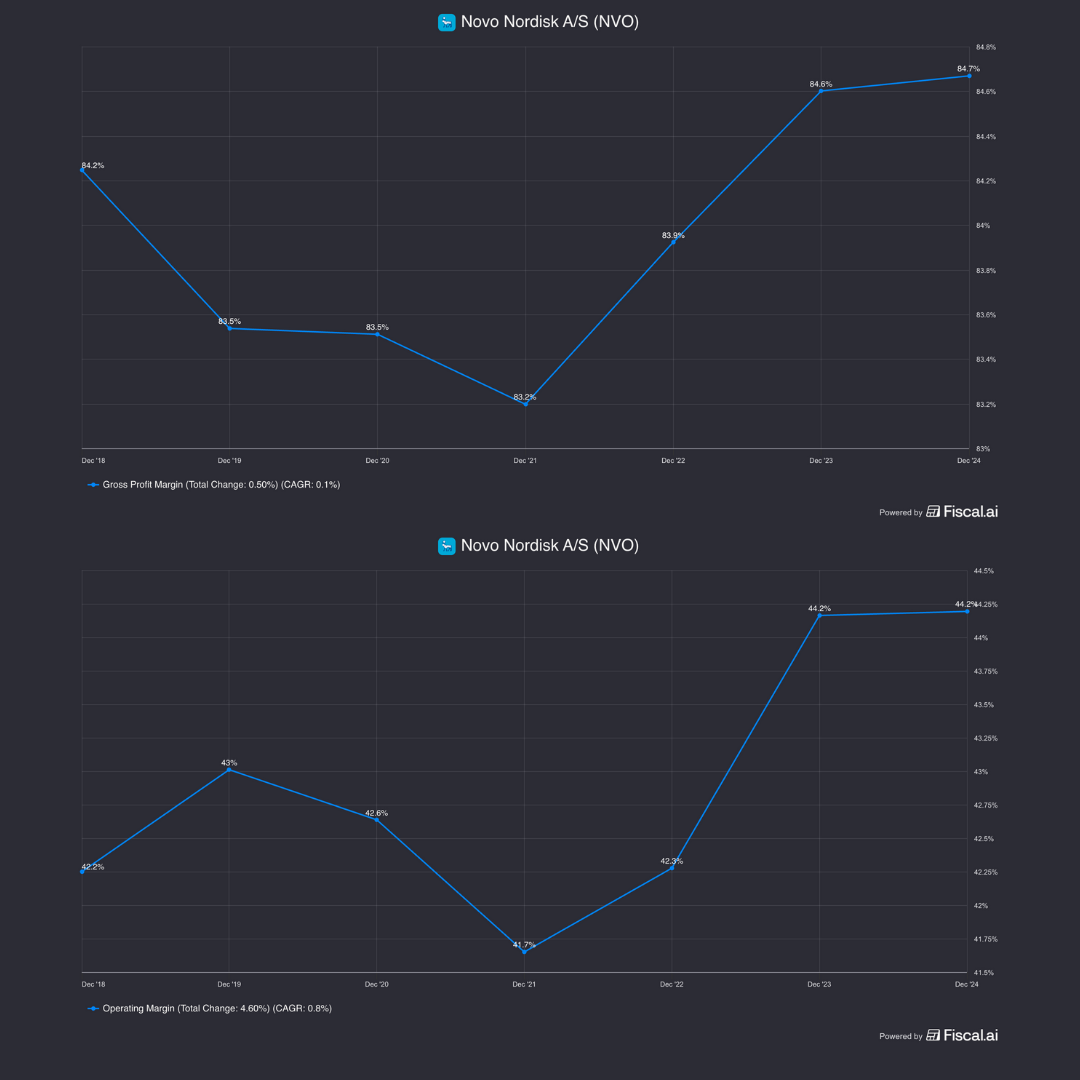

Gross margins have been steady at mid-80%.

In addition, operating margins have slightly expanded to 44%.

At a stock price of $62 they have a market cap of $260bn.

With $16 billion in earnings over the last year, that puts them at 16x trailing earnings.

2026 estimates put them at 13x earnings.

However, on a free cash flow basis, they trade at ~26x trailing FCF or 22x on analysts’ estimates.

This is because they are going to continue to invest aggressive in manufacturing capacity.

And analysts are expecting a reacceleration of growth.

Why?

Opportunity.

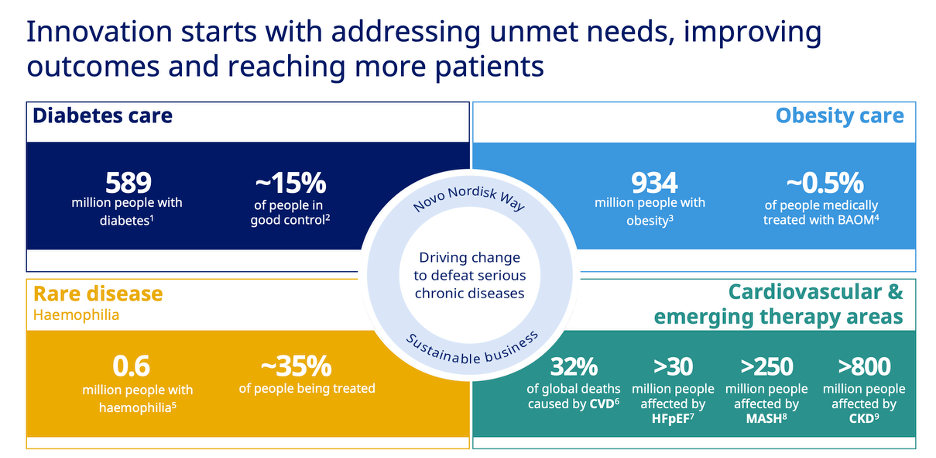

The top two boxes are the most relevant. The one on the top right is the biggest opportunity.

Only ~0.5% of obese people are treated with Bariatric and Anti-Obesity Medications (BAOM).

There is a large enough market for both Novo and Eli to grow, even if Eli does have a better product…

But that also could change.

The past incretin drugs were injectables.

As you can imagine, many people don’t want to take injections.

In December 2025 Novo received approval for a Wegovy Oral Pill.

This could massively open up the market for them.

Early data showed demand for it was strong.

In fact, the data showed it is already outpacing the demand for the injectable version of the drug.

BUT the game isn’t over…

Eli Lilly has two new drugs that could be approved in 2026.

Orfoglipron, which a pill and “small molecule”. The benefit is that it is easier to manufacture and can be taken without dietary restrictions (you can’t eat or drink for 30 minutes after taking the Wegovy pill).

However, it is currently tested to be less effective than the Wegovy Pill with 13% average weight-loss versus 15% for the pill version of Wegovy.

This has the potential to reverse the dynamics and market share.

Eli’s other drug that could be approved in 2026 is the strongest weight-loss drug created so far though.

It is called Retatrutide and targets not just GLP-1 and GIP, but also Glucagon. This has resulted in average weight-loss of 28%.

But its downside is that it is still an injectable.

And Novo Nordisk has a new injectable called “CagriSema” that was just approved and drove 23% weight-loss in patience.

Still though most people will probably want a pill instead of an injectable.

And the side effects are more likely to dictate which medicine they take.

All of this puts Novo Nordisk in a good position—maybe not a clear market leader, but they definitely earned their spot to continue to penetrate the large obesity opportunity.

Other Considerations.

Their Semaglutides drugs could prove to be helpful for other conditions too. They just got a label expansion to use Wegovy for MASH which is a form of fatty liver diseases.

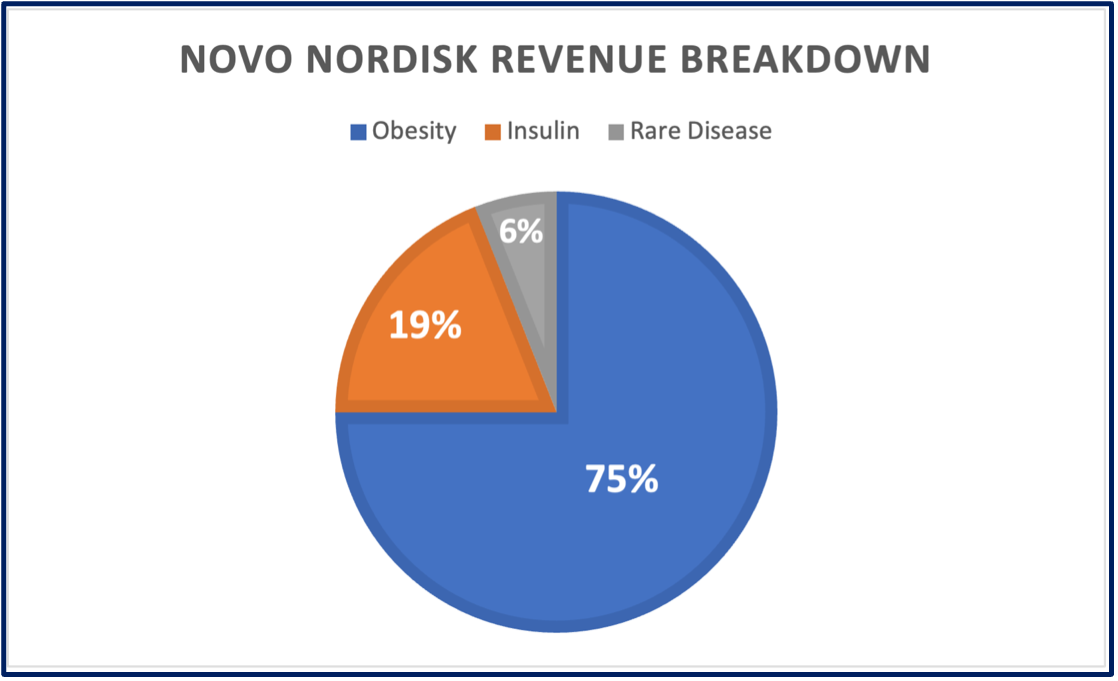

While we have just focused on Semaglutides, that is only 75% of Novo Nordisk’s business today.

Insulin is about 19% of revenues (and they have 43% market share globally)

Rare disease is about another 6%.

There is also a D2C push with NovoCare Pharmacy to offer direct sales, namely to cash pay buyers.

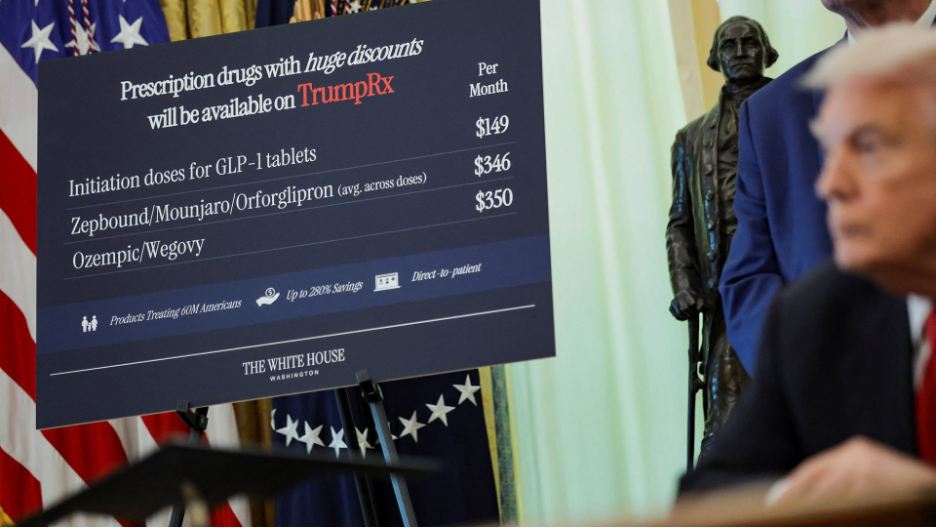

This came alongside an aggressive pricing of their Wegovy pills at $149/ month to suffocate the copy cats.

Political risk, including “TrumpRX.gov” which aims to offer consumers the same priced drugs as exist internationally. The Wegovy price cuts have largely already accounted for this, but no deal is ever final…

Tariffs could also lead to new cost pressures.

But at 16x trailing earnings, an investor has to decide how much of that is already priced in.